Halfway through the year, with no shortage of uncertainty about the future and COVID still making daily headlines, what does remain certain is that deals are still getting done. The number of deals and total funding may fluctuate, but New York founders and investors remain active. Because after all, we are New York Tough.

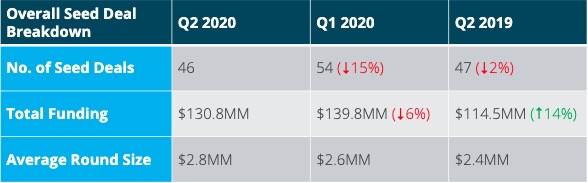

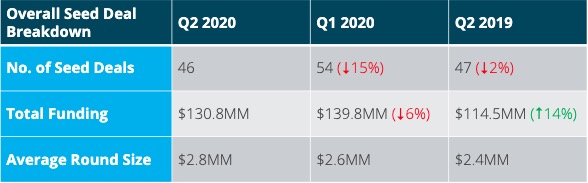

After seeing total funding and average round size modestly decline in Q1, the question was whether a more dramatic dip would occur in Q2. The number of deals and total funding decreased by 15% and 6% respectively from Q1, though average round sizes saw a slight increase. The last time we hit $2.8MM was Q4 2019, which was the highest average round sizes had been all year.

Industries to Watch

Health = Wealth

Wellness products continue to find footing throughout quarantine to help us better live and understand our lives and also shed the extra pounds from sitting inside all day. Tatch creates sleep patches to help you measure and improve the quality of your sleep, and Calibrate has launched a weight loss program around your metabolic system. On the fitness side, Playbook is creating a marketplace to help instructors monetize video workouts, Every Mother has created prenatal and postnatal workouts for all stages of motherhood, and Mirror continues to improve its offering after an exciting acquisition from Lululemon.

Dealing with data

With the big data market continuing to explode, companies now more than ever continue to search for better ways to structure, share, and visualize data. Cape Privacy, a platform focused on collaborative data privacy, raised $5MM, and Agamon, a healthcare platform that converts clinical text into structured data, raised $3MM.

Leveling up

Interactive, digital entertainment is here to stay. That’s why Playbyte is betting on the next generation of meme formats along with GIFs and images to be games, and PickUp is developing a platform to create interactive sports content.

Managing finances

FinTech companies across the board saw funding rounds. Retail investors looking to diversify their portfolios can do so with Cadence, hedge funds seeking better data models can look towards Daloopa, and online shoppers can earn Bitcoin back on their purchases with Lolli.

(Online) shopping spree

It’s no surprise E-Commerce startups are having a moment with physical retail stores temporarily closed for most of the quarter. For the kitchen, Caraway Home raised $5.3M to bring design-oriented, non-toxic and chemical-free cookware to the masses. For your closet, Pepper raised $2M to bring a new line of intimates for petite and small-chested women.

Earning with learning

As Zoom School likely continues into the new school year, EdTech companies are focused on keeping students engaged. Classtag, a platform for teachers and schools to streamline parent communication, raised $5MM. In higher education, Edsights raised $1.6MM to help universities communicate with students who are frustrated and confused with the ongoing changes throughout the pandemic.