The pandemic has pushed more and more consumers online with both online sales and the percentage of online share of total retail sales surging globally. While this created a windfall for many e-commerce businesses it also drove up customer acquisition costs, making LTV even more important. Using technology to quickly, efficiently, and accurately understand the science of behavior when it comes to customer interactions has become instrumental for the health of e-commerce and retail businesses. Bluecore is an AI-driven retail marketing platform that helps brands and retailers create personalized campaigns based on the analysis of millions of customer data points. By understanding a customer’s experience throughout their journey, retailers are able to focus on creating loyalty rather than churning through single-purchase low-value customers.

AlleyWatch caught up with CEO and Cofounder Fayez Mohamood to learn more about why the e-commerce industry needs a native marketing solution, the company’s impressive growth, future plans, latest round of funding, and much, much more.

Who were your investors and how much did you raise?

Bluecore raised $125 million in Series E funding. The round was led by existing investor Georgian, a multi-billion dollar fintech company that focuses on high-growth software companies leveraging data in powerful ways. Current Bluecore investors FirstMark and Norwest, and new investor Silver Lake Waterman, also invested in the round. The new investment brings Bluecore’s total funding to more than $225 million and puts its valuation at $1 billion.

Tell us about the product or service that Bluecore offers.

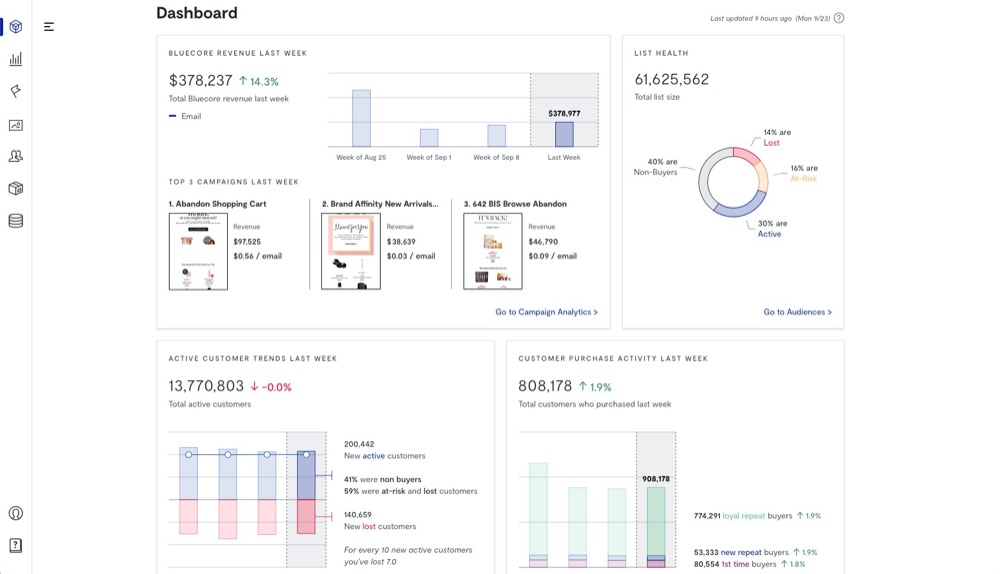

There are a number of challenges for retail, but the primary issue is that 80% of customers only ever buy from a retailer once. We call this the ‘one-and-done buyer problem’. When traditional retailers go digital and digital brands scale, they have to focus as much on customer retention as acquisition. Fortunately, digital offers a data-rich environment for connecting shoppers to the next-best product that gets them to buy again and again. We work with 400+ retail brands, including Jockey, NOBULL, 4ocean, Lane Bryant, and Foot Locker, to drive revenue and growth by increasing purchase frequency, cart size, and conversions through personalization and ensure they dominate the permanent shift to digital.

Bluecore’s predictive retail AI platform merges three traditionally disconnected data sets into a single unified view that includes Shopper Identity (who is the shopper?), Shopper Behavior (how and where are they engaging with products?), and Product Catalogue (which products are they engaging with?). We currently manage nearly 500 million shopper IDs and a cumulative product catalog second only to Amazon. Bluecore leverages this first-party data to predict and execute on the exact experience a shopper should receive–across owned and paid digital channels, including email, e-commerce websites, and social media and search ads.

In 2019, Bluecore launched Bluecore Communicate™ so that retailers could replace their traditional Email Service Providers (ESPs) and bring together their batch emails and triggered emails to introduce fully personalized emails. That same year we also launched Bluecore Site™ to personalize every step of the e-commerce shopping experience, from homepage to checkout. And in 2021, we launched Bluecore Advertise™, our first product line to operate outside of retailers’ owned and e-commerce shopping channels. Bluecore Advertise™ activates retailers’ first-party shopper data on more than 20 digital ad channels, including Google, Facebook, Instagram, Pinterest, Snapchat, and others, so that they can target their shoppers wherever they spend the most time, with consistent, relevant, 1:1 experiences. We also have personalized SMS on the horizon this year, our next product that operates outside of retailers’ owned and e-commerce shopping channels.

What inspired the start of Bluecore?

What inspired the start of Bluecore?

I cofounded Bluecore with Mahmoud Arram and Max Bennett after working in the loyalty space where I saw that retailers were missing out on the opportunity to leverage their live online product catalogs to directly influence their customer communications and offers. If retailers could identify shoppers at the individual level and understand each of their interactions with specific products, they could create more relevant interactions that would get shoppers to purchase again and again. For example, if a consumer does not need a discount to convert, they shouldn’t receive a discount code from a brand, or if a product a consumer previously viewed drops in price, they should receive a notification on the channel where they spend the most time on – whether that’s email, SMS or Instagram. This original philosophy has become core to a new type of retail marketing platform that automates acutely personalized communications at the individual level and matches shoppers with products they love.

How is Bluecore different?

Bluecore’s key point of differentiation is its ability to integrate with retailers’ live product sets and connect this real-time visibility and insights, into every product a shopper has ever viewed, clicked, searched for, or browsed while on their sites, to a set of predictive recommendations. Using this data set, we can automate actions across channels with the goal of continuously creating matches between each individual shoppers and the products they’ll love and creating hyper-personalized experiences that will drive them to purchase.

Bluecore also uniquely serves only retailers and brands, so we can build tools and models natively into the platform, which cater directly to the needs of the retailers and brands we work with. Our verticalized approach means using artificial intelligence and machine learning to activate Bluecore’s intelligence through a growing suite of retail-specific applications including replenishment models, discount affinity models, and promotion and product preference.

What market does Bluecore target and how big is it?

Bluecore is focused on retail e-commerce, roughly a $4.6 trillion market. Over the last two years, the retail world has seen sales shift from 85% in physical stores to a 50/50 online-offline split, as shoppers migrated to convenient, personalized customer experiences. Now, more than three-quarters of shoppers are expected to begin their experience with a retailer through digital channels, independent of whether the ultimate purchase takes place online or in physical stores. With this growth in just the past two years, the e-commerce market is projected to hit $10 trillion by 2027.

In the US, we focus on the top 2,500 retailers and fast-growing DTC brands, which is a $5B market. Bluecore is directly responsible for driving billions in Gross Merchandising Value (GMV) for hundreds of retailers.

What’s your business model?

Bluecore’s Shared-Success Business Model aligns a retailer’s investment with customer engagement, instead of total campaigns or send volumes. We’re focused on delivering incremental revenue through the platform for retailers, rather than sending communications for the sake of reach alone. With this, we have launched the industry’s first and only success-based pricing model, where clients pay solely based on traffic and conversions generated by the platform. With e-commerce now the primary source of revenue for many retailers, they need an infrastructure and success model that is built specifically for them and fundamentally different from what was built in the past.

How has COVID-19 impacted the business?

In 2020, the whole world moved to digital shopping. This was a major wake-up call to those omnichannel, enterprise retailers who still did the majority of their sales in-store and didn’t consider their e-commerce sites primary revenue generators.

In addition to that, all retailers were suddenly competing 100% online–not only against each other but against highly curated digital-first experiences from brands like Netflix and Spotify. The contrast between the experience these retailers offered online and what others were doing–and how a poor experience affected conversions–jolted retailers into action.

Not only were their online shopping experiences poor; their marketing infrastructures weren’t built for the digital world. They were designed to drive in-store sales. To be digital-first they needed to win in e-commerce, and to win, they needed personalized marketing.

Retail saw more than a hundred major bankruptcies last year. Many of these were retailers who had figured out how to generate sales online but weren’t set up to market to and retain customers to compete there.

All of this has made what Bluecore does critical for brands looking to grow online.

What was the funding process like?

Georgian doubled its investment in Bluecore for the third year in a row. These conversations with Georgian were ongoing because of Bluecore’s continued success and the accelerated shift of eCommerce where our offering became critical for brands. Our work with three existing investors, as well as a first-time investor, allowed us to put together a round that helped us stay focused on executing on the business. Investors are optimistic about the role technology plays in transforming retail, and understand verticalized technology to uniquely solve industry challenges, which has put Bluecore in a great position during funding rounds.

Georgian doubled its investment in Bluecore for the third year in a row. These conversations with Georgian were ongoing because of Bluecore’s continued success and the accelerated shift of eCommerce where our offering became critical for brands. Our work with three existing investors, as well as a first-time investor, allowed us to put together a round that helped us stay focused on executing on the business. Investors are optimistic about the role technology plays in transforming retail, and understand verticalized technology to uniquely solve industry challenges, which has put Bluecore in a great position during funding rounds.

What are the biggest challenges that you faced while raising capital?

Great companies are built over time. As Bluecore continues to grow, the challenges are less around capital, given the clear signal in the market for an alternative solution to mass marketing signals, and more around how well Bluecore can predict where the market is headed. The imperative is to meet the shopper where they are going next.

What factors about your business led your investors to write the check?

We’ve been laying the foundation for long-term stability for hundreds of retailers who look to us to compete in the world of online shopping, because it’s exactly what our technology was built for. And more specifically, built for the unique use cases of retail, such as the need to create repeat purchases, preserve margins and guide shoppers through product discovery. We bet on verticalized tech in the early days of Bluecore, and it’s become more mainstream to investors as it solves deep industry problems.

We’ve been laying the foundation for long-term stability for hundreds of retailers who look to us to compete in the world of online shopping, because it’s exactly what our technology was built for. And more specifically, built for the unique use cases of retail, such as the need to create repeat purchases, preserve margins and guide shoppers through product discovery. We bet on verticalized tech in the early days of Bluecore, and it’s become more mainstream to investors as it solves deep industry problems.

What are the milestones you plan to achieve in the next six months?

Personalization has always been important to retailers, but the value retailers can derive from it has accelerated as e-commerce becomes a greater source of revenue. Our focus continues to be on driving significant increases in revenue for retailers and brands by connecting live product catalogues with first-party shopper data and onsite behavioral data and automating decisions around the recommendations that will convert for individual shoppers.

The future of commerce and marketing is digital-first, and brands need to be offering connected shopping experiences on whatever digital channels shoppers are on. Our investments in the next six months will focus on scaling the channels and tools available to retailers to connect with retailers anywhere, while guiding retailers through ongoing transformation that drives profitability.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

At Bluecore, we’re built for the success of our customers in every way possible: from our pricing model to the way we develop the product, to the way our teams are structured. Companies need to double down on what fuels their growth, and make sure both teams and operations are aligned around that mission. They also need to focus on the one problem they solve exceptionally well and execute around that, rather than trying to solve too many different problems at once.

Where do you see the company going now over the near term?

We’re currently helping retailers make retention and shopper loyalty a key strategy and driving revenue growth. While retention is the primary challenge retailers are facing, there are also deeper problems that plague retailers like supply chain, product assortment, actionable insights and channel development. Retailers are currently solving some of these problems indirectly through personalization. For example, we’ve seen some retailers that have put their focus on personalized marketing and seen an impact to their supply chain as well. We see Bluecore helping retailers more directly with these deeper issues in the near term.

What’s your favorite outdoor dining restaurant in NYC?

Lucali in Brooklyn.