In this series, we dive into technologies and industries we’re excited about, going deep into their change drivers and stakeholders while exploring investment trends and opportunities through an early-stage lens.

Sector: E-commerce enablement: Supply Chain Tech

In a sentence: The future of eComm-enabled supply chain refers to a series of trends and advancements that are helping online retailers improve their logistics processes to operate faster, more efficiently, and more transparently in the wake of changing consumer expectations.

Size and scope: While COVID-19’s disruption alerted businesses to the importance of supply chain resilience, pandemic-related interruptions were not the beginning of these issues. In fact, 40% of executives believe their exposure to supply chain risks has increased over the past three years.

Following this trendline, Pitchbook estimates that the global supply chain technology market is expected to top $6 trillion by 2025 across the verticals of freight ($5 trillion by 2025, growing at 24% CAGR), warehousing & fulfillment ($527 billion by 2025, growing at 35% CAGR), enterprise supply chain management ($25 billion by 2025, growing at 80% CAGR), and last-mile delivery ($579 billion by 2025, growing at 67% CAGR).

Stakeholders: The two most important categories of stakeholders in the supply chain industry are the business leaders responsible for supply chain operations and the consumers demanding the increasingly fast, free, sustainable, and frictionless online shopping experiences catalyzing such change.

Change drivers:

Last Mile: Research suggests that 96 % of today’s consumers consider “fast delivery” to mean “same day” delivery, yet only 51 % of retailers offer this option. As next-day, same-day and even same-hour options continue to appear across categories, evolving consumer expectations will hasten innovations in last-mile logistics.

In the spirit of improving shipping times, businesses everywhere are thinking about how to shorten the distance between their warehouse(s) and their customers’ front doors to optimize the last mile, which currently comprises a whopping 53% of companies’ overall logistics costs. Startups that can develop solutions to help online retailers improve last-mile logistics (while increasing margins) will fast-track their way to hyper-growth. Companies disrupting the last mile are experimenting with concepts such as leveraging unused space in people’s homes as micro-fulfillment centers and figuring out alternatives to quickly fulfill luxury fashion and beauty products, which aren’t as suitable for Amazon, due to issues such as counterfeiting, illegitimate resale, and decreased brand value by offering luxury at mass.

Decentralized Fulfillment: In the past, many eComm retailers preferred centralized distribution to decentralized models due to better bargaining power with suppliers and lower storage costs (e.g. greater economies of scale). However, with rising consumer expectations for free and fast delivery, the increased shipping time from a single, central warehouse to a customer’s front door is no longer worth the cost savings. In fact, the cost of customer churn due to a slow delivery experience may now outweigh the savings gained from centralized models.

For all these reasons, having a decentralized warehouse network is now looked to as the leading fulfillment solution, which will become the new normal for all companies — not just those big enough to own their own supply chains.

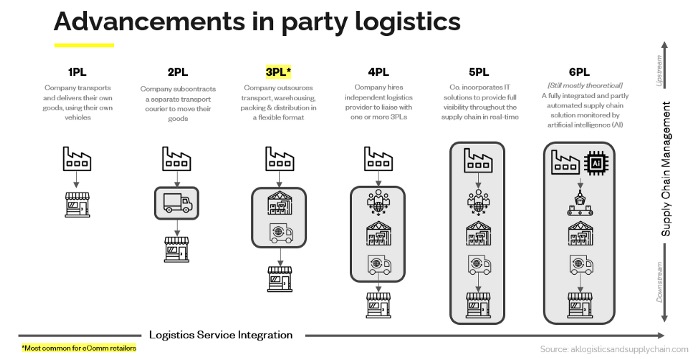

Supply Chain as a Service (SCaaS): Outsourced logistics were rare before the 1990s. Now, businesses everywhere are realizing that handling their own warehousing and fulfillment services isn’t the most productive or cost-effective. New innovations in “supply Chain as a Service” (SCaaS) will give SMEs the means to scale affordably by turning fixed expenditures into variable costs without large capital expenses or ongoing maintenance fees. Particularly, 2PL and 3PL providers have been seeing increased demand from D2C eComm retailers due to their ability to help SMEs scale without the expensive upfront investment.

Increased ESG compliance: Prior to recent innovations in SCM technology, the only companies that invested in supply chain visibility were those most prone to counterfeiting (i.e., luxury fashion and cosmetic brands). But as investors set new standards for ESG compliance and consumers demand higher levels of social and ethical consciousness by the companies they support, it is now more critical than ever for businesses to double down on their supply chain transparency efforts.

Adding to this urgency are new laws being proposed by the FDA to enforce greater farm-to-table traceability of food products. FSMA Rule 204 is one such proposal that signals a major shift toward what the industry is calling a “New Era of Smarter Food Safety”. If Rule 204 is passed — and it looks like it will be — companies will have exactly two years to begin complying with a strict, new set of standards that mandate increased recordkeeping and the enhanced tracking and tracing of food products across the entire food system.

While Rule 204 would invite positive change for the industry, it’s worth noting that ensuring supply chain visibility is currently the single most challenging area for supply chain leaders to tackle, meaning businesses everywhere will be looking for solutions to get ahead of it.

Where our portfolio fits: Recognizing these trends, Lerer Hippeau has invested in the supply chain stack, including a modern fleet management company called Transfix, a less-than-truckload transportation management system called MyCarrier, a returns management platform called Loop Returns, and is currently looking at ventures leveraging NFC and blockchain technology to enable better communication between brands and consumers regarding end-to-end supply chain visibility of their products.

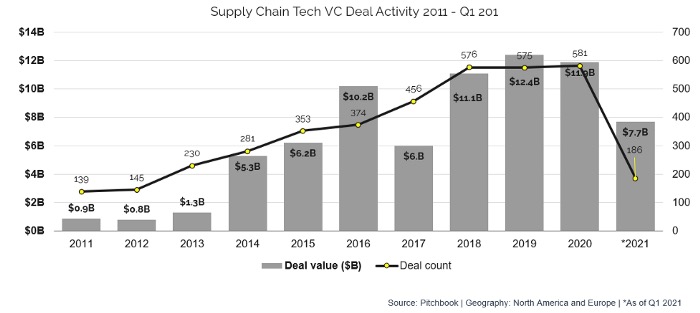

Investment trends: According to Pitchbook’s Supply Chain Technology report (Q1 2021), venture investment into supply chain tech startups totaled $7.7 billion in VC investment across 186 deals in Q1 this year, up 90.6% QoQ and 355.1% YoY as compared to 2020.

Valuations for supply chain tech startups also increased significantly since last year. The median pre-money valuation for early-stage supply chain tech startups increased 125.1% YoY to $67.5 million, while the median pre-money valuation for late-stage supply chain tech companies increased 100.0% YoY to $200 million. This increase was largely driven by late-stage “winners” in the delivery space which benefited from pandemic demand surges for online retail and food delivery, which has attracted more venture investment as a result.

What to look for: While the eComm supply chain industry can be divided into four main buckets — freight, warehousing & fulfillment, enterprise supply chain management, and last-mile delivery — we are particularly excited about companies thinking about solutions for SMEs, which make up 70% of the global supply chain and traditionally experience the most supply chain challenges due to their lack of resources. Specifically, the startups on our radar are thinking about the following:

- Hyper-local fulfillment

- Cross-platform counterfeit and brand management

- Applications of NFC technology

- Supply chain tracking using blockchain-enabled ledgers

Seed Considerations: Across industries, founder-market fit is incredibly important; however, that’s perhaps even more true in this market where multiple stakeholders, complex operations, and long-standing relationships require deep industry knowledge and networks. With platforms like Amazon and Shopify enabling a large percentage of e-commerce transactions today, understanding the opportunities and obstacles of those platforms is essential. Finally, coming out of the rocky foundation left by the pandemic, it will be important for investors of e-commerce companies to evaluate a company’s supply chain strategy before considering a product-based investment.

This post was authored by Jess Schram and is reprinted with permission.