Demographic information of an area and the health of the economy are two of the four main determinants of the real estate market. Interest rates and government policy are the other two. Markerr is a real estate analytics and intelligence platform that layers both public and private data to provide insights into any real estate market. The company looks at factors like income levels, job growths, spending, and demographic profiles to empower commercial property owners, investors, and lenders to understand present and future rental rates. Markerr offers a dashboard that can analyze, in real-time, at the property level in addition to offering reports and data feeds.

AlleyWatch caught up with CEO, Founder, and repeat entrepreneur Brian Lichtenberger to learn more about how data is used in strategic decision-making in the real estate industry, the company’s future plans, recent round of funding, and much, much more.

Who were your investors and how much did you raise?

Series A, $5 Million. The round was led by RET Ventures, joined by Continental Realty Corp, a long-time client of Markerr and owner of 10,000 multifamily residential units. Additional investors in this round include Matt Levin of Twin Shores Capital (formerly of Bain Capital); Edward Norton, actor and technology investor; and Joe Lettween of Osso Capital (formerly of Vista Equity Partners).

Tell us about the product or service that Markerr offers.

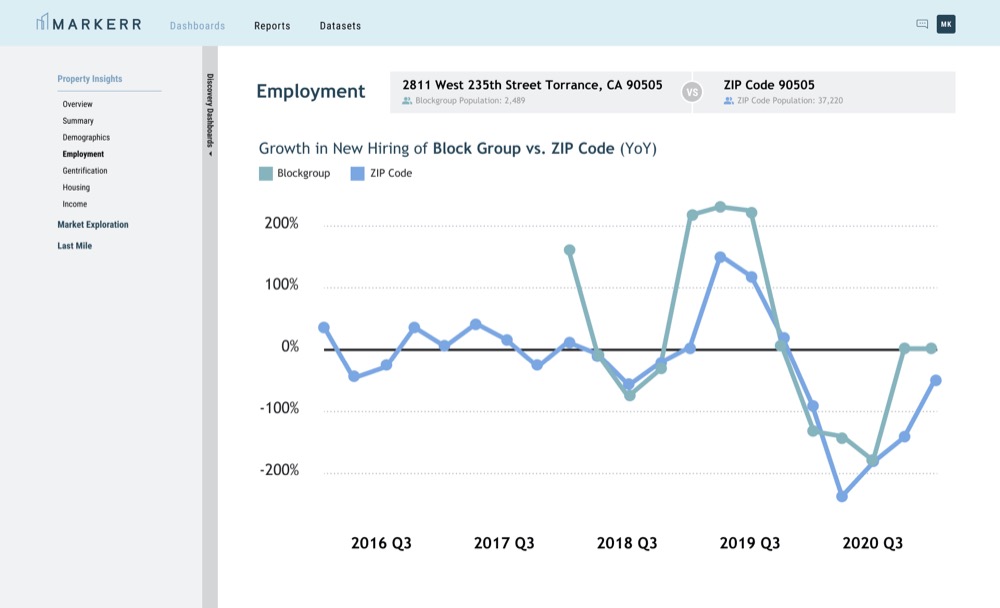

Our products – dashboards, reports, and data feeds – leverage proprietary and public data sources to highlight the most impactful, forward-looking indicators of real estate demand and supply. Markerr’s granular insights provide perspective into the most critical drivers of rental rates and other key metrics, including income, job growth, and demographics. These insights are then used by investors, owners, and operators to improve forecasting, underwriting, and investment decisions.

What inspired the start of Markerr?

What inspired the start of Markerr?

My career has been focused on the role of data and analytics in strategic decision-making. The commercial real estate industry— while very data-intensive— currently uses data in a narrow way. There exists tremendous potential to leverage external data to transform decision-making, enabling institutional owners and operators of real estate to make more accurate and efficient decisions. In an environment where companies are competing for deals as well as assets, it’s increasingly important to differentiate at the decision-making level — and to do so with great efficiency. At Markerr, we see a huge opportunity to synthesize external data, connect it to internal data, and derive insights in a way that streamlines and simplifies the investing and underwriting workflow.

How is Markerr different?

- More accurate, timely, and granular than traditional data sources

The real estate industry has historically focused on supply, whereas Markerr offers insight into demand that is not available anywhere else. And where the industry does leverage demand data, the primary sources have a significant lag and are pretty commodified, leaving little opportunity to gain a competitive edge. By addressing the need for more timely, granular data, we’re able to deliver insights that provide more accurate forecasts and better returns for our customers. For example, our Income & Employment data has an 80% higher correlation to rental rate growth than BLS data.

- Unified view of supply and demand

We don’t just bring unique data sources together—we synthesize and analyze that data, putting insights directly in the hands of our customers through dashboards, reports, and data feeds.

- A streamlined evaluation process

Many of our customers are aware of the wealth of data available to them, but the processes necessary to pull meaningful insights from the data are far too cumbersome. One would have to procure, vet, and license the data, as well as build or hire the infrastructure necessary to store, analyze and visualize that data. Real estate professionals need a concise look at the most important metrics for a given property so that they can best communicate with investment committees, and make apples-to-apples comparisons between deals. That’s what our platform allows.

What market does Markerr target and how big is it?

Anyone who invests in, develops, owns, or operates commercial real estate can be a customer. The US market is currently estimated to be over $16T by Nareit.

What’s your business model?

Customers sign up for an annual subscription to either an always-on dashboard or to a specific dataset that is updated weekly or monthly.

How has COVID-19 impacted the business?

The real estate industry has been significantly impacted by the acceleration of demographic trends already underway. These trends disrupted the decision-making processes of many institutions as the data sources they’ve historically relied upon were no longer relevant in a post-Covid environment. We’ve seen an explosion of interest as firms are more reluctant to view historical data as an accurate comp, looking for new ways to understand the pace at which trends like suburbanization or moves to the Sunbelt are accelerating.

What was the funding process like?

We met RET Ventures back in December 2020 and identified them as the lead investor from the start. Between a proven track record of success in the proptech industry, and a wealth of strategic partners that are dominating the multifamily sector, we knew RET had the ideal resources to support Markerr’s growth. We ran a process and had multiple term sheets—the entire process took around four months from outreach to close, so it came together quickly.

What are the biggest challenges that you faced while raising capital?

Our process was fully remote which was certainly different. Getting investors to buy into your vision is critical during the fundraising process, and doing so over Zoom was unique. Fortunately, we were able to get over that hump with the RET team.

What factors about your business led your investors to write the check?

Several factors led RET to lead our round. First, RET believed we had the right vision to address real pain points in the market. Second, RET was really impressed with the Leadership team we assembled. Lastly, we already had a group of co-investors interested in our round, including Continental Realty Group, Matt Levin, and Edward Norton. I’m fortunate to be an experienced founder, and my previous venture exited to Vista Equity Partners, so I think that helped a great deal.

What are the milestones you plan to achieve in the next six months?

My focus is on ensuring that we have the most talented team possible. We will continue to hire in all areas of our business, and over the next 6 months we will expand our products, acquire new data, and likely 4-5x our client count. This is such a fun phase of growth for us at Markerr.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Just keep going every day and don’t stop. Raising capital is incredibly difficult, particularly for first-time founders. Building a great company is even more difficult and things will consistently go wrong. There will be times when it feels like it’s not going to work. All you can do is keep going because I’ve seen first-hand that things come together in unexpected ways.

Just keep going every day and don’t stop. Raising capital is incredibly difficult, particularly for first-time founders. Building a great company is even more difficult and things will consistently go wrong. There will be times when it feels like it’s not going to work. All you can do is keep going because I’ve seen first-hand that things come together in unexpected ways.

Where do you see the company going now over the near term?

Our goal is to set a new standard for property evaluation, and we will continue to do that by expanding our platform’s network of datasets, as well as building analytics to support additional teams and processes.

What’s your favorite outdoor dining restaurant in NYC

Odeon in Tribeca.