“All models are wrong, but some are useful” is a quote attributed to British statistician George EP Box. With the increased use of unprecedented computational capabilities in models, the numerical accuracy isn’t a concern but these numbers still may not represent reality, indicating a potential weakness in the model. Seeking to resolve this discrepancy is Arthur, a startup founded in 2018 that bills itself as an “AI-performance company”. The platform takes a holistic look at machine learning models to understand where enterprises can optimize models to yield better results. As AI is becoming an increasingly important part of companies’ strategic plans, Arthur is able to ensure that they are leveraging technology that is accurate, transparent, and free of bias. The company is working with several Fortune 100 companies across a range of industries; for one financial service client, the use of the platform led to a decrease in $30M in operating expense while increasing model revenue by $100M.

AlleyWatch caught up with Arthur CEO Adam Wenchel to learn more about the business, the company’s strategic plans, latest round of funding which brings the total funding raised to $60.3M, and much, much more…

Who were your investors and how much did you raise?

We raised $42M Series B led by Acrew Capital and Greycroft with participation from BAM Elevate, Acrew, Index Ventures, Work-Bench, and Plexo Capital.

The investment will help Arthur deliver on its mission to make AI work for everyone, increasing investment in research and development to fuel the continuing advancements for our customers.

Tell us about the product or service that Arthur offers.

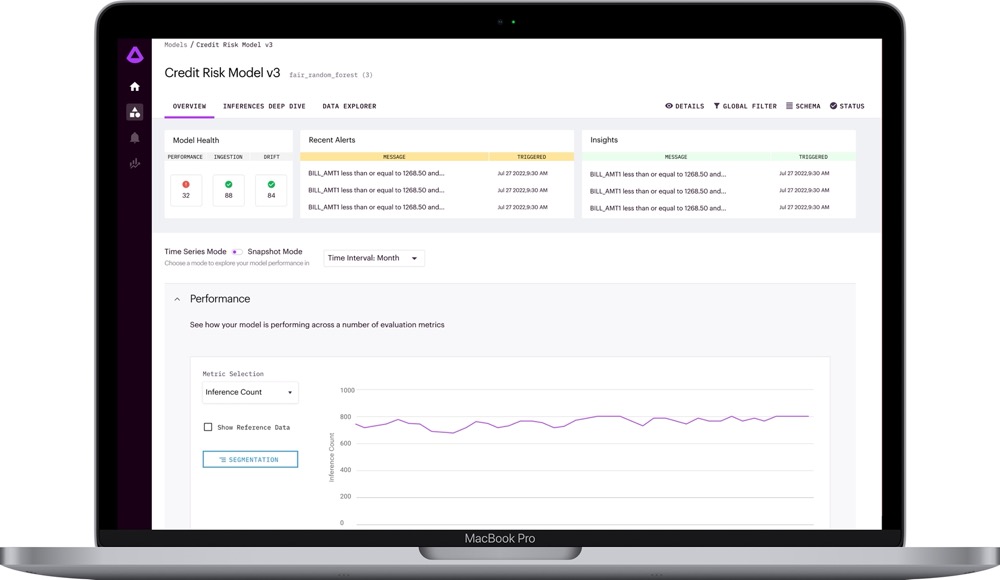

Arthur is the AI performance company. The Arthur platform monitors, measures, and improves machine learning models to deliver better results, working with enterprise teams to accelerate model operations and optimize for accuracy, explainability, and fairness.

What inspired the start of Arthur?

What inspired the start of Arthur?

I’m always astounded by how many analytical models have been deployed in the last 20+ years without any monitoring. ML amplifies the need for guardrails enormously—the complexity and adaptation of these systems go well beyond traditional statistical models. There are time series monitoring tools for traditional software applications, cybersecurity, network operations, not to mention trading floors and power plants. The reason AI monitoring is different and that distinct tools exist for different domains is because of the unique failure modes that require an entirely new set of metrics.

When I was deploying ML systems at Capital One, there were no available solutions for this problem, and it kept me awake at night. That’s why we started Arthur, and it’s been exciting to see how much it has resonated with ML practitioners everywhere.

How is Arthur different?

Arthur is the leading AI Performance solution for computer vision and NLP, and offers unmatched enterprise scalability, bias detection and mitigation, and a research-led approach to development.

What market does Arthur target and how big is it?

Gartner predicts the AI Software market will reach $62 billion this year and double by 2025—and 40% of organizations reported having thousands or hundreds of thousands of AI models deployed. AI-native companies—those adopting AI at the core of their business—are deploying AI to improve critical outcomes, like revolutionizing healthcare, hiring and retaining talent, and providing equitable access to credit.

What’s your business model?

Companies buy our software to make sure their AI models make good decisions and to let them know when they aren’t.

How are you preparing for a potential economic slowdown?

We are intentional and measured about growth—scaling once we’ve proven success in our approach. We have built partnerships with our customers that allow us to prioritize the most important outcomes for their AI monitoring needs, which will be crucial in helping them deliver results. In raising this round, we are well-positioned to grow our team and business, even in the case of difficult economic times.

What was the funding process like?

It took a bit more work, it’s a challenging environment, but ultimately if you are building a business with solid fundamentals there are plenty of interested investors.

What are the biggest challenges that you faced while raising capital?

We were raising when fear was extremely high in the VC market. What we found is that the investors who put in the work to truly understand AI remained confident in their conviction even during a period when others were scared and pulling back. Theresia Gouw, our lead investor, has been doing this for a long time. She is very good at it and has been through these cycles before. These are the kind of investors we want to work with.

What factors about your business led your investors to write the check?

Our growth is one of the main reasons for investor interest. Arthur has averaged 58% ARR growth over the last four quarters, which looks even better when you consider the economic ups and downs of the last couple of years.

What are the milestones you plan to achieve in the next six months?

Over the next six months, we will keep growing the team as we expand our enterprise customer base and have a number of exciting product capabilities rolling out including even more features for people using LLMs (large language models) and foundation models.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

One of our investors, Mike Volpi, has provided some great guidance for companies in that position in his thoughts here. In times like these, it is important to intentionally invest in where you are seeing traction and solving real pain for customers—pick your partnerships carefully, with customers, investors and vendors.

Where do you see the company going now over the near term?

With this recent raise, we have first and foremost scaled up our investment in fundamental research. Our research team has produced a number of breakthroughs that not only advance the state of AI but also create significant value for our customers. It is this spirit of innovation, deeply rooted in Arthur’s DNA, that has driven our growth. We are also scaling up many client functions like customer success and our team of field data scientists to make sure that our quickly growing user base has the world-class support they deserve.

What’s your favorite restaurant in the city?

We are lucky to call SoHo home for us in the city and love so many great spots around the city, but ultimately The Wren and The Dutch are two spots often frequented by the Arthur team.