I started writing about the tremendous harm of FAMGA’s (Facebook, Apple, Microsoft, Google & Amazon) increasing share of tech market cap in January 2017 (“FAMGA Is Eating The World”). At the time, I recognized our archaic monopoly laws, focusing on harm to consumers, were not going to slow FAMGA’s inexorable march. I also saw no emerging technology that would impact the five behemoths.

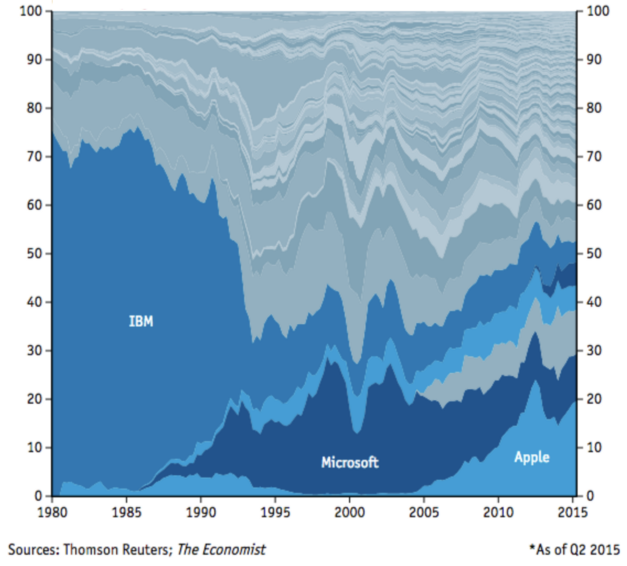

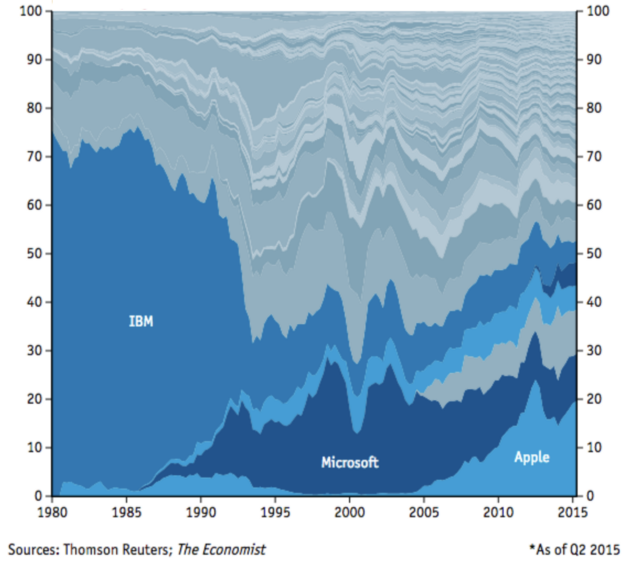

As I gathered more data, in April 2017, I published “The Profound Implications of Five Increasingly Dominant Tech Companies.” While my outlook was growing more dire, I saw a glimmer of hope. I realized that nothing is constant but change, particularly in tech, as represented by this 2015 chart of market cap share of the top 100 tech companies over time:

This is a good video of some of the same data, updated to 2019:

Only two months after I wrote that second piece, I saw the crypto light. I’ve been focused on crypto 24/7 ever since, as I think it has the potential to be the biggest thing to happen in the history of humanity, and it’s our best hope to challenge FAMGA (as I wrote in “The Coming Epic Battle Between Crypto & FAMGA”).

There may be other actions the U.S. federal government can take to reign in FAMGA. But, by a very wide margin, the most effective thing the federal government can do to address FAMGA’s impact is to provide a friendly regulatory environment for crypto and let capitalism do its thing.

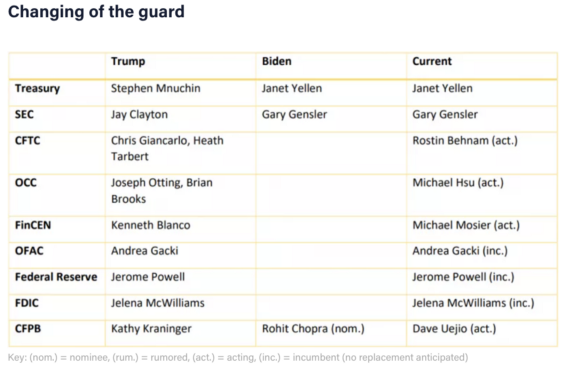

There have been a lot of announcements made by different agency heads of the new administration. Acting Comptroller of the Currency Michael Hsu announced a staff review of all pending matters and interpretive guidance issued under the Trump administration.

The Office of the Comptroller of the Currency, the Federal Reserve and the Federal Deposit Insurance Corp. said they were discussing a potential interagency group to examine crypto policy. And the Fed’s first research paper about a digital dollar is coming this summer. But the industry needs clarity about the rules now. And we still don’t have new heads at many of the government agencies overseeing crypto:

Instead of providing greater clarity, Biden rolled out a kitchen sink of executive orders, which will have a modest impact, at best, on FAMGA’s inexorable rise.

The White House Has A Sense Of The Problem

The White House Fact Sheet on “The Executive Order On Promoting Competition in the American Economy” highlighted some of the problems of the growing number of industries controlled by monopolies or oligopolies. These problems include the fact that the “… lack of competition drives up prices for consumers,” for many products, and that barriers to competition are “…driving down wages for workers.”

The White House estimated that the combination of higher prices and lower wages costs American households $5,000 per year. The fact sheet also noted how inadequate competition holds back innovation, as new business formation has fallen 50% since the 1970s, as large businesses make it harder for good ideas to break into markets.

The simple facts are that as competition declines, productivity growth slows, business investment and innovation decline, and income, wealth, and racial inequality widen.

Biden Is No Roosevelt (Teddy or Franklin)

I actually like Biden and think he means well. But comparing these 72 acts to the trust-busting of former President Teddy Roosevelt, or eight-fold increase in anti-trust cases brought forth under former President Franklin Roosevelt, is a stretch.

While the order calls on the U.S. Department of Justice and the FTC to vigorously enforce antitrust laws, they are, as written, totally inadequate, as U.S. antitrust laws focus on harm to consumers, not competitors. Proving free products like Facebook and Google are harming consumers is pretty hard, as is proving Amazon is harming consumers.

The White House Has No Good Solutions

The order focuses on three areas where the White House sees dominant tech firms undermining competition and reducing innovation.

The first area of focus is mergers. While a policy of greater scrutiny of these transactions was announced, the horse has left the barn. And unintended consequences could be perilous. What percentage of VC investments are predicated on a potential FAMGA acquisition?

The second area of focus is the accumulation of personal information. That’s great news for privacy advocates, like me. But whatever the rules are, FAMGA will still have massively more information than competitors. And the lack of ability for small competitors to innovate on data accumulation could be another unintended consequence.

The third area of focus is FAMGA unfairly competing with small businesses, like Amazon’s use of data from sales of third parties on the Amazon platform. Amazon has historically used that data as a kind of research and development lab, yielding more than 100 Amazon-owned private label brands.

While focusing on those unfair practices is a noble gesture, the devil is in the details. And the government is ill-equipped to provide the kind of surgical oversight necessary for that to be effective. Not to mention that Amazon can simply choose to not allow certain third parties, or all third parties, on its platform. At the end of the day, Amazon is so massive, it can also easily do the R&D outside of the third parties.

Let Crypto Compete!

It’s interesting to note that Microsoft helped Apple stave off bankruptcy in 1997 out of antitrust concerns should its beleaguered competitor go out of business. But Apple’s rise to glory resulted from its ability to innovate and effectively compete.

Letting crypto compete against FAMGA should be the rallying cry of crypto lobbyists. Letting crypto compete should also be the rallying cry for regulators In fact, letting crypto compete should be the rallying cry for everybody everywhere who longs for a better future.