The decentralized nature of the blockchain and cryptocurrencies is heralded as one of its biggest benefits but at the same time, it’s one of the factors that’s preventing rapid adoption by larger institutions. Government agencies, financial service providers, and exchanges have explicit regulatory requirements and the anonymous nature of the blockchain has traditionally provided little visibility to these transactions. Chainalysis is the blockchain data platform that brings transparency to blockchain and cryptocurrency transactions, fueling the charge for widespread adoption. The platform can be used to power investigations, maintain compliance with anti-money laundering and KYC requirements, and even as a risk management tool, providing the assurance that cryptocurrency transactions are safe and secure. In addition to data and software, the company also provides training and research to ensure that Chainalsyis clients are up-to-date on the latest developments in this ever-changing landscape; clients include Barclays, Square, BitPay, and the United Nations Office on Drugs and Crime.

AlleyWatch caught up with CEO and Cofounder Michael Gronager to learn more about the company’s mission to promote the safe adoption of blockchain data as an asset class, the increasing demand for cryptocurrencies, Chainalysis’ latest funding round, which comes at a $4.2B valuation, and much, much more. This funding comes only months after the company raised its $100M Series D in March.

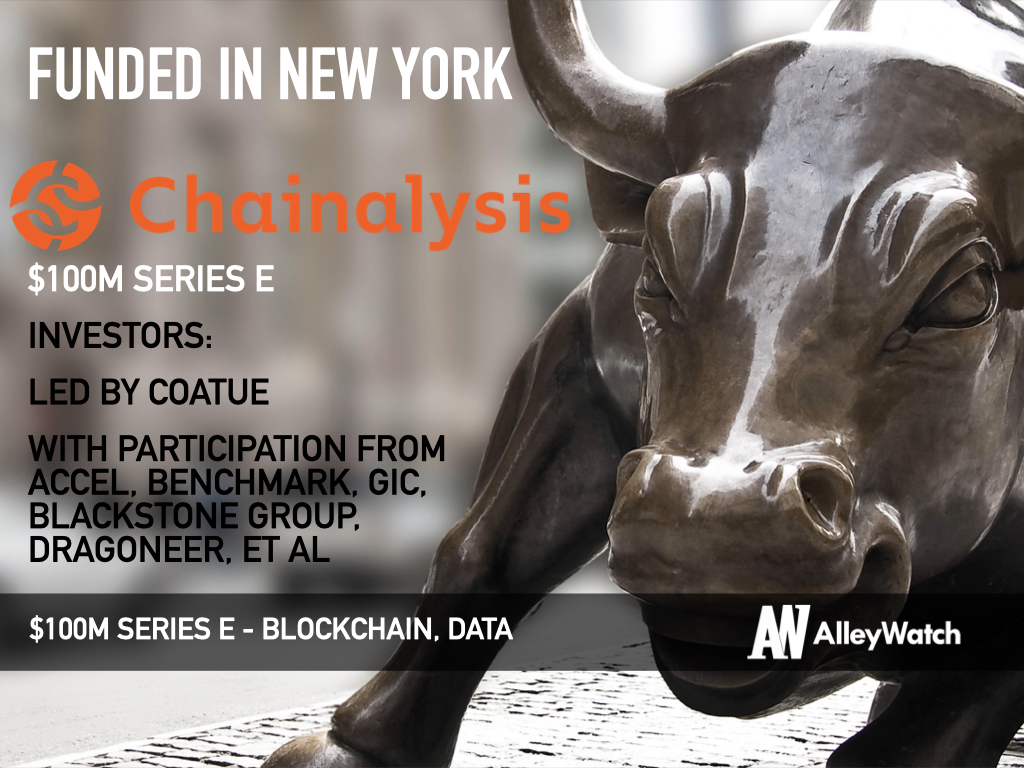

Who were your investors and how much did you raise?

Chainalysis’s latest Series E funding round was led by Coatue, raising $100M.

Tell us about the product or service that Chainalysis offers.

Chainalysis provides data, software, services, and research to government agencies, exchanges, financial institutions, and insurance and cybersecurity companies. Ranging from investigations software to real-time transaction monitoring and on-chain customer behavior data, our products ensure transparency in blockchains.

What inspired the start of Chainalysis?

In 2014, I saw how the cryptocurrency space was struggling to become part of the financial system with regulators and banks. As a co-founder of the cryptocurrency exchange Kraken, I used my experience with big data and industry knowledge to develop the data platform that has become the foundation of Chainalysis products today.

How is Chainalysis different?

Chainalysis has the most comprehensive proprietary data set in the industry. Due to the company’s early entrance into the market, we can offer the most historical data sets in order to provide a better, more complete view of the blockchains people are transacting on most. This comprehensive overview allows our clients to build out their compliance strategies, investigate suspicious activities, and understand their customers’ behavior.

What market does Chainalysis target and how big is it?

What market does Chainalysis target and how big is it?

Chainalysis works with government agencies, cryptocurrency exchanges, financial institutions, insurance, and cybersecurity companies around the world.

What’s your business model?

Chainalysis is a SaaS company, providing software, data, and subject matter expertise to clients.

How has COVID-19 impacted your business?

Many aspects of our business, from events to in-person sales meetings, had to quickly move to a digital format almost overnight. The company pivoted to an entirely remote workforce. But as a global company from the start, we already had systems in place to continue operating.

What was the funding process like?

Investors understand that Chainalysis provides foundational infrastructure for the growth of the cryptocurrency industry. We’re thrilled to partner with Coatue and grateful to our existing investors who continue to re-invest in our growth.

What are the biggest challenges that you faced while raising capital?

Investors understand that our biggest challenge now is scaling. We’re aiming to hire hundreds of people this year across functions and across the world.

What factors about your business led your investors to write the check?

We’re already well known for building trust in the cryptocurrency industry as the leading provider of software that enables government agencies and private sector businesses across the world to detect and prevent cryptocurrency crime and money laundering. This work is only becoming more important as cryptocurrency enters the mainstream. And new applications for our underlying data – like market intelligence and business data – are emerging, too. Our investors believe that as cryptocurrency adoption grows, public and private sector organizations will increasingly deploy Chainalysis’s platform to make important decisions.

What are the milestones you plan to achieve in the next six months?

Within the next six months, we are focused on scaling our operations globally. We are opening new offices and hiring more technical talent to realize our vision as the data platform for cryptocurrencies.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

One piece of advice for New York City-based companies that don’t have fresh capital from investors; stay nimble and stay strong. In Chainalysis’ early days, we had to create innovative solutions to essential problems. For example, the company’s infrastructure was built by a team of engineers with cheap, bare-metal servers to save money on cloud storage. If you have a great product and the right team, there’s no reason to stop. Keep fighting.

One piece of advice for New York City-based companies that don’t have fresh capital from investors; stay nimble and stay strong. In Chainalysis’ early days, we had to create innovative solutions to essential problems. For example, the company’s infrastructure was built by a team of engineers with cheap, bare-metal servers to save money on cloud storage. If you have a great product and the right team, there’s no reason to stop. Keep fighting.

Where do you see the company going now over the near term?

In the near term, we’re focused on hiring. We’re going through a hiring surge at the moment and we’re looking to fill a diverse set of roles within the company, ranging from engineering to customer success.

What’s your favorite outdoor dining restaurant in NYC

Da Umberto on 17th Street.