Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements typically require financial institutions to rely on numerous third-party data providers for both onboarding and ongoing monitoring. Digitally-focused financial providers (neo-banks, fintech startups, global banks, and platform banks) face the decision to build systems in-house, a resource-intensive undertaking, or rely on third-party integrations that are available in order to be compliant. Footprint is a frictionless identify verification platform that when integrated allows users to submit the information necessary to comply with KYC in a single click. The company also offers personal identifying information (PII) vaults that allow companies to securely collect a user’s required data without ever needing to touch it. Users are verified using biometric scans, liveness checks, and peer-to-peer verification. All this can be accomplished with a few lines of codes, saving steps for both users and the customers of the platform; Footprint says its solution is 12x faster and 2x cheaper than using existing disparate processes. The complete KYC and PII security solution are only $.50 per verification and $.25 per user/per year for storage, making it readily accessible for companies both large and small.

AlleyWatch caught up with Footprint Cofounder and CEO Eli Wachs to learn more about the business, the company’s strategic plans, latest round of funding, and much, much more…

Who were your investors and how much did you raise?

We raised a $6M seed round led by Index in February, with participation from seed funds such as BoxGroup, Operator Partners, Lerer Hippeau, Palm Tree Crew, and K5. We also had participation from the founders of Plaid, Ramp, Moonpay, Lattice, Kayak, and JumpCloud

Tell us about the product or service that Footprint offers.

Footprint is building one-click KYC and PII vaulting for companies to more frictionlessly onboard users while offloading the security risk of storing their data.

What inspired the start of Footprint?

What inspired the start of Footprint?

My biggest problem with Google actually isn’t what they do with my data–it’s what they don’t do with it. Google is probably the best predictor in the world of who will get diseases like Parkinson’s and Alzheimer’s by seeing if your finger tremors during Recaptcha and your typo rate over time. When a family member of mine got the disease, I remember feeling powerless. I wanted to build a trusted third party that could put people in control of their data (and metadata), but to do that they had to own their identity first. I wanted to remove the toggle between security and usability and between friction and accuracy.

How is Footprint different?

Footprint foremost is a security company. As such, we offload the storage of PII while still satisfying KYC through their patent-pending tokenization + nitro enclave. Our technology also increases accuracy through real-time biometrics such as Face ID, and provides a great developer experience by integrating with just five lines of code. Lastly, Footprint reduces friction + lifts conversion by building the first ever one-click KYC product.

What market does Footprint target and how big is it?

Enterprises spending $10 billion a year on IDV – and that number is quickly growing as online identity theft skyrockets. The spend around securely storing this information is more difficult to peg, as it is often multiple tools stitched together, but we think it is at least half the size of the IDV/KYC TAM.

What’s your business model?

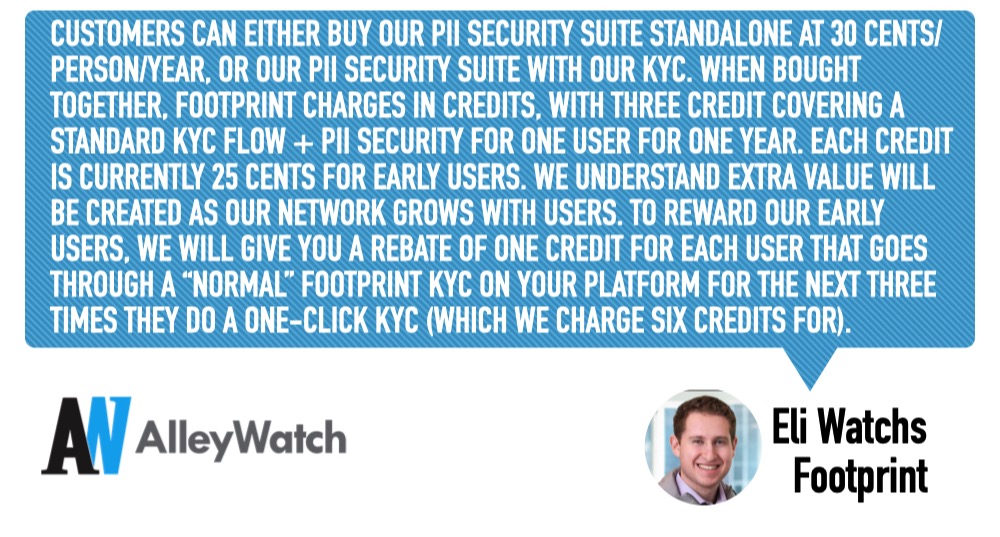

Customers can either buy our PII Security Suite standalone at 30 cents/person/year, or our PII Security Suite with our KYC. When bought together, Footprint charges in credits, with three credits covering a standard KYC flow + PII Security for one user for one year. Each credit is currently 25 cents for early users. We understand extra value will be created as our network grows with users. To reward our early users, we will give you a rebate of one credit for each user that goes through a “normal” Footprint KYC on your platform for the next three times they do a one-click KYC (which we charge six credits for).

How are you preparing for a potential recession?

We think our pricing model is much more aligned with the customers we serve. As budgets tighten, we think Footprint becomes a very natural solution for any company doing IDV/KYC. Whereas pure KYC companies become part of your CAC, we generate customer LTV through conversion uplift. We make more money when you bring on more good actors to your business who continue to be active for many years. A KYC company couldn’t care less about if users delete accounts or churn—they want more verifications. When verifications shrink, their bottom line will be hurt, while Footprint makes money from both the security suite and KYCs.

What was the funding process like?

We were lucky to have a significantly oversubscribed round, and were humbled by the interest. At the end of the day, we felt incredibly aligned with Shardul and the Index team and were honored to have them lead the round which also brought together fantastic seed funds and angels/operators we have long looked up to.

What are the biggest challenges that you faced while raising capital?

I think it was important to find people aligned with both our business model and mission to bring trust back to the internet, knowing there could be no shortcuts taken.

What factors about your business led your investors to write the check?

Shardul Shah from Index said that “Verifying online identities is broken for both businesses and consumers. The processes are siloed, high friction, inaccurate, and managed separately from data security. Footprint is the first platform that delivers verification that is both low-friction and high accuracy. The platform’s opinionated data storage architecture facilitates this breakthrough. Eli, Alex, and the footprint team have a deep-rooted passion and multi-disciplinary expertise to realize their ambition. We couldn’t be more enthusiastic about partnering with Footprint from day 0.”

What are the milestones you plan to achieve in the next six months?

We are excited to commercially launch the product to customers before the end of the year, a feat we are incredibly proud of given the complexity of the product and having just started building in February.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Focus on your core product, look to partnerships to expand your offerings, and remember that some of the biggest companies today were built on incredibly lean teams. This is especially true today when there is so much off-the-shelf technology that lets us replace tools companies had to internally build years ago with easy-to-integrate software.

Where do you see the company going now over the near term?

For now, we are laser-focused on being the last identity form people ever fill out.

What’s your favorite outdoor dining restaurant in NYC?

I love Bar Tulix in SoHo and Canto in The West Village!