Whether you’re a tech investor, a tech operator, or just a user of tech, the single most important thing in tech is FAMGA, and the profound implications of their domination of tech value creation.

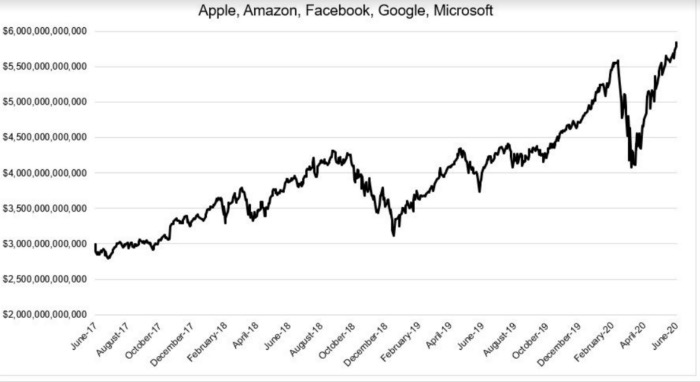

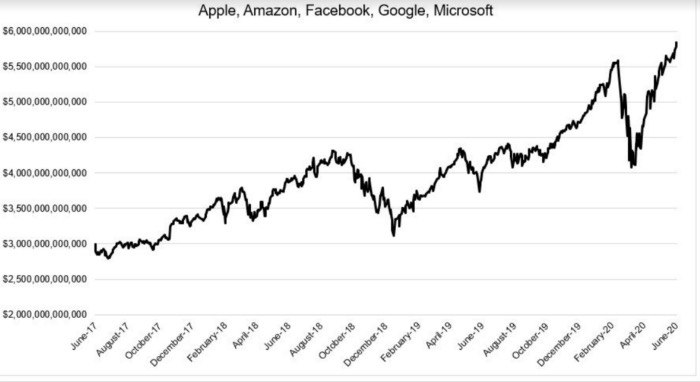

The chart above highlights the incredible wealth creation by FAMGA (Facebook, Apple, Microsoft, Google, & Amazon) over the last three years. That chart is a few days old. As of the publication of this post (6/10/20), FAMGA surpassed $6 trillion in value for the first time:

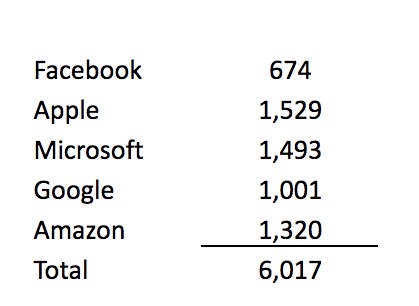

The $3 billion in market cap that FAMGA has added since June ’17 (the start of the chart above), is equal to the market cap they had generated in their entire collective lifetimes. And these aren’t new companies:

They took, on average 27.6 years to create the $3 trillion in market cap they had achieved by June ’17. It took just three years to create the next $3 trillion. Thus, they’ve been accumulating value at 9X the rate in the last three years than they had been beforehand.

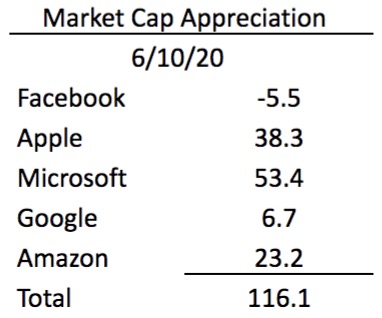

It took Apple 30 years to create it’s first $100 billion in value. FAMGA created $116 billion in market cap just today:

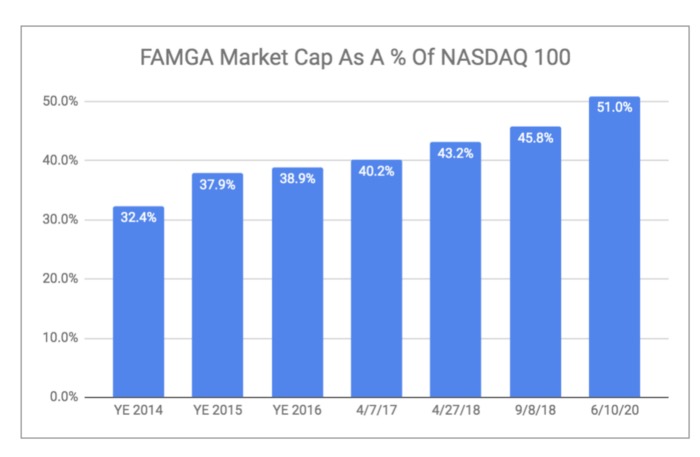

But the problem isn’t the amount of wealth they’ve aggregated, the problem, as I started writing about on January 1st, 2017, is the percentage of wealth creation that they are capturing. FAMGA has captured almost 70% of all the wealth creation by the NASDAQ 100 over the last three years, and now accounts for more than 50% of the total market cap of the NASDAQ 100:

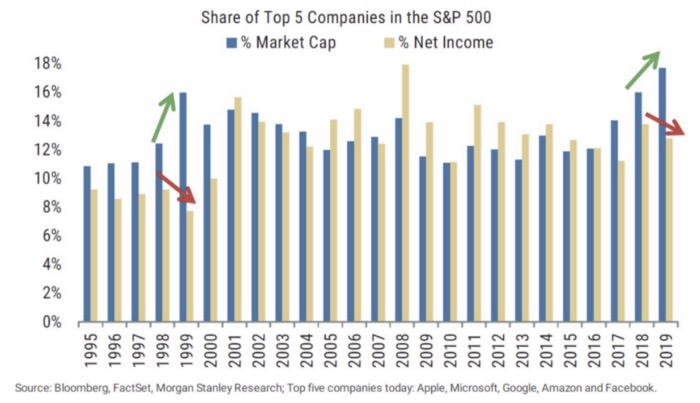

FAMGA is now 21.5% of the S&P 500. That’s up from 18% just six months ago, increasing the record-breaking percentage of the market cap that the top five stocks in the S&P 500 have represented over the last 25 years:

The Implications of FAMGAs Dominance Are Profound, Starting With Declining Outside Investments In Markets They Dominate

Innovation slows when markets are dominated by just a monopoly or oligopoly.

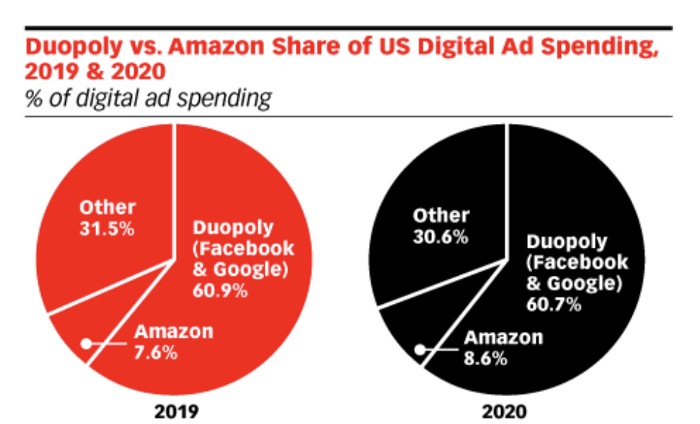

As the dominant position of the top three internet advertising platforms continues to grow:

It’s not surprising that investment in competing technology declines:

Apple and Google have more than 99% share of the mobile phone operating system.

Apple and Google have more than 82% share of the browser marketplace

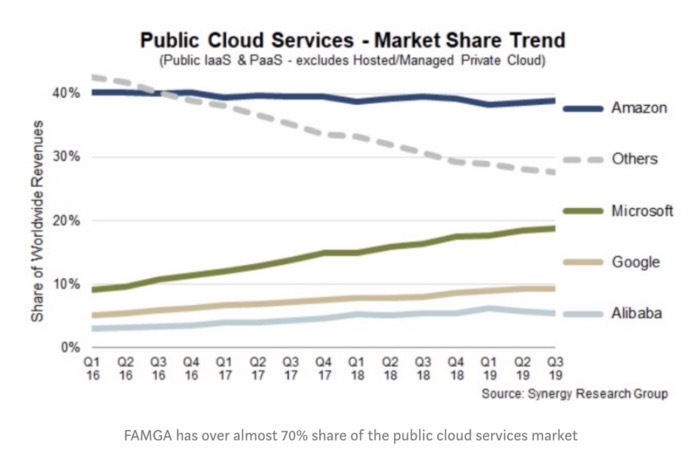

Amazon, Microsoft, and Google have about 70% market share of public cloud services:

Emerging Tech Markets Are At Risk of Being Dominated By FAMGA

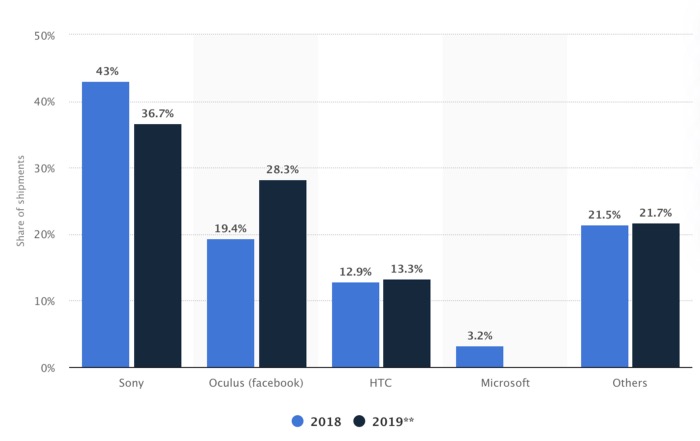

Given current trends, Facebook’s Oculus is poised to be the largest VR device platform by 2021, if not sooner:

Think about the race to space (Amazon).

Think about self-driving cars (Google’s Waymo).

Think about cryptocurrency (Facebook’s LIBRA).

Ultimately, The Users Will Be Worse Off As Well

As some internet users appreciate, if you’re not paying for the product, you are the product. FAMGA uses our data to create value.

Facebook knows what we like to click on, and they fill our newsfeed with those elements. Unfortunately, it turns out, the thing we like and click on the most is fake news. So Facebook feeds us lies.

When there is less innovation, when there is less investment, when there is less competition, users suffer.

I Still Have Hope For A Better Future

The forces compelling FAMGA to ever-greater share of market cap are strong, and their dominance grows, the implications will be increasingly profound.

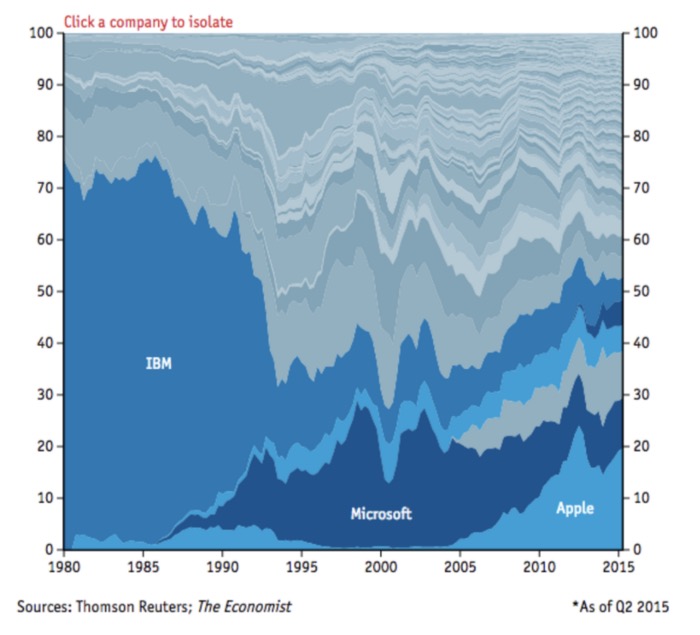

But the chart below, which looks at market cap percentage of the top 100 tech companies over time, gives me hope:

There was a time when it looked like IBM would dominate tech forever. In 1980, it had a 70+% market share of tech market cap of the top 100 tech companies. But things changed, and then it looked like Microsoft would dominate forever. Today it looks like FAMGA will dominate tech forever. But there is nothing constant but change.

I believe crypto/decentralization offers a potential meaningful challenge to FAMGA.

I wrote that post 21 months ago when the crypto market cap was $195 billion. It’s up more than 40% since then. FAMGA is up about the same. So right now, FAMGA is winning the battle. But tomorrow’s another day.