I’ve written 250+ crypto-related posts since I saw the crypto light on June 29th, 2017. The most widely read of all those posts is titled “7 Thoughts On Blockchain, Cryptocurrency & Decentralization After Three Months Down The Rabbit Hole”. The 5th thought was “ It’s A Bubble….So What”. I went on to explain:

I say “so what” because I believe in Amara’s Law: We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run. This is part of the reason we get bubbles. We get overexcited about a new technology and we drive up prices beyond any reasonable valuation. Bubbles can go on for years. The internet bubble lasted 5+ years.

It still feels like we’re in the early stages of a Cambrian Explosion in crypto. Just as the Cambrian period enabled the creation of a multitude of new life forms, the emergence of blockchain, cryptocurrency, and decentralization, is opening up a wide range of previously unavailable markets, as well as new ways to compete against entrenched incumbents. Sure, most of the new crypto entities emerging today will die out, but many of the ones that survive will be epic.

Given that view, I think the three charts below give additional perspective to the crypto crash debate.

1. Amazon Price Chart 1997–1999

The chart below looks at the meteoric rise of Amazon’s price from its IPO in May 1997 (at a split-adjusted $1.50 a share) to a peak of $105+ in April 1999. Amazon’s share price went up 70X in under two years. That was EPIC! But was that a bubble?

The 2 “s”’s in the brown boxes in the chart above indicate times that Amazon’s share price split.

2. Amazon Price Chart 1997–2001

We took the price chart above and added two years. So the chart below has both the epic rise and then an epic 95% implosion of Amazon’s stock price from its peak in December 1999, at $105+, to its low of less than $6 in September 2001. That’s a drop of 95%. Is that a crash?

3. Amazon Share Price 1997–2021

Since Amazon’s share bottomed out in September 2001, it is up more than 540X, to yesterday’s close of $3232. From its IPO price of $1.50, it’s up 2150X, generating a compounded annual return of 36% over the last 24 years.

With the perspective of more time, when we look at Amazon’s price chart from 1997–2021, that violent up ‘97-’99 (bubble?), and violent implosion down ‘99-’01 (crash?), we see it really wasn’t either of those.

It turns out Amazon’s share price from 1997–2001, when put into the context of what Amazon has become, was just a ……. blip.

4. The Problem With Market Volatility Is Investor Psychology.

I’m not here for where bitcoin is going to be in a day, or week, or month. I’m here for the long term. I still believe bitcoin represents a remarkable asymmetric bet. Sure, it could go down 95%. But it could also go up 25X. In fact, I’ve written that I believe bitcoin will be worth $1 million in 2031.

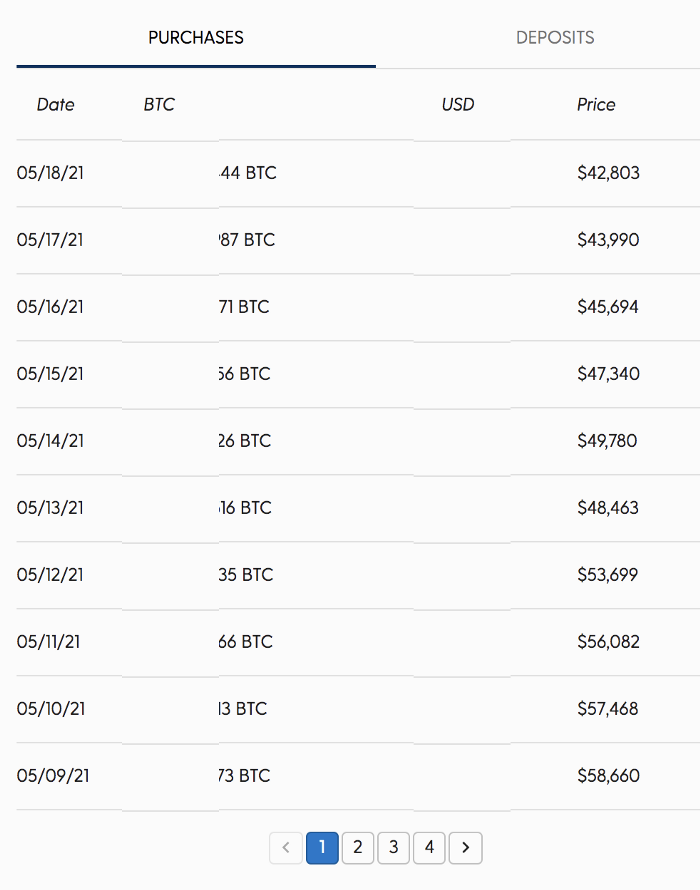

So I dollar-cost average. It eliminates the effects of investor psychology and market timing on my bitcoin holdings. I simply committed to a certain dollar amount I’m going to invest on a daily basis, and I set it and forget it. When the market goes down, I get to buy bitcoin cheaper, and cheaper, as has been happening for the last 10 days:

If I’m right, in 10 years when crypto has caused more disruption and created more value than the internet, we’ll look back at the previous violent crypto price swings, and the violent crypto price swings certain to come, and they’ll simply be blips in crypto’s long term rise. They’ll be blips in crypto’s massive value creation. And most importantly, they’ll be blips on the path to the better (decentralized) planet we’ll be living on.