Life as a retail investor can be tough. The sheer volume of information, understanding, and detail you need to process to keep on top of the markets is a full-time job, and can be profoundly difficult for individuals who are trading alongside their day jobs.

There’s also the issue of fairness to consider. Are all investors equal? Or are some more equal than others?

As much as 56% of retail investors believe that the market is rigged against them, with 41% of non-investors agreeing with the statement.

Although such accusations can be linked to naivety over the difficulty of timing stock purchases and sales, there are also very valid concerns over the treatment individual investors receive compared to their institutional counterparts. Battling rich rivals, living with gamified investing apps, and relying on social media sentiment have all taken their toll on retail investors where no such problems exist for hedge funds and institutional investors.

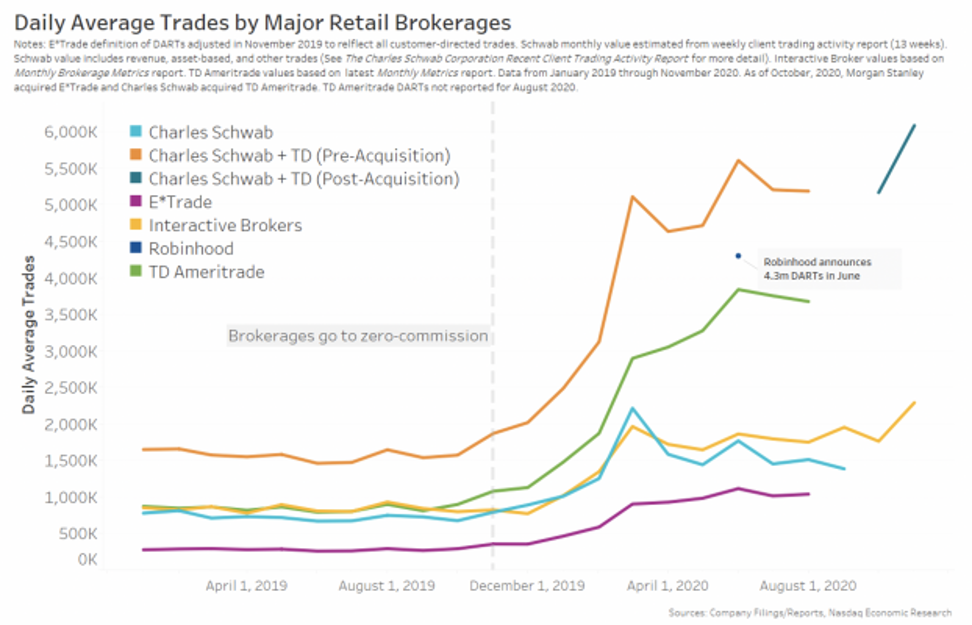

However, to say that retail investors are stuck in the world of trading on their own would be an understatement. As we can see from the chart above, trading volumes of retail brokerages have all grown exponentially since apps began switching to zero-commission trading.

This coupled with the arrival of the Covid-19 pandemic created a perfect storm of stimulus packages, digital transformation, and unprecedented levels of free time at home to explore the world of trading.

As we’ve already seen with the cases of the GameStop and AMC short squeezes, retail investors have the ability to make their presence felt in the modern stock market, so why does it feel like they’re still the little guys on Wall Street? Let’s take a look at the uneven playing field of retail investing:

The Battle of GameStop

The GameStop short squeeze that saw retail investors coordinate their trading patterns via Reddit to dumbfound institutional investors and send the stocks of GME soaring was heralded by some as the backlash of the individual investor.

However, Christopher Schelling, columnist for Institutional Investor, saw the event as an example of how hedge funds always have the final say over the market.

“I’ll bet at the end of the day, more individual investors will have lost money on this trade — buying into the hype on the way up, only to watch it crash back down below their entry point before they could exit — than will have actually locked in realized gains,” Schelling notes. “And in an ironic twist, most of the biggest winners appear to have been hedge funds themselves who profited in the massive run-up in price.”

This statement can be evidenced by the performance of Mudrick Capital, a hedge fund with around $2.7 billion in assets. The fund reportedly made around $200 million on a combination of several Reddit-driven stocks, amounting to a 9.8% gain in January that was heavily punctuated by the events surrounding GME. Senvest Management also reportedly took $700 million in profits from the GameStop short squeeze alone.

Herein lies the challenge faced by retail investors. Hedge funds have the resources to keep their ears to the ground and spot emerging trends faster than the average individual investor – and this counts for social media-driven market movements too.

It can be difficult for investors to time the markets, and their challenge is multiplied when they find themselves up against deep-pocketed, well-resourced, full-time professionals with teams of researchers. It’s these factors that make life harder for active traders who intend to outperform straightforward buy-and-hold strategies.

Accusations of Gamification

To make the playing field even more uneven, retail investors have become increasingly dependent on apps that gamify the investing process.

Notably, Robinhood has found itself coming under increasing pressure for the way the app gamifies the investing process.

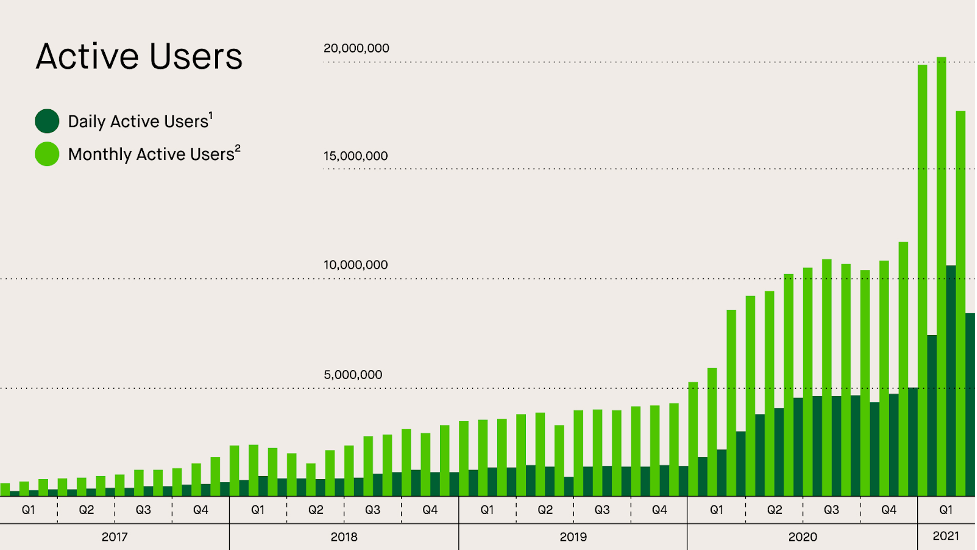

Robinhood created its app with the intention of ‘democratizing finance for all’, and it’s clear that the platform has resonated with retail investors – with around 20 million monthly active users recorded at the beginning of 2021.

The company’s investing app has also been developed to be especially intuitive and user-friendly. Maxim Manturov, head of investment research at Freedom Finance Europe said that “Robinhood created an app with its clients in mind. Among the top features one may mention is quick signup that requires only 5 five minutes, no minimum number of accounts, easiness to use, social touch, crypto trading, 24/7 trading, and, last but not least, zero commissions.”

However, this zero commission model has led to accusations that the company is gamifying trading as a means of making more money through its payment-for-order flow business model.

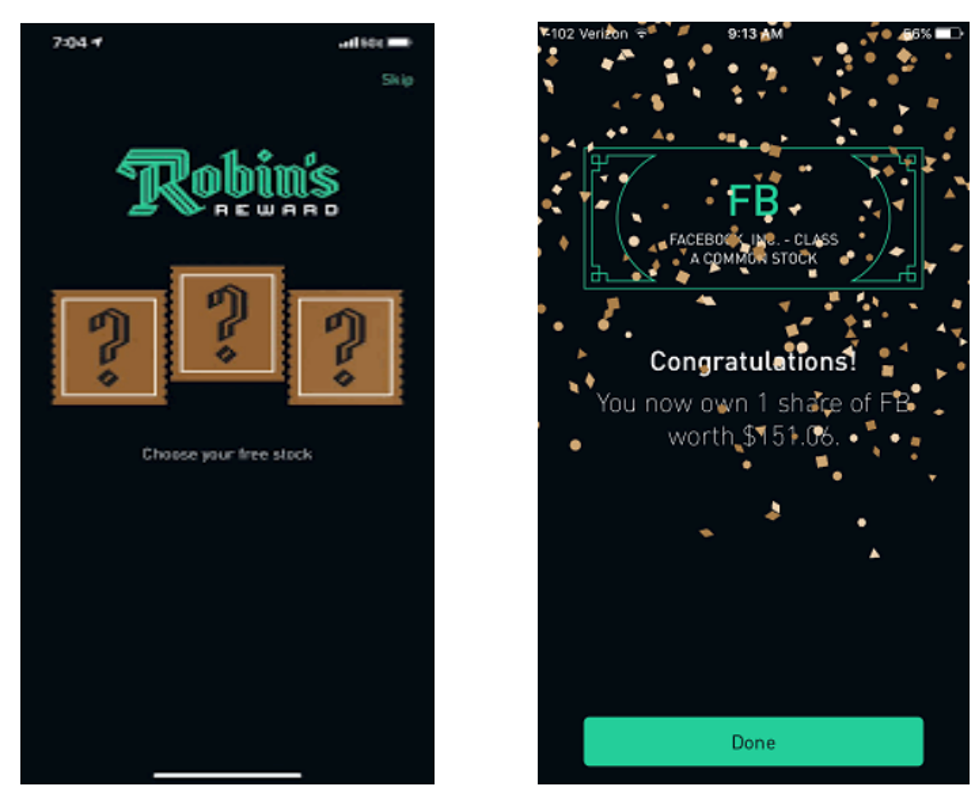

Writing for Fast Company, James Fielder believes that Robinhood’s app has been devised to take advantage of people new to active investing by utilizing the same psychological motivators that drive game behavior. “Robinhood’s simple interface is replete with emojis, push notifications, digital confetti, and backslapping affirmation emails. Its “gameplay loop” is making stock trading easy while providing sensory feedback,” Fielder argues.

In fact, Robinhood recently took the decision to remove its confetti feature when users make their first trade on the app in reaction to accusations of gamification.

However, this setup that appears to reward active trading may give the impression that the app is encouraging users to continue buying and selling, rather than sitting on their investments – a much riskier strategy than simply holding for retail investors who may be none the wiser to such tactics.

Succeeding as a Retail Investor

In the wake of the GameStop short squeeze, the SEC claimed that it will “act to protect retail investors.” However, retail investors could be forgiven for believing that they’ll never get to access the same levels of favourability as their more resourceful counterparts.

Unless you jump on the next short squeeze at precisely the right time, there’s little chance of you competing against the sheer power of global hedge funds. But by adopting a more patient approach and by avoiding playing them at their own game, and work to outstay the institutions.

Hold on to the stocks you love, and avoid the temptation of playing the game of jumping from stock to stock.

It’s also worth looking more to index funds as a financial safe haven. Index funds are highly diversified, low-risk investments that can replicate the average returns of a broad market index. Over time, they typically outperform most hedge funds, too.

Sometimes, the best way to compete with hedge funds is to work in a slightly different way to them. By resisting the temptation of playing the game and treating Wall Street like a casino, you can rely on the quality of your research and make more sustainable decisions for a better chance at winning on Wall Street.