Evergrande has rarely strayed from newspaper headlines for all the wrong reasons throughout 2021. At the beginning of the year, investor panic was sparked by the container ship Ever Given as the vessel became stuck in the Suez Canal – causing jitters across global energy markets and international trade. Today, markets have been rocked by the prospect of a default by the Chinese real estate giants. But what could the collapse of Evergrande mean for the wider stock market and retail investors?

While the markets overcame the Ever Given incident on the path towards an excellent H1 for 2021, stocks have undergone a downturn as fears over the potential default of Evergrande may slow down the Chinese economy. The news of Evergrande’s prospective demise has been compounded by the growth of delta variant cases of Covid-19, growing inflation rates, and the Federal Reserve reportedly set to announce that it’s set to buy fewer bonds – leading to a perfect storm of negative sentiment.

Evergrande’s well-documented issues have led to widespread speculation about what a collapse could mean for the global economy, and whether the news will be overcome in a similar manner to the Ever Given incident in the Suez Canal, or whether the dwindling fundamentals of the real estate leaders will turn into something more severe.

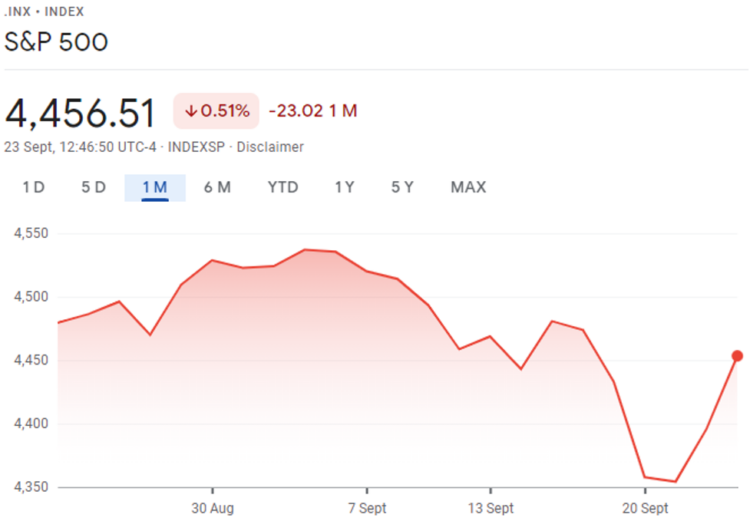

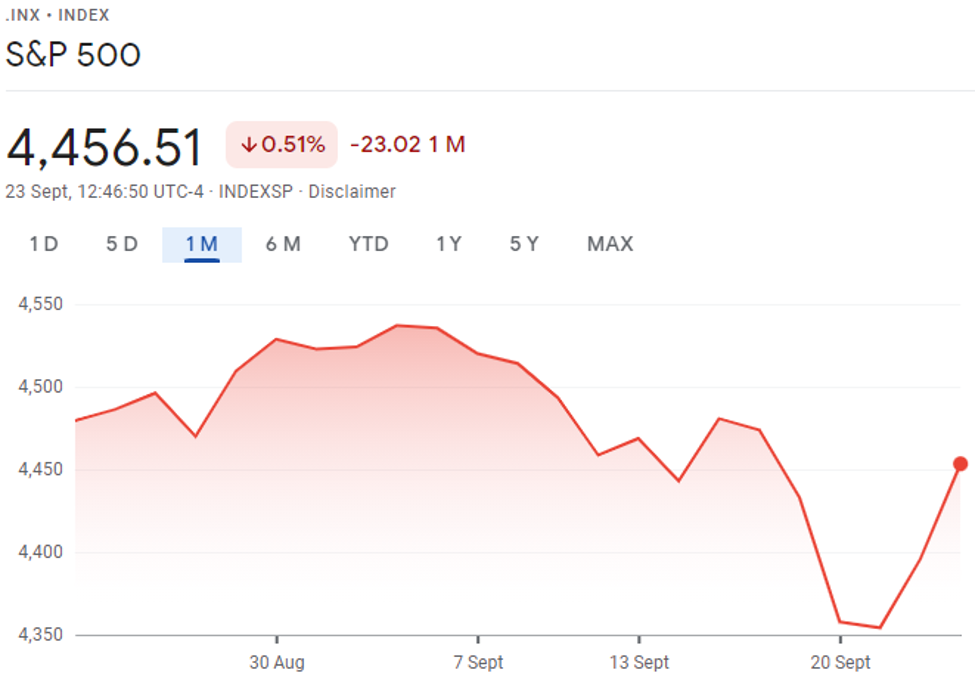

Fortunately, indexes like the S&P 500 are showing early signs of recovery following a month of increasing investor fears surrounding the health of Evergrande.

David Bahnsen, chief investment officer at The Bahnsen Group, believes that the wider market impact regarding Evergrande will be short-lived. “On a down market day, it’s easy to look to the nearest headline like Evergrande and attach a cause and effect, but this market has experienced almost no downside volatility for a long time and a pullback was long overdue. Evergrande’s collapsing bond prices have been forecasting its challenges for some time.”

But what could happen if Evergrande were to collapse? And are retail investor shares safe? Let’s take a deeper look at why market experts are nervously looking towards China for good news:

Could Evergrande Collapse?

Evergrande is an enormous entity in China with a wide range of subsidiaries and international ties – making its $300 billion of debt particularly concerning for wider markets.

The company itself is a key property developer but also has investments in health, automotive, sports, media, and finance sectors among many more. To better understand the sheer magnitude of the company, Evergrande recorded some $110 billion in sales in 2020, and at the last count owns $355 billion worth of assets within 1,300 developments. The company also employs some 200,000 people and hires around 3.8 million yearly for project developments.

As we can see from the company’s stock performance, Evergrande’s crisis is nothing new. The retail giants reported a liquidity scare in 2020, warning that payments due in January 2021 may ultimately lead to cross defaults throughout the broader financial markets. Although the crisis was averted at the beginning of the year thanks to investors waiving their right to force through a $13 billion repayment, Evergrande’s troubles continued to mount.

The crisis has drawn comparisons to the Lehman Brothers collapse at the start of 2008 financial crash from some onlookers, but strategists generally believe that an Evergrande default won’t be felt around the world on quite the same scale.

David Rosenberg, chief economist and strategist at Rosenberg Research noted that “It feels like an ominous repeat of what happened when the Asian property bubble began to burst in the summer of 1997,” when addressing clients but added that “it may not exactly be a Lehman moment.”

How Could Wider Markets Become Affected by Evergrande?

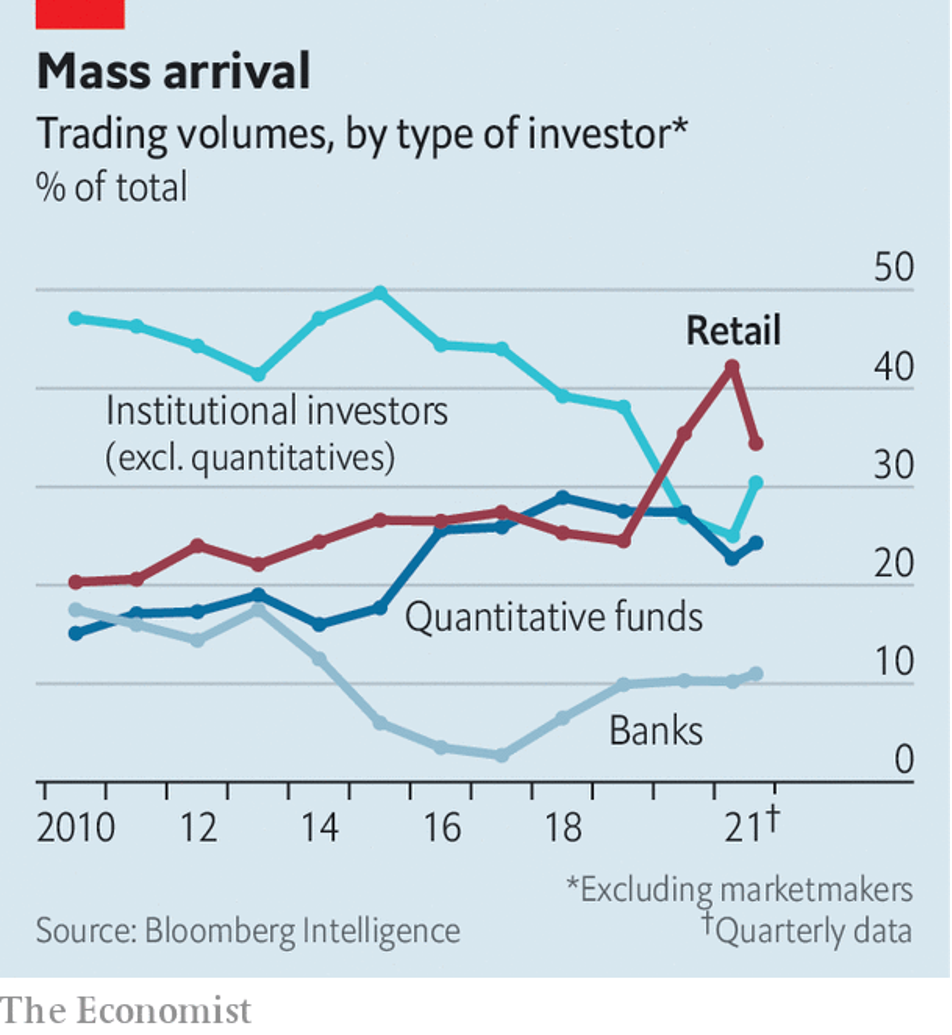

One significant difference between today and the Lehman Brothers crisis of 2008 is that the market has changed significantly in recent years – particularly in the wake of the Covid-19 pandemic.

As the data above shows, retail investors are now a dominant force in terms of trading volumes. Maxim Manturov, head of investment research at Freedom Finance Europe, attributes this rise to the accessibility of investment technology in recent years.

“Millions of people now use mobile apps to trade stocks as easily as they do to share content on social media,” Manturov explains. “In January 2021 alone, approximately 6 million US users downloaded the trading app, and retail brokerage firms reported record high daily average volumes, with this growth being observed globally.

At the same time, approximately 10 million people in the United States opened a brokerage account in 2020, dubbed ‘the year of the retail investor’ by some. In early 2021, retail investors in the United States generated roughly the same amount of equities trading volume as mutual funds and hedge funds combined.”

However, this means that the ‘year of the retail investor’ is set to come under real scrutiny for the first time. Newer investors who are perhaps inexperienced in terms of market downturns may find themselves spooked into launching sell-offs at scale if stocks continue to trend downwards, however, it appears that governmental help may be on hand to step in before the mettle of retail newcomers is tested en masse.

“This default has been widely predicted and we believe will have been at least partly anticipated by the Chinese authorities,” said Robin Parbrook, a fund manager at an Asian equities firm. “We therefore believe that government intervention to prevent a disorderly collapse is very likely, however, this is still likely to be very painful for equity holders and foreign bondholders.”

Although the case of Evergrande may represent a brand new challenge to a stock market that looks very different to that of 2008, it’s hoped that the lessons learned from the collapse of Lehman Brothers will help in the avoidance of fresh tests for the industry. Should a collapse occur, it may be down to the strength of retail investors as a dominant force to maintain optimism in the wake of a potentially difficult challenge.