Francis Bacon is credited with using the phrase “knowledge is power” in the late 16th century. 400+ years later, the phrase is still very applicable. The advent internet of the internet has exponentially increased the amount of information available both publicly and privately. AlphaSense is a market intelligence platform for corporations that uses NLP and AI to extract relevant insights from over 10,000 premium business sources that include analyst research, transcripts, SEC filings, and news sources. The platform saves businesses countless hours and ensures they are not missing potentially market-moving content. The company has built a strong presence within financial institutions, where the timely synthesis of information can translate into millions of dollars, but the platform is versatile enough to be used in any application that relies on mission-critical information. The company works with 1800+ customers, including a large portion of the SP 500, and the team has scaled to close to 500 employees since its founding in 2011.

AlleyWatch caught up with AlphaSense CEO Jack Kokko to learn more about the company’s impressive traction, strategic plans, latest round of funding, which brings the total equity funding raised to $267.1M, and much, much more.

Who were your investors and how much did you raise?

We raised $180 million in a Series C round. Our lead investors were Viking Global Investors and the Growth Equity business within Goldman Sachs Asset Management. Joining them were Morgan Stanley, Citi, Bank of America, Barclays, Wells Fargo Strategic Capital, Cowen Inc., AllianceBernstein, and existing investors.

Tell us about the product or service that AlphaSense offers.

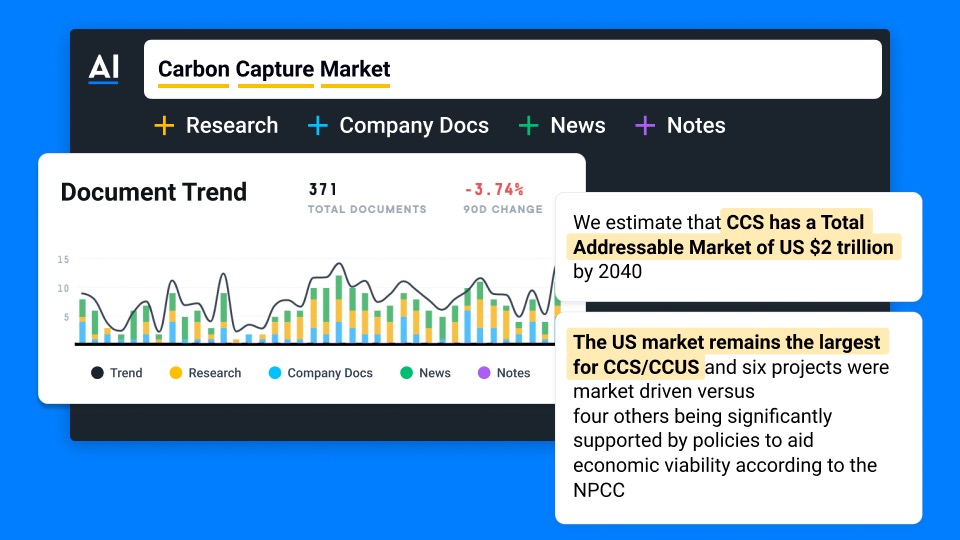

AlphaSense is a market intelligence and search platform for businesses. It leverages AI and natural language processing technology to extract relevant insights from an extensive universe of public and private content, including over 10,000 premium business sources. Without AlphaSense, people would lack a reliable way to find the mission-critical information that matters, given how disparate and inaccessible much of it is. We enable professionals to make critical decisions with confidence and speed, improving their business performance and outcomes.

What inspired the start of AlphaSense?

The idea behind AlphaSense goes back to the early 2000s. As a young analyst at Morgan Stanley, I knew there had to be a better way to find business-related information in the course of my duties. I would always manually hit “Ctrl-F” using my eyes to trace what I found, and I got tired of this, as you can imagine. Then Raj Neervannan, my cofounder and business school classmate, agreed with me that this was a need worth solving, as we noticed through the course of the 2000s that search technology wasn’t really improving in the ways we wanted. So, we launched AlphaSense in 2011… and here we are, with so many people getting behind us and recognizing the importance of cutting-edge market search technology.

In short, AlphaSense is the best platform of its kind because of our unique combination of user-friendliness, breadth of sources, and buy-in from the top financial institutions. Plus, our AI-enabled tech is second-to-none—it understands the nuances of business language across thousands of sources and saves our users from missing important information because of those language variations.

What market does AlphaSense target and how big is it?

Users in all industries can, and do, use AlphaSense to power their decision-making. Our platform is trusted by over 1,800 enterprise customers, including most of the S&P 500, signifying how critical we are in the corporate world. In addition, over 75% of the S&P 100, 70% of the top asset management firms, 76% of the top consultancies, all the largest 20 pharmaceutical companies, and leading companies in energy, industrials, consumer goods, and technology all use AlphaSense.

What’s your business model?

We have a SaaS subscription model and offer both seat-based pricing for smaller teams and organizations, as well as department- and enterprise-wide options for larger organizations.

What are your post-COVID office plans??

In addition to our New York HQ, we have teams in India, Finland, and the UK. Across offices, some of us working from home while others are in the office. We’re flexible—which is one of the great benefits of working at AlphaSense.

What was the funding process like?

For us, it was incredibly reassuring to see so many of our investors start as clients. Securing financing from top firms that also use our services, as well as supply much of our information, made this Series C uniquely rewarding and symbolic of our value.

What are the biggest challenges that you faced while raising capital?

There was an overwhelming amount of interest in our round, and the most difficult part was assembling the right co-lead and strategic investors for us – those that can help us through content partnerships and can provide guidance and support once we embark on our IPO path.

What factors about your business led your investors to write the check?

Our investors were impressed by the broad market adoption we’ve gained within the corporate market while also achieving strong growth in financial services. This widespread adoption signifies confidence in our product—which made it much easier for these investors to determine that we were a company they should get behind. Additionally, many of our new investors have already been involved in our business as content providers for Wall Street Insights®—our exclusive research collection from the world’s top analyst teams.

What are the milestones you plan to achieve in the next six months?

We’ll be investing in product development, expanding content offerings in new geographies and languages, and hiring more amazing talent. In the next two years, we plan on doubling the workforce in our product development operations—and within the next six months, we hope to achieve a significant part of that.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

The market is very strong right now and it’s a great time to raise money. But because everyone else knows that and is raising too, make sure to differentiate and make your story really easy to understand for investors, as they are incredibly busy right now and likely have less time to spend learning about a business if it’s not immediately obvious why you are a great investment as opposed to other opportunities. So put the effort in to do the work for them in advance, and you are much more likely to get a strong result.

Where do you see the company going now over the near term?

Our future is full of possibility. We intend to build a very large business that leads this big market for the long term. And, we’re hiring if any of your readers would like to join us on this journey!

Where is your favorite bar in the city for an after-work drink?

Terroir in Tribeca.