It’s been a busy 2021 for Robinhood, and the investing app’s biggest challenge of the year is set to arrive in the coming weeks in the form of its long-anticipated IPO. But will Robinhood’s multi-billion dollar flotation send retail investing social?

Robinhood has found itself at the center of a short squeeze surrounding the meme stock GameStop and became embroiled in a war of words with Wall Street stalwarts Warren Buffett and Charlie Munger. The app also crashed during a recent bull run on the meme-based cryptocurrency, Dogecoin.

Despite plenty of negative press over the course of the year, Robinhood has experienced exponential growth and has emerged as a leading online brokerage for individual investors.

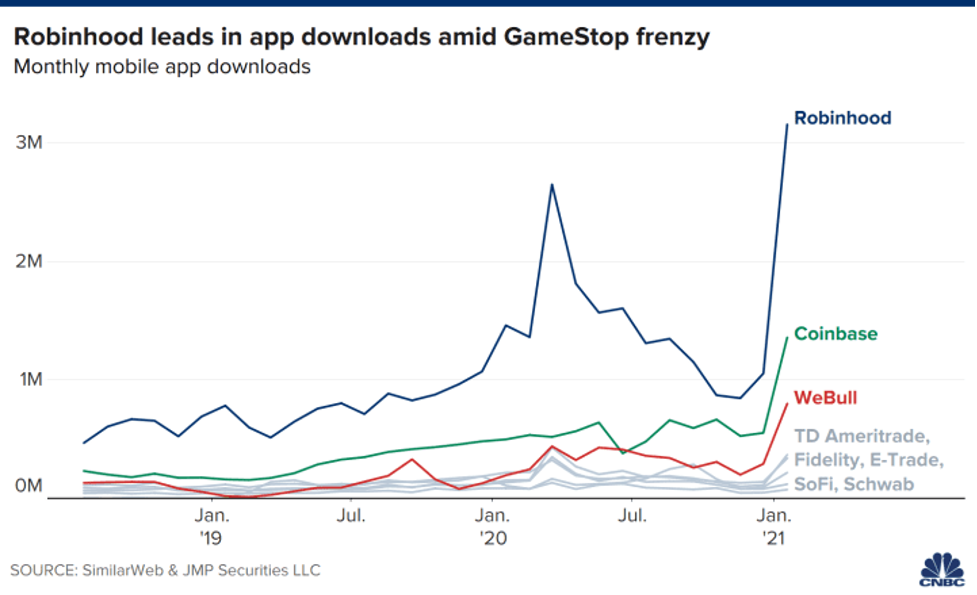

Robinhood is one of the fastest-growing fintech startups and has emerged as one of Silicon Valley’s most valuable private unicorns. Since the start of the pandemic, Robinhood has outpaced many other investing app downloads – including that of cryptocurrency giants Coinbase.

With a current valuation of around $11.7 billion, and significant backers like Sequoia Capital and Andreessen Horowitz, NEA, Kleiner Perkins and Alphabet, it’s anticipated that Robinhood’s IPO could lead to a valuation of at least $30 billion.

Bringing Power to Retail Investors

Significantly, Robinhood has opened its IPO up to retail investors as part of the company’s bid to democratize initial public offerings.

The recent announcement of Robinhood’s IPO Access service represents a significant step towards making IPOs a genuine investment opportunity for retail investors where, in most cases, initial public offerings tend to be reserved for institutional investors that are capable of buying many shares in a single transaction.

Robinhood states that its mission is to democratize finance for all. In democratizing IPOs, it appears that the company is making waves in opening areas of investing up to new users.

As the investing app’s usage stats indicate, 2020 saw a huge surge in retail investors choosing to place their finance in stocks and shares. Maxim Manturov, Head of Investment Research at Freedom Finance Europe explained that this boost to the volume of investors “actually looks like the consequence of the pandemic and the stimulation packages that followed. This created a pool of funds retail investors could start investing into stocks. As per Fidelity report, there were 26M retail accounts in 2020, i.e. up 17% compared to 2019, while the daily trading volume doubled.”

Robinhood’s app makes investing a straightforward process which has helped to inspire many individuals around the world to place their money into stocks. However, these freedoms appear to have led to some significant surges in investments in meme-based stocks like GameStop and Dogecoin – indicating that while the brokerage is playing a vital role in making shares and IPOs available for all, it’s also helped to leverage some unusual trading patterns.

Could Robinhood’s IPO Bring More Meme Investing?

Robinhood took in at least $110 million as a result of the GameStop meme stock rally at the beginning of 2020. As masses of investors congregated on Reddit to decide to generate a short squeeze on GameStop, we saw the power of social media lead to widespread losses for hedge funds.

While this event was heralded as something of an uprising against the power of hedge funds, many retail investors lost out as they unwittingly bought the top of the GameStop price surge.

The number of fees that Robinhood obtained from selling its users stock orders to Wall Street firms climbed to $331 million in the first three months of 2021 according to Alphacution statistics. This figure is significantly higher than the $221 million the company made in the final three months of 2020 – it’s also much higher than the $91 million Robinhood gained from the same fees at the beginning of 2020.

Since the central role that Robinhood played in the GameStop short squeeze, the platform also recently crashed as social sentiment for Dogecoin, a cryptocurrency listed on the app and supported by Elon Musk, reached a fever pitch. As a digital currency that has literally been built on a meme in 2013 and hasn’t undergone an update since 2019, Dogecoin represents a perfect example of a meme investment.

Despite its fundamentals, and a struggling cryptocurrency market over the past couple of months, Dogecoin’s price has surged throughout 2021, with the coin experiencing a rise of almost 14,000% over the span of 12 months.

Robinhood has been confident enough to list Dogecoin since mid-2018, and as investors on the app have grown in recent months, so too has the value of the cryptocurrency. With the upcoming flotation of Robinhood on Wall Street set to bring even greater exposure to one of the fastest-growing brokerage apps since the start of the COVID-19 pandemic, we may see further investment in meme-based stocks taking place in the future.

Whether the social sentiment towards the next asset pump will be focused on traditional markets or cryptocurrency remains to be seen, but with the ease in which retail investors can plan short squeezes, it’s likely only a matter of time before another GameStop case takes place.