After working in a nursing home for five years, the founders of Trusty.care saw an opportunity to reduce the burden on the elderly population facing financial and high healthcare costs for retirees. Trusty.care is the dual-facing digital platform that helps health insurance brokers and financial advisors identify financial risks that older clients may incur due to healthcare costs. The platform then matches clients’ customers with appropriate insurance products, public benefits, and cost-saving tools. The healthcare system has become increasingly complex for retirees and Trusty brings much-needed transparency for a financially vulnerable population.

AlleyWatch caught up with CEO and Cofounder Joseph Schneier to learn more about Trusty.care, the company’s experience raising during COVID, and recent funding round, which brings the total funding raised to $4.3M across four rounds.

Who were your investors and how much did you raise?

We raised a $1.5M Seed extension with Manchester Story Ventures and angel investors.

Tell us about the product or service that Trusty.care offers.

Tell us about the product or service that Trusty.care offers.

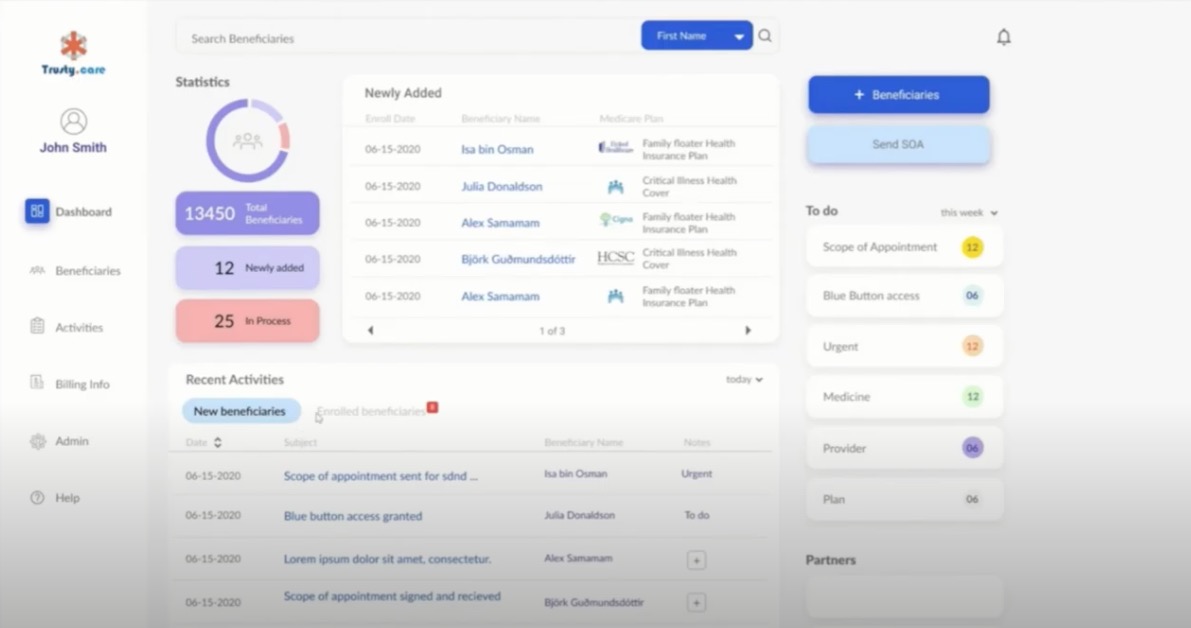

Trusty has built a platform that empowers brokers and financial advisors to become the HR department for retirees.

What inspired the start of Trusty.care?

My younger brother was in a car accident and didn’t have health insurance. The experience of seeing the financial impact of insurance on individuals is at the heart of what we do. For retirees, health care costs are their second-largest expense during retirement and the best way to control those costs is getting the right insurance.

How is Trusty.care different?

Trusty.care is the only platform that has both a consumer and broker facing side that allows consumers to manage their costs and improves the speed to sale for insurance brokers.

What market does Trusty.care target and how big is it?

Trusty’s platform is sold to insurance brokers and has a marketplace for consumers. There are hundreds of thousands of brokers that reach 45M seniors.

What’s your business model?

We sell a SaaS model on a per broker basis and we take a share of transaction fees on the marketplace.

What are some positive innovations that resulted in your company as a result of Covid-19?

We are working on the data science behind a Covid-19 application for retirees that is being used by state governments to help them manage their older adult residents. We are using the data being collected to inform our insurance business.

What was the funding process like?

We raised almost the entire round during Covid-19. It was definitely complex to raise from groups that we hadn’t met in person. This is our third raise, bringing our total capital to $4.3M and thankfully our investors have participated in multiple rounds.

What are the biggest challenges that you faced while raising capital?

The biggest challenge was finding ways to get in contact with investors virtually and to build that trust while all working from home.

What factors about your business led your investors to write the check?

We went from being pre-revenue to launching our product in the market and converting our customers to paying. That was our primary goal and I think our investors responded to reaching our milestones.

What are the milestones you plan to achieve in the next six months?

We plan to hit 15K brokers and be at least $100K MRR.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

It seems like funders are getting used to virtually connecting and are moving past the need to focus exclusively on their portfolio companies to navigate these complex times. Reach out to funds, they have more time to speak than even pre-COVID times.

Reach out to funds, they have more time to speak than even pre-COVID times.

Where do you see the company going now over the near term?

We want to touch the lives of hundreds of thousands of retirees this year and to empower the brokers that work with us to provide a whole host of services to their older adult customers.

Where is your favorite summer destination in and around the city?

Pre-COVID my favorite summer past time was going to Rockaway Beach, these days I am just enjoying having a back yard and growing vegetables.

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today