The online sports betting industry generated over $1B in revenue in 2020 in the US and that is expected to increase sixfold by 2023 as the legalization of wagering continues to spread throughout the nation. Sports have become an American obsession with sports fandom defining how people view themselves over religious, political, and regional affiliations. However, not all fans are interested in gambling but would like to engage with sports with something on the line. PredictionStrike makes investing in sports accessible with its simulated stock exchange that allows users to buy and sell virtual shares in professional athletes. Share prices are determined by not only supply and demand but also real-time athlete performance. The company plans to give athletes a percentage of their respective market caps to have interests aligned as well as deepen engagement. Technology has forged new possibilities in the athlete-fan relationship and PredictionStrike’s exchange creates a new avenue for fans to monetize their passions.

AlleyWatch caught up with CEO and Cofounder Deven Hurt to learn more about the Aha moment for the business, the state of sports engagement, the company’s strategic plans, recent round of funding, and much, much more…

Who were your investors and how much did you raise?

PredictionStrike raised $1.7M from MaC Venture Capital and New Age Capital in our first funding round.

Tell us about the product or service that PredictionStrike offers.

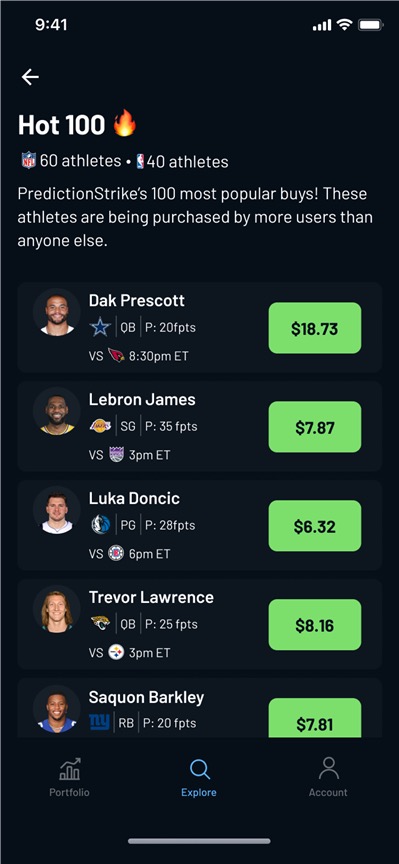

The only performance-based sports platform where fans can buy and sell virtual shares of professional athletes as if they were stocks.

What inspired the start of PredictionStrike?

Brad Chabra (cofounder) and I wanted a way to engage with and make money from watching sports, our favorite pastime. We wanted something that was less risky and more emotionally rewarding than traditional gambling or daily fantasy.

The actual moment PredictionStrike was founded: Brad and I were talking one morning about the real stock market when it just clicked. The night before, LeBron James was tearing through the Eastern Conference playoffs, and Brad said to me “Why can’t I just put my money into LeBron instead?” It was then that we decided a stock market built around athletes was what they had to build. We wanted to build a platform where fans could intelligently engage with the game and create an attachment to their favorite athletes.

How is PredictionStrike different

How is PredictionStrike different

Buying shares of an athlete is not gambling, it’s not daily fantasy sports. It features none of the all-or-nothing aspects of these alternatives, and it allows users to feel like they’re a part of an athlete’s journey. Especially as we roll out the athlete engagement features, in which users will be able to attend “shareholder meetings,” and see exclusive content that athletes can push right to their fans.

Sportsbooks and daily fantasy sports companies fought for years to avoid having to pay players for the right to use their image and likeness. PredictionStrike is going the opposite way and is granting athletes a portion of their market cap. Not only is it the morally right thing to do, but to create the feel of a real stock market where users have a vested interest in these athletes, the athletes must be able to gain something too.

The past couple of years have seen a big spike in “investing” – whether that be retail investors in the traditional stock markets, meme stocks, crypto, NFTs, art, wine, so on and so forth. People could invest in all these things that so many of us don’t truly understand. Sports are people’s favorite pastime, and they spend more time engaging with sports than doing so many other things. PredictionStrike allows users to capitalize on that knowledge

What market does PredictionStrike target and how big is it?

PredictionStrike sits across a mix of major global industries: Sports Gambling ($250B), Fantasy Sports ($19B), Sports Collectibles ($15B), and more.

57 million people participated in season-long fantasy games and there are 10 million registered daily fantasy sports (DFS) users.

37% of American men aged 18-34 play fantasy, while only 12% invest in financial markets.

Sports fanatics want to be financially invested, but 55% of them do not feel comfortable gambling. We are making sports an accessible investment.

What’s your business model?

PredictionStrike takes a fee from every transaction – the lowest fees in the market.

PredictionStrike also plans to leverage the platform’s data analytics to help athletes and everyone in the business of sports make more intelligent business decisions. PredictionStrike can provide intelligence about how popular athletes are and where they are popular down to the individual level, in real-time. This will be crucial information for athletes, agents, sports retailers, ticket sellers, and anyone who wants to use fan analytics in their decision-making, especially as leagues struggle to maintain/grow viewership and foster fandom amongst the younger generations.

How has COVID-19 impacted your business?

We launched to the public in September for the 2019 NFL season, so only a few months before sports, and the rest of the world, shut down. That fall we were bootstrapping, trying to grow organically, and improve the product wherever possible. We were planning to raise capital based on the growth we saw that year. When the NBA shut down that night in March, we [Deven and Brad] called each other and asked “Is this it? Are we done here?” Long story short, it wasn’t. We cut all of our non-essential spend and continued working on the product. When the NBA returned with the bubble playoffs, we had a much better UI/UX, and an improved go-to-market strategy. We grew more in a matter of weeks than we had at any point prior. The time and focus that the sports hiatus forced us to act with us gave us a much better ability to execute when we finally could again.

What was the funding process like?

Long! We started raising before COVID, and because the market was so spooked about companies that relied upon live events, those conversations slowly dragged all throughout that year. But, as discussed in the previous question, when we managed to grow so much post the COVID-induced sports hiatus without having raised any money, it did get easier since we had proven that we could execute. We found investors that really believed in us, in what we were doing, and it all paid off!

What are the biggest challenges that you faced while raising capital?

Time management is always a challenge while raising capital. Time that you spend raising capital, you aren’t spending on improving your product or acquiring users. Conversely, time spent in areas outside of fundraising will not push you forward in the fundraising process.

It is very important to find investors who align with your vision. As a sports company that is in a new market, PredictionStrike is in outside of what many investors are comfortable with. We spent a lot of time just looking for the “right” investors. It was well worth the time, and we couldn’t be happier with who we are working with.

Time management is always a challenge while raising capital. Time that you spend raising capital, you aren’t spending on improving your product or acquiring users. Conversely, time spent in areas outside of fundraising will not push you forward in the fundraising process.

It is very important to find investors who align with your vision. As a sports company that is in a new market, PredictionStrike is in outside of what many investors are comfortable with. We spent a lot of time just looking for the “right” investors. It was well worth the time, and we couldn’t be happier with who we are working with.

What factors about your business led your investors to write the check?

New Age Capital: “The PredictionStrike team is incredibly intelligent and hardworking with a crystal clear vision of the future of sports fan engagement,” said Ivan Alo and LaDante McMillon, Cofounders of New Age Capital. “We’ve had the pleasure of getting to know Deven and Brad for over a year before we made our investment. Their ability to organically build a large community of users and execute at the highest level gave us the confidence to be a part of their journey.”

MaC Venture Capital: “We’re proud to support PredictionStrike through this exciting next chapter as it expands its technological offerings to trade virtual shares of athletes,” said Marlon Nichols, Cofounder and Managing General Partner of MaC Venture Capital. “We are looking forward to seeing PredictionStrike drive culture forward by bringing sports lovers together while providing opportunities for athletes to further benefit off the field for the performance and brand that they build on the field.”

What are the milestones you plan to achieve in the next six months?

First and foremost, we are excited to launch trading for the UFC in November. It is something that we know a ton of our users want, and we can’t wait to see how fans engage with the sport in a way they never really could before. We’re also especially excited because with the launch of UFC, we’ll have a select number of athletes on board and ready to directly engage with their investors through exclusive content.

While fans can look forward to that, athletes, leagues, and organizations can look forward to the rollout of our data offerings and features, as mentioned above in the business model question.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Keep building! However possible, keep building. Do as much as you possibly can to get closer and closer to your vision. You want to find the right investors, not just anyone. Nothing will help you find the right investors and convince those investors that you are building the future like having a great product. Don’t forget, a great product is one that your users love, not just one that you love.

Where do you see the company going now over the near term?

This is going to be a big period of growth. Not only are we releasing a much-improved app and launching new sports and features, but we have money to spend on growth for the first time. We are really excited about it.

What’s your favorite outdoor dining restaurant in NYC

It’s got to be Casa La Femme! It is an Egyptian restaurant with incredible food, incredible energy, and its outdoor setup is second to none.