Homeownership and real estate are often cited as one of the primary drivers of creating intergenerational wealth in the United States. Amid the pandemic, Americans went on a homebuying spree as the line between work and home blurred. Owning a home can be extremely rewarding but it does come with significant responsibility. Realm is a centralized data hub for homeowners to access insights on every aspect of homeownership, based on their personalized circumstances, enabling them to make data-driven decisions for what will likely be the single largest investment of their lives. The platform, launched earlier this year, leverages proprietary and public data to assess value (both current and potential with renovations), estimate project costs, and learn more about financing options. In California, homeowners can work with Realm advisors to work on renovation projects from beginning to end. In the six months since launch, the Realm has been used by 20,000+ homeowners across the nation.

AlleyWatch caught up with CEO and Founder Liz Young to learn more about scaling consumer data applications in the real estate space, the company’s strategic plans, the latest round of funding, which brings the total funding raised to $15.2M, and much, much more.

Who were your investors and how much did you raise?

Realm’s Series A fundraise of $12M was led by GGV Capital, with participation from existing investors Primary Venture Partners, Lerer Hippeau, and Liberty Mutual Strategic Ventures.

Tell us about the product or service that Realm offers.

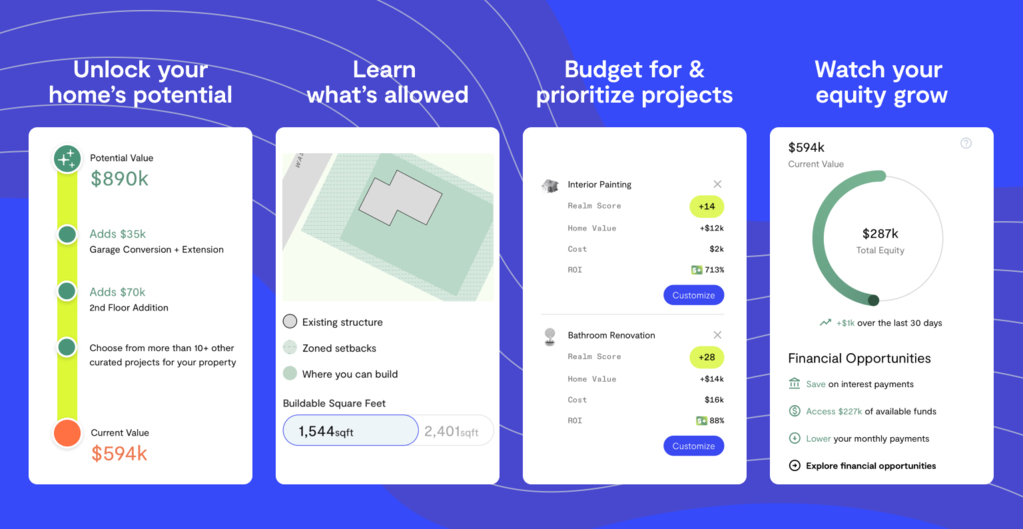

Realm is the first unbiased, free-to-use and centralized source of actionable data available for American homeowners, launched earlier this year to provide a one-stop-shop for accessible, actionable home advice. For all homeowners, especially newer homeowners, Realm is here to answer the burning question, “What’s next?” With data-backed insights ranging from when to tackle a bathroom renovation to when to refinance, Realm is the modern American homeowner’s guiding light to maximizing their biggest asset. Through a three-pronged approach to data, Realm provides customers with Real-Time Home Valuation, Realm Key Insights, and a Personalized Property Plan.

What inspired the start of Realm?

What inspired the start of Realm?

Primary homes account for 62% of the average American homeowners’ total assets, and the spending doesn’t stop once they move in. Our homes are our most expensive asset, and there’s no other place people spend so much money, with so little accurate information to base their decisions on. As a real estate investor and multi-property owner, I have a firsthand look at all of the information investors have access to, but homeowners don’t – and I quickly realized this needed to change.

How is Realm different?

Realm not only shares information about what a home is worth today (like a handful of existing platforms), but what it could be valued at in the future. Notably, Realm now has the largest parcel-level zoning database in the US and, on average, its customers are uncovering $175,000 in untapped property value.

What market does Realm target and how big is it?

Realm can and should be used by all homeowners, but the platform was especially created for new homeowners who have lived in their homes for 3 years or less. Realm has helped over 20,000 homeowners to date (and growing 50% month over month) in all 50 states.

What’s your business model?

We’re a marketplace business model. We offer insights for free, and make money by connecting homeowners to the people and businesses that can make our recommendations a reality. We use our data to match homeowners to the vendors that are best suited to work on their specific property and needs.

How has the business changed since we spoke after your launch in February?

A lot has changed! When we spoke in February we were just launching our national tool. Since then, we’ve analyzed over 20,000 homes and have spoken to thousands of homeowners. They’re loving our platform for our unbiased project pricing, ROI analysis, and real-time home valuation. We’ve strengthened the quality of our insights significantly through investing in more data sets and building our more sophisticated data models.

What was the funding process like?

Our funding process moved pretty quickly. We had a shortlist of the partners and funds we wanted to work with, and the terms that were most important to us – in order as follows: partner, fund, terms.

Partner – is this someone with high conviction in the business that will help us build towards the ultimate vision? Is this someone we’ll enjoy working with for the next 5+ years?

Fund – is this a fund that has a good reputation, deep pockets (for participation in future rounds), and has helped build large businesses tackling similar problems or with similar business models?

Terms – is this a fair valuation with clean terms to preserve future flexibility?

Partner – is this someone with high conviction in the business that will help us build towards the ultimate vision? Is this someone we’ll enjoy working with for the next 5+ years?

Fund – is this a fund that has a good reputation, deep pockets (for participation in future rounds), and has helped build large businesses tackling similar problems or with similar business models?

Terms – is this a fair valuation with clean terms to preserve future flexibility?

What are the biggest challenges that you faced while raising capital?

The hardest thing about fundraising is that it’s a full-time job, but your other responsibilities don’t magically disappear. You’re still running the business – recruiting, 1:1s, QA’ing the product, talking to customers, paying bills, etc. You have to take a step back from some things during fundraising, which is why running a fast process is so beneficial.

What factors about your business led your investors to write the check?

Generally, the VC community’s feedback was this is a “no brainer” problem to solve, with a huge market size, and we were taking the right approach to solve it (data-driven). There are a ton of tools that help people buy and sell homes, but there’s no unbiased platform to turn to once you move in – there’s nowhere else you spend so much money with such little information.

What are the milestones you plan to achieve in the next six months?

We’ll 5x our homeowner user count and triple the team size.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

I’d advise them to take a step back and ask themselves:

- Why do we need the capital?

- What’s preventing us from raising it today?

Then, fix #2.

For us, we knew we needed more capital to improve the quality of our data insights, because scaling a data business is expensive. We also knew that we needed to answer some big investor questions ahead of raising that capital- Is it possible to build a national platform? Can you offer good quality data? Do homeowners care about this? So, we spent January-April 2020 obsessing over those things.

Where do you see the company going now over the near term?

We want to be the trusted destination for American homeowners. While we have a lot of work to do, every week we’re getting closer- better data, more users, a more engaging product.

What’s your favorite outdoor dining restaurant in NYC

The outdoor dining spots in my monthly rotation are Charlie Bird, Raoul’s, & The Dutch – they’re all consistently solid and within a 5-minute walk of my apartment.