Most companies proudly offer their employee retirement benefits such as 401ks, but what happens to your 401k when you leave the company is rarely a selling point. An overwhelming number of employees forget about their 401ks or cash out prematurely during a job change thanks to the administrative hassle. Capitalize, dubbed the “TurboTax for rollovers”, automates the transfer process so people can confidently choose a new retirement account and retain their accrued benefits. Capitalize’s platform handles all the administrative work while allowing customers to compare, select, and open a new retirement account. The model allows it to offer its services completely for free to the user while earning a commission on the back-end from the new IRA provider.

AlleyWatch caught up with CEO and Cofounder Gaurav Sharma to learn more about how Capitalize reduces the friction encountered during account transfers through technology, the company’s future plans, and recent funding round.

Who were your investors and how much did you raise?

Capitalize closed a $2M Seed round led by Bling Capital, with participation from Greycroft, RRE Ventures, and Walkabout Ventures.

Tell us about the product or service that Capitalize offers.

Tell us about the product or service that Capitalize offers.

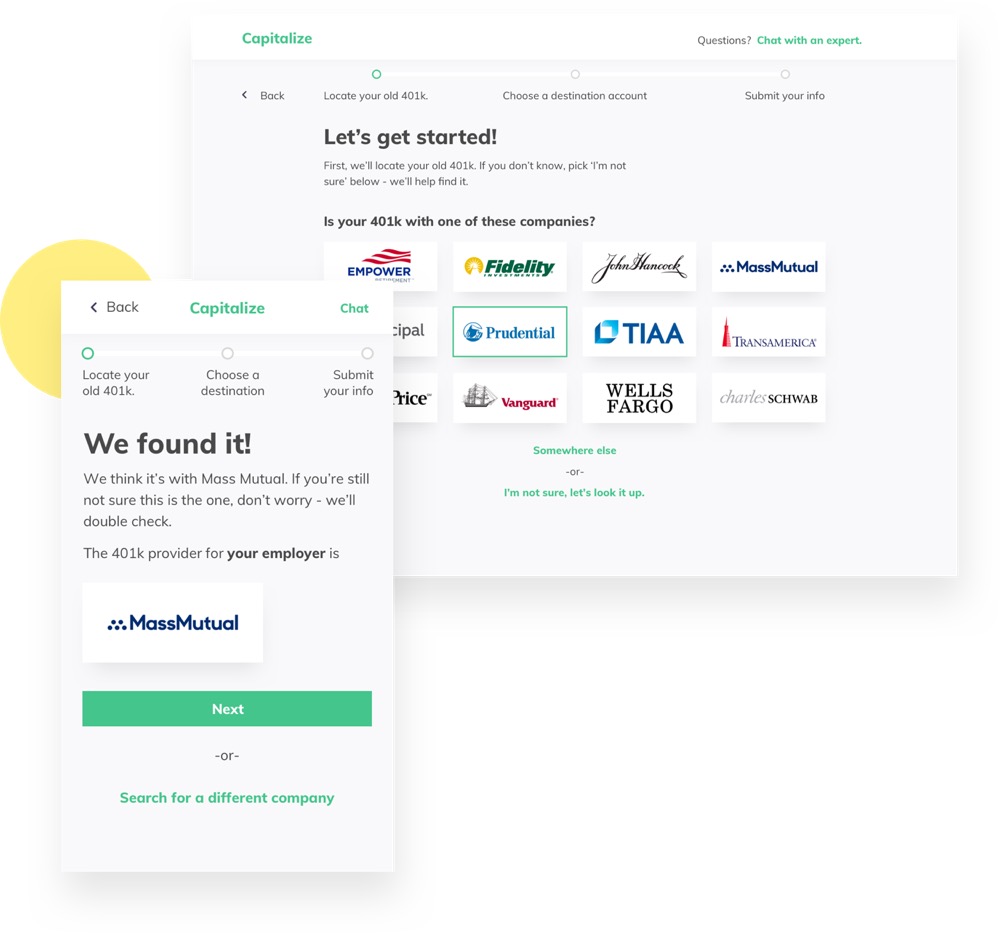

Capitalize is automating the historically manual, paper-based process of transferring (“rolling over”) old retirement accounts – for free. The platform instantly locates former 401k accounts, matches users to individual retirement accounts at leading financial institutions, and initiates rollovers on their behalf. We often refer to it as the “TurboTax for rollovers”. With over 15 million 401k account-holders changing jobs each year and higher levels of financial insecurity resulting from the COVID pandemic, Capitalize helps ensure Americans avoid cashing out or losing track of their 401k savings.

What inspired the start of Capitalize?

After almost a decade in the hedge fund industry, I realized how hard it was for Americans to manage their finances. I also noticed how little people had generally saved for retirement, and concluded that a large issue was what people did with their 401ks when they changed jobs. Millions of them cashed out their accounts prematurely or left their retirement funds behind due to administrative hassle and confusion at the point of a job change. There was an opportunity to improve this antiquated customer experience – that inspired us to launch Capitalize to provide consumers with an easier way to tackle the dreaded “rollover”.

How is Capitalize different?

We’re focused on helping people transfer their retirement accounts and there isn’t currently a good, digital way to do that. While some people might get help from their financial advisor, they have to have significant wealth in order to do so. Some IRA providers might offer a bit of help, but a user already needs to have an existing relationship there. Capitalize is filling the gap with our platform built explicitly to help people consolidate 401k accounts. Our platform also supports employers by helping them lower fees paid to administer their 401k plan, reduce exposure to potential ERISA lawsuits, and free up HR time otherwise spent communicating with former employees.

What market does Capitalize target and how big is it?

Capitalize is operating in the $20T retirement savings market and making sure that the 15 million people who change jobs each year do the right thing with their 401k. Right now, almost 5 million of them cash out up to $100B of assets each year when changing jobs and millions more leave their assets behind for an extended period of time. We now estimate that there are 30 million orphaned 401k accounts in the US. An additional 5 million Americans are estimated to have rolled over more than $500B of 401k assets into an IRA in 2019 but they endured a manual, complex process in order to do so.

What’s your business model?

Our service is free to the user. If they choose to open up an IRA on our platform then we might be compensated by the IRA provider. This helps us keep the service free for the user. If you’ve ever used Credit Karma or NerdWallet then you’ll be familiar with this model.

How has COVID-19 impacted your business?

More than 25 million workers could be eligible to rollover a 401k or other employer-sponsored retirement account due to record terminations as a result of the pandemic. Capitalize sped up the launch of our platform to help those laid off or going through job changes during this time. In times like these, it is incredibly important for people to have financial resources to support them. We aim to be a support system for people saving for retirement.

Capitalize sped up the launch of our platform to help those laid off or going through job changes during this time. In times like these, it is incredibly important for people to have financial resources to support them. We aim to be a support system for people saving for retirement.

What was the funding process like?

Capitalize has been fortunate to have raised money with relative ease, even during a turbulent time in the market. Our investors recognize the great, user-friendly product we have built in an industry that is growing rapidly.

What factors about your business led your investors to write the check?

Capitalize’s unique approach to solving a major problem in the retirement industry-led investors to help finance the platform. Our investors believe in Capitalize’s platform and capabilities in helping Americans save for retirement.

What are the milestones you plan to achieve in the next six months?

Capitalize hopes to partner with employers to include how to handle employer-sponsored 401k accounts as part of the offboarding process. Over time, Capitalize intends to help users manage all of their employer-sponsored and individual retirement accounts as they move throughout their careers.

Where do you see the company going now over the near term?

The new funding will allow Capitalize to build out its retirement platform capabilities and hire additional team members focused on operations, product, and engineering.

What’s your favorite outdoor dining restaurant in NYC

Claudette in Greenwich Village!

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today