For the 50M+ Americans who act as informal caregivers to an older loved one, the caregiver is often overwhelmed with keeping track of a loved one’s healthcare, finances, and more. Pillar is the digital platform that makes it easier for families to protect and care for their loved ones by organizing and store important information such as medical records, legal documents, and financial accounts – all online. In addition to organizing a family’s most critical details, Pillar also provides personalized guidance during the caregiving process. Pillar is accessible via subscription on either an annual or monthly plan.

AlleyWatch caught up with CEO and Founder Michael Bloch to learn more about how COVID-19 forced a pivot, how his own personal experience caring for his mother served as the foundation for the idea, and the company’s recent funding round.

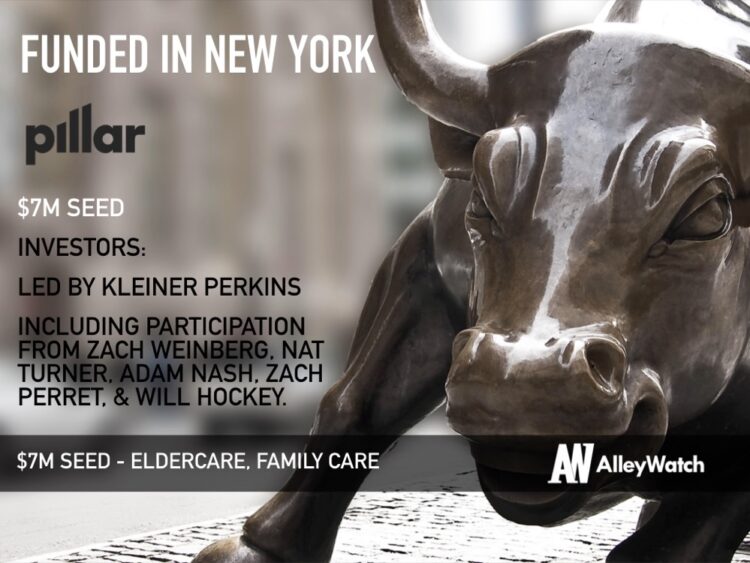

Who were your investors and how much did you raise?

Pillar has raised $7M in Seed funding led by Kleiner Perkins and from founders and executives like Zach Weinberg & Nat Turner (cofounders of Flatiron Health), Adam Nash (former CEO of Wealthfront), and Zach Perret and Will Hockey (cofounders of Plaid).

Tell us about the product or service that Pillar offers.

Pillar is a web platform that helps families better protect and care for their loved ones. Pillar lets people organize and store all their family’s information like medical records, legal documents, and financial accounts online so their family has access to everything they need if the unexpected happens. In addition, we provide personalized guidance on what to do as loved ones get older; secure collaboration with trusted family members; and fraud monitoring tools to prevent scams & financial elder abuse.

What inspired the start of Pillar?

What inspired the start of Pillar?

In 2017, my mom was diagnosed with a rare autoimmune disease. My siblings and I became informal caregivers and immediately experienced the difficulties so many caregivers face. What medications was she taking? What was the login for her bank account? Was her life insurance policy up to date? It was difficult to know what I needed to do and to balance this change with everything else in life. Thankfully, my mom is doing better, but we still grapple with these issues on a regular basis.

How is Pillar different?

Our competition is the status quo. It’s the analog systems people currently cobble together–physical papers, post-it notes, google sheets, emails, texts, and phone calls– to organize their family life.

What market does Pillar target and how big is it?

Over 50M Americans act as an informal family caregiver to an older loved one. These people – daughters, sons, wives, husbands, grandchildren, nieces, nephews, and more – take on a wide range of responsibilities like scheduling doctors appointments and making medical decisions to managing household finances and organizing legal affairs. They all want to support their older loved ones, but they often feel overwhelmed balancing these responsibilities against the needs of their own children, partners, and jobs.

What’s your business model?

All Pillar subscribers receive the same tools to make family life easier to manage. We offer two plans – an annual plan that costs $9.99/month or a monthly plan for $14.99/month.

Would you please tell us about the decision to pivot?

Our team originally set out to build a company that would help 45M Americans get out of student loan debt. We built the largest challenger student loan app in the US and helped borrowers manage over $500M worth of student loans. Everything was going according to plan until March. COVID-19 hit and Congress suspended student loan payments and reduced interest rates to 0%. This relief, though necessary for millions of borrowers during trying times, effectively shut down the market we operated in.

It quickly became clear to me that the student loan market had been fundamentally altered. Although our business had traction and was helping people, I realized our original product would not survive as a standalone company in the long-run.

What was the funding process like?

Kleiner Perkins, the lead investor in our seed round, asked to invest more in Pillar after I shared our plans for the pivot. We raised our seed extension solely from existing investors that believe in our vision and ability to execute.

What are the biggest challenges that you faced while raising capital?

Fundraising during a pandemic is difficult as people are unable to meet in person. It’s harder to convince someone to invest if you don’t already have a relationship with them.

What factors about your business led your investors to write the check?

Eldercare is a $300B market that is growing fast yet has traditionally been underserved. Our investors recognized the huge opportunity we’re aiming for and were excited to back this vision.

What are the milestones you plan to achieve in the next six months?

Our team will continue to iterate on our core product and add new features that will make Pillar the best product in the space.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

In March, when our original market got shut down virtually overnight due to executive and regulatory actions in the student loan space, we had to move swiftly to ensure our business would survive in the long run. Don’t be afraid to take the actions you need to ensure your business survives this downturn.

In March, when our original market got shut down virtually overnight due to executive and regulatory actions in the student loan space, we had to move swiftly to ensure our business would survive in the long run. Don’t be afraid to take the actions you need to ensure your business survives this downturn.

Where do you see the company going now over the near term?

Our goal is to become the essential tool that every family will use to protect and care for their loved ones.

What’s your favorite outdoor dining restaurant in NYC?

I haven’t been in the city for a while! Pre-COVID, I was a big fan of Momoya in Chelsea.

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today