Global fintech startup, Revolut, has announced that it’s set to offer commission-free stock trading in the US for the first time. The company, valued at $33 billion, is heading on a collision course with Robinhood – a market leader domestically with a similar operating model. Could Revolut outmaneuver its more established rivals to win market dominance in the US?

Founded in 2015, Revolut has developed into one of Europe’s most prevalent consumer fintech firms. Packed with an ever-evolving range of features, the app’s become a favored form of financial management across the continent.

Although Revolut began life as a way for users to avoid currency conversion fees whilst traveling, it’s since grown into a banking, trading and cryptocurrency tool that features a wide range of products and a user base that’s 16 million strong.

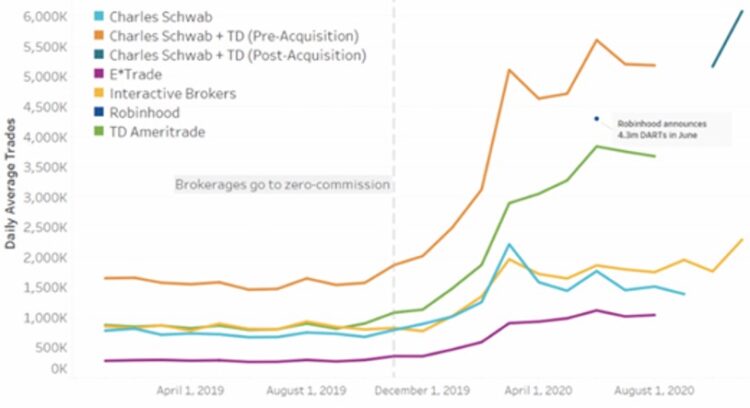

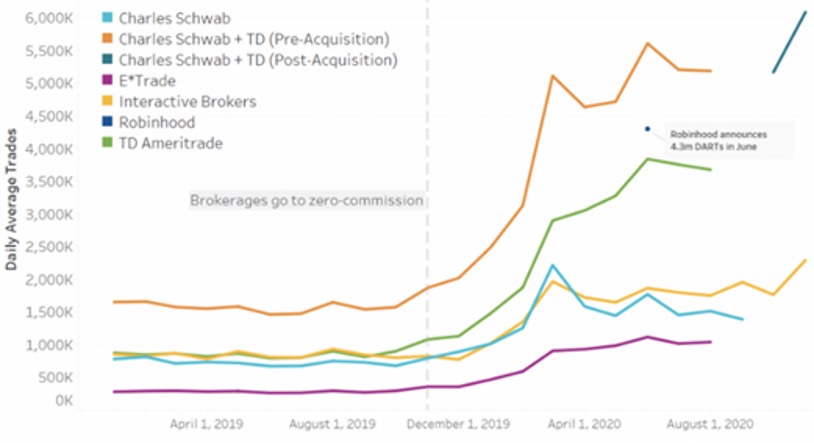

As we can see from the chart above, the emergence of zero-commission trading has paved the way for significant growth in terms of retail investor volumes. In offering commission-free trading for US users, Revolut is set to become a formidable player in delivering more options for this developing market of investors.

“It makes sense that the company would try to increase its appeal by introducing commission-free trading, given the rather ‘hot’ market for those kinds of apps,” explained Maxim Manturov, head of investment research at Freedom Finance Europe. “It’s likely that the company will also use a business model similar to Robinhood’s PFOF-based one to make money.”

Manturov acknowledges Revolut’s expected adoption of a payment for order flow operating model that allows the platform to offer ‘zero-commission trading by selling the orders it receives to third-party market makers. However, this approach may be a stumbling block for the company if the US Securities and Exchange Commission follows through with its threats to ban the controversial practice.

Dangers of Utilizing Payment for Order Flow

Payment for order flow (PFOF) is a method for online brokerages to make money through commission-free trading. Rather than charging users commissions for the trades they carry out, companies sell their order flow to third-party market makers, who pay fees in return for the guaranteed supply of stock orders.

Although PFOF systems can be a great way for online brokerages to avoid charging their users a commission, the SEC chairman, Gary Gensler, has threatened to ban the practice due to what he believes is an “inherent conflict of interest.”

Gensler’s concerns come from brokerages accepting larger payments from market makers who agree to pay more money for order flow whilst failing to provide competitive rates for customers – leaving retail investors to lose out.

The outlawing of PFOF could threaten to undermine Revolut’s new trading platform before it has a chance to get started, however, many industry experts believe that payment for order flow won’t be banned any time soon due to a lack of functional alternatives.

The SEC is “going to arrive at the conclusion that payment for order flow is undoubtedly an amazingly good thing for retail investors and they’re not going to ban it,” claimed Dan Gallagher, Robinhood’s chief legal officer and a former SEC commissioner.

Taking on the Major US Investing Platforms

In September, Revolut gained its US broker-dealer licence, enabling the platform to offer trading to US markets and for the app to encroach on the territory held by the likes of Robinhood and eToro.

“Launching commission-free stock trading is the next logical step in our plans for the U.S. market,” said Nik Storonsky, CEO and founder of Revolut. “We are building a single app where people can manage all aspects of their finances, from banking and foreign exchange to cryptocurrency and stock trading.”

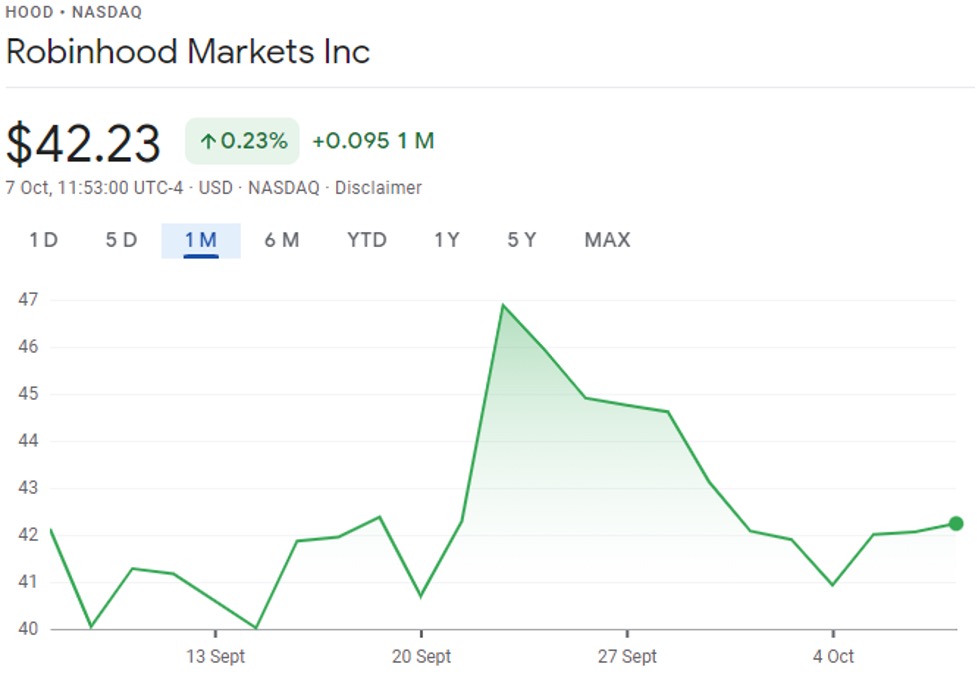

The news of Revolut’s entry into US trading, along with rumors regarding PayPal mulling an entry into stock trading and the Chinese financial downturn sparked by falling Evergrande share prices, contributed to a sizable drop in the share price of Robinhood in late September.

But could Revolut really take on Robinhood’s US market dominance? The company may find that it could potentially win over a considerable market share simply by not being Robinhood.

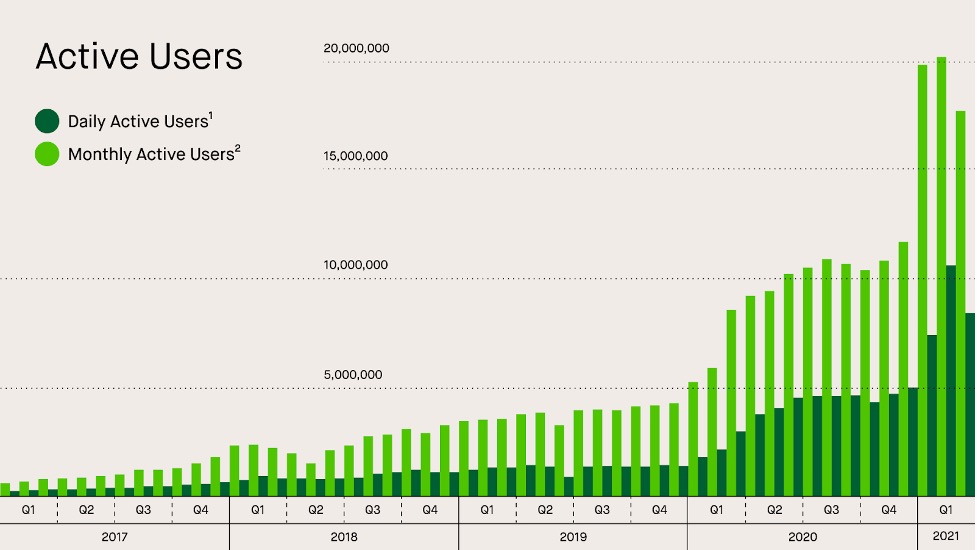

Firstly, it’s important to acknowledge that Robinhood is a wildly successful investing platform that has seen monthly active users top 20 million in 2021.

However, the company has rarely strayed from the wrong kind of press attention. $65 million fines, halting the purchase of stocks, and accusations of gamification have led to severe PR damage to a company that’s brought retail investing to the fingertips of millions.

The arrival of a platform like Revolut, which may take lessons from Robinhood’s embattled reputation during its expansion into US trading, could be a significant test of investor loyalty. For Revolut, Robinhood may be its key rival in the US markets, but the company has laid down a solid PFOF-oriented blueprint for success. It’s also delivered a valuable lesson in how not to operate in terms of its well-documented PR blunders. Now, Revolut needs to learn from Robinhood’s mistakes to successfully crack America.