The housing market has been red-hot with buyers looking for new spaces in a remote-first market. In some popular markets, the median number of days a home sits on the market is as low as 3 days. More than 68% of sales come from situations where there is a competing offer. With such dynamics, time is of the essence especially for buyers that already have existing homes that need to be sold. Orchard is a home buying and selling platform that allows homeowners to manage this delicate balancing act by allowing buyers to purchase a new home before they have sold their existing properties. Through the Orchard Dashboard, homeowners can manage the entire purchasing transaction with integrated options for mortgages, title, and insurance as well as managing the sale of the existing property by setting up listings, showings, cleanings, and light repairs.

AlleyWatch sat down with Orchard Cofounder and Chief Product and Marketing Officer Phil DeGisi to learn more about the company’s mission to streamline the home buying and selling process, the state of the real estate market, the company’s expansion plans, latest round of funding, which brings the total equity funding to $255M, and much, much more…

Who were your investors and how much did you raise?

Orchard raised $100 million in Series D funding. The round was led by Accomplice with participation from repeat investors FirstMark, Revolution, First American, Juxtapose, and a syndicate of new investors.

Tell us about the product or service that Orchard offers.

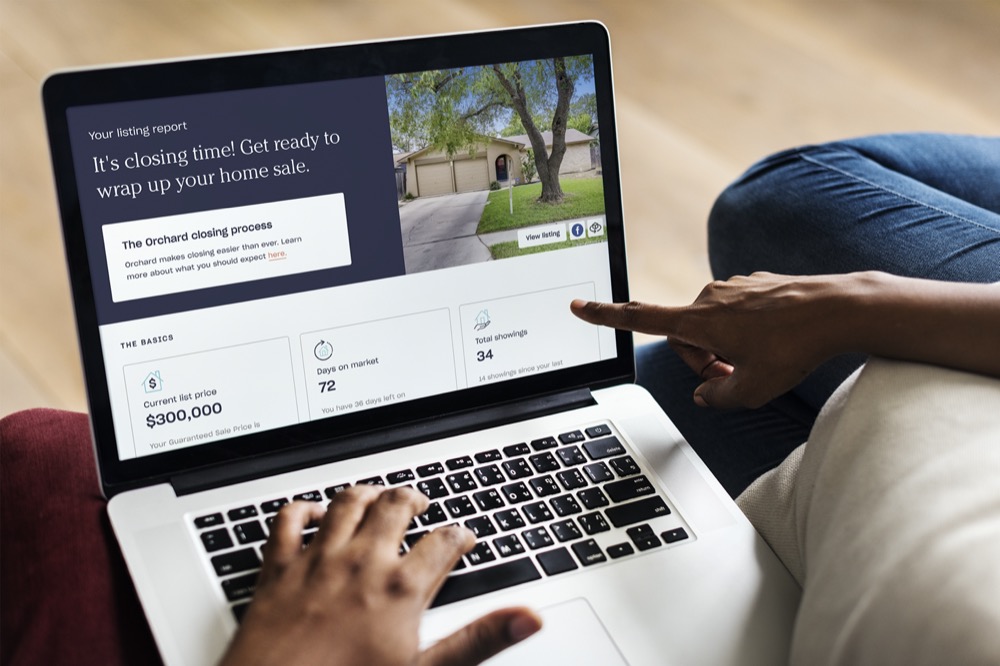

Orchard is radically simplifying the home buying and selling experience from search to close. Traditionally, homeowners looking to purchase their next home face a stressful and uncertain process—they have to either sell their old home first and move twice or buy as a contingent buyer and risk not getting their dream home. We pioneered the ‘buy before you sell’ model which solves the problem which plagues a majority of home buyers: having to sell your old house before buying your new one. Orchard’s Offer Boost option is particularly attractive to customers in competitive markets by giving them the option of using Orchard’s cash to secure their dream home. Cash offers are more likely to be accepted by sellers—a huge benefit in the current competitive market environment. Our customers have access to top-of-the-line technology, including the Orchard Dashboard which allows them to manage their entire transaction, from search to close, in one place. Orchard’s platform is fully integrated and has the ability to offer customers mortgage, title, and insurance options all under one roof.

What inspired the start of Orchard?

What inspired the start of Orchard?

We saw how antiquated the home buying and selling experience was, and hadn’t seen any innovative solutions in decades. After hundreds of research conversations with home buyers, we heard loud and clear there was a need for something new. We launched Orchard to create a stress-free and simple end-to-end experience for home buyers.

How is Orchard different?

Orchard is different from others in the space because of our relentless focus on the customer experience. Orchard’s mission is to transform the way people buy and sell their homes by drastically simplifying the customer experience, and eliminating the traditional pain points that occur when buying and selling homes.

What market does Orchard target and how big is it?

Residential real estate is a $1.5 trillion dollar market.

What’s your business model?

Orchard delivers unprecedented value to our customers by enabling them to buy before they sell their home, as well as a simple, digital closing process. Orchard does all of this for the same fee as a traditional agent.

How has COVID-19 impacted the business??

It turned out that COVID was a tailwind to our business, not a headwind, as record-low interest rates drove home buyers into the market in record numbers. But with that demand came faster than expected growth. Growing a business at more than 3x in a year, while simultaneously building the technical backbone to manage customer transactions was extraordinarily challenging, but we succeeded and are thriving.

What was the funding process like?

Our leadership has deep knowledge and experience in funding rounds so everything ran smoothly. This year, our round was preempted by our lead investors because they saw so much potential in our business model.

What are the biggest challenges that you faced while raising capital?

The biggest challenge, and is seen by many startups throughout the space, was finding the right balance between scaling our company to meet consumer demand, while also making time to meet with investors.

What factors about your business led your investors to write the check?

The biggest factor was our ability to grow 3x year over year, and remaining focused on the customer experience.

What are the milestones you plan to achieve in the next six months?

We will continue to grow our team and markets where we’re available. This past year we launched in Houston, Raleigh-Durham, Charlotte, and Maryland, and Virginia. In 2022, we plan to go to 4 more markets.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Stay focused on your customers. At the end of the day, the most successful companies are the ones that are relentlessly focused on the customer.

What’s your favorite outdoor dining restaurant in NYC?

Our team is a big fan of the rooftop at Gallow Green, or the outstanding garden at Wayla.