Walking through a grocery store during the height of the pandemic, it was a common sight to see empty shelves and this is an indication a larger issue within the food supply chain – disparate information between suppliers, distributors, brokers, and retailers. Crisp is the cloud-data platform that collects, verifies, and solidifies hundreds of different data sources to generate recommended actions that ultimately result in less food waste and more profit. Paper and pencil processes combined with rudimentary spreadsheets that required significant time to be maintained can now be replaced through Crisp’s Data Platform, reducing time spent to seconds. Crisp’s initial focus was helping supply chains in produce and dairy, and after building significant traction in that vertical, Crisp has expanded to service beverages, bakery, CPG, flowers, and meat and poultry spaces.

AlleyWatch caught up with CEO and Founder Are Traasdahl (repeat entrepreneur; sold Tapad for $360M) to learn more about Crisp’s growth during the pandemic and recent funding round. Crisp has raised a total of $26M across two rounds since being funded in 2016.

Who were your investors and how much did you raise?

Crisp recently announced our Series A round of $12M. The round was led by FirstMark Capital and included participation from investors including Spring Capital and Swell Partners.

Tell us about the product or service that Crisp offers.

To facilitate collaboration throughout the supply chain, Crisp is working with food companies including suppliers, producers, brokers, distributors and retailers to efficiently gather and verify data, integrate hundreds of disparate data sources, break down silos, analyze data, and provide recommended actions that result in less waste and more profit.

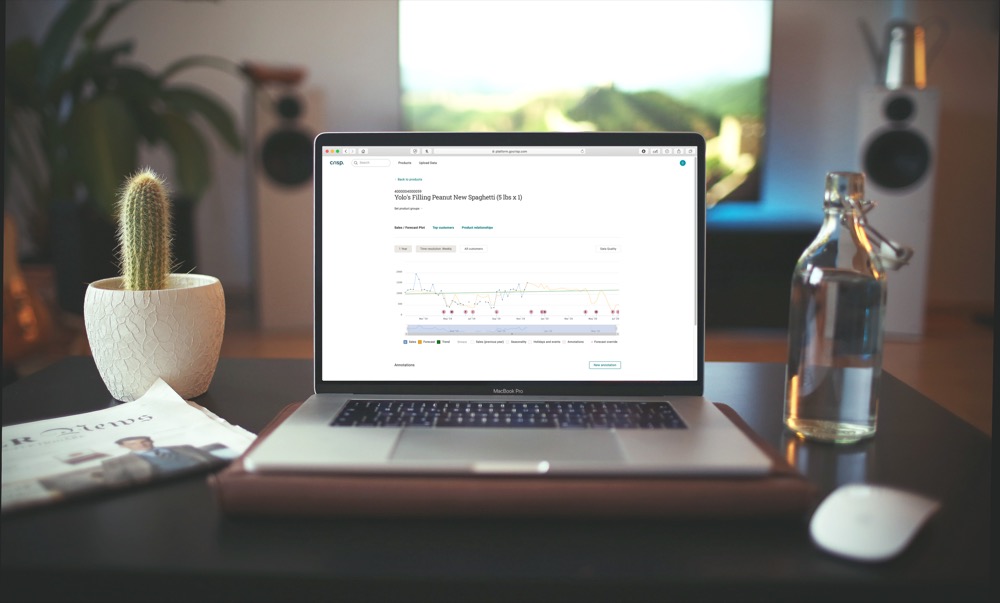

The Crisp Data Platform connects to data sources such as retailer and distributor portals. Crisp ingests this critical sales data, standardizes it, and delivers critical insights about sales, inventory levels, products, locations, and more.

What inspired the start of Crisp?

What inspired the start of Crisp?

We have all walked into a grocery store and seen empty shelves, while food is being wasted at alarming levels. This paradox is the result of thousands of food companies being dependent on outdated, siloed infrastructure. The recent pandemic has only accelerated the need for the industry to modernize in a way that is open, flexible, and collaborative. Crisp transforms the value chain by providing an open data flow to solve critical problems such as out-of-stock, shrink, on-shelf optimization, and adaptation to changes in consumer demand.

How is Crisp different?

While data exists throughout the food supply chain, it is locked in silos and not easily shared. This lack of transparency and communication between suppliers, distributors, brokers, and retailers leads to waste and inefficiencies, resulting in $400B worth of food being disposed of before it even gets delivered to stores. The Crisp approach is to build an open data platform that will empower every node in the supply chain to access and share the information they need to manage their business more effectively.

What market does Crisp target and how big is it?

Our target market encompasses any company – food suppliers, distributors, brokers, and retailers, whose end product is sold in grocery stores. We estimate that to be a $10T market with over 100,000 potential customers to start.

What solutions were your customers typically using before Crisp?

Our customers were dependent on a combination of Excel spreadsheets and hours of logging in, downloading, emailing, uploading, and manually entering data. As Kelli Lee, founder of Rowdy Bars said, “If we had to do this manually it could be 20-40 hours a month. With Crisp it takes seconds.”

What’s your business model?

It is a SaaS model comprising a set of easy-to-use integrations that securely connect data sources. There is a monthly subscription fee for each data source.

What was the funding process like?

I have had the pleasure of working previously on successful ventures with Rick Heitzmann and the team at FirstMark. They were early investors in Crisp and have been extremely generous with both their financial backing as well as with their advice. Being able to learn from other companies at an early stage is an incredible asset.

What are the biggest challenges that you faced while raising capital?

We have exclusively worked with FirstMark since the beginning of Crisp. They have been instrumental in shaping the product, pricing, and our go-to-market strategy. The challenge has been around finding a highly scalable yet lightweight model in a traditional industry. We believe we have that now. The investor interest has increased significantly during the pandemic. We used to get 1 email from potential investors per week but now it’s averaging 5 per week. The weaknesses in the food supply chain became very real and personal when the partners of the venture firms weren’t able to find food on the shelves.

What factors about your business led your investors to write the check?

FirstMark invests in companies that address significant global problems and whose founders are passionate about their mission. The team at Crisp believes strongly in our mission to reduce food waste while developing an advanced technology platform.

What are the milestones you plan to achieve in the next six months?

We plan to expand the number of portals with which we are integrated. We also plan to develop significant partnerships with distributors and brokers in order to expand our reach exponentially.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

The value of listening to your customers and understanding their pain points cannot be underestimated.

The value of listening to your customers and understanding their pain points cannot be underestimated.

This was true prior to the pandemic and is even more important today. People are looking for genuine solutions to real problems and they want a partner who values their time and their limited resources.

Where do you see the company going now over the near term?

We have experienced rapid growth since launching the platform in January. From an expansion into new verticals to an 80% increase in the number of customers using the platform. Over the near term, we plan to continue that expansion with new integrations.

Where is your favorite summer destination in and around the city?

Saratoga is at the top of the list for the summer.

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today