Customer retention is the most efficient growth lever for any business, yet companies often struggle to balance the near-term highs of new customer growth with the importance of retaining (and expanding) those customers downstream. As COVID-19 has introduced challenges for sales teams — ranging from lead volume declines to “red zone” slowdowns that have delayed signatures — a maniacal focus on customer retention is critical.

When assessing SaaS customer retention, net dollar retention is usually, and rightfully, the north star metric, with the best businesses boasting net negative churn (100%+ net dollar retention). Equally as important to net dollar retention, though, is net promoter score (“NPS”), which is not always given its due. Yes, NPS is typically a lagging metric and no, there is not always a statistical correlation between NPS and churn or net dollar retention. However, given that NPS is gauging the likelihood that customers recommend your product to others, a strong NPS can truly do you no wrong, as referrals will always be the most cost-effective sales channel on an LTV/CAC basis. (For SaaS businesses, it’s not uncommon to see referrals boasting more than double the win rate of other channels!) A thoughtful NPS methodology unlocks detailed customer insights that, in turn, can be leveraged to drive growth.

“The” NPS question is insufficient on its own

NPS on its own is not all that helpful, as it lacks context. Does your negative NPS score mask amazing customer support that is stymied by a buggy, hard-to-use product (or vice versa)? It is important to ask customers the why behind their scores; the narrative that unfolds from verbatim comments is exceptionally powerful.

It is also important to ask questions beyond “the” NPS question because NPS on its own often masks both positive and negative nuances underpinning the score. In the example of the hard-to-use product and negative NPS score, perhaps your customer was actually over-the-moon about your customer support; that context is lost unless you proactively seek it out. You should request more specific customer satisfaction ratings (CSAT, often on a 1–5 scale) for dimensions such as:

- Customer Success Manager (consider actually naming the CSM on the account)

- Technical support

- Sales experience

- Specific product features (e.g. APIs, reporting)

- Ease of use

- Product availability or inventory

- Repeat purchase propensity

Customer success is about your customers’ ability to achieve their desired outcomes, not yours, so you should also ask how you are delivering against their objectives: Thinking about your experience with Company X’s ability to help you drive results for your organization, how would you rate your satisfaction for each of the following: (and then get specific). If your software promises QA testing automation, you would ask customers to rate you on dimensions such as, “Makes it easy for me to automate my QA testing” and “Helps decrease total support tickets.” Not surprisingly, CredSimple, which offers software to simplify the medical credentialing process, has observed a strong correlation between credentialing time (time to value!) and NPS. BounceX, a behavioral marketing platform, has proven a significant relationship between customer health and the percent of total digital revenue that can be attributed to its marketing programs. Roadmap awareness (and more importantly, progress!) are very often tightly correlated to NPS, so ask your customers if they were aware of recent releases and if they had an impact.

There is merit too in adding bonus questions to tease out feedback around different points of the customer journey as well as general sentiment toward your brand. Ask customers to rate you on statements such as “Product X is easy to implement,” “Company X is easy to buy from” and so forth.

Remember, customer perception is your retention reality.

Dive beneath surface metrics

It is helpful to analyze NPS scores vis-a-vis your existing customer data (e.g. onboarding date, number of training sessions completed, products utilized, service package, etc.), but it’s equally crucial to unlock the “sticky drivers” of your product; which usage patterns or experiences make your customers happier (and similarly, stickier)? In the BounceX example, customers using pre-built email service provider integrations are notably stickier. For AlphaSense, an AI-powered research platform, saved searches and watchlist alert subscriptions are two of the most telling proxies for customer satisfaction.

Lean in on second-order customer data too. Instead of merely comparing NPS to contracted service level, CredSimple analyzed NPS vis-a-vis customer wait times with support, ultimately building a business case to make organizational investments to improve response times. Catalyst, a customer success platform, unlocked an important CSAT trend in how customers perceive value during onboarding, so they now customize every product demo and training to address specific pain points customers highlighted during the sales process.

Do your ratings vary by stakeholder (e.g. the day-to-day user versus your economic buyer)? By industry? Contract size? In a situation where scores lag for economic buyers, consider standardizing or increasing the cadence of value reporting back to your executive sponsors. If NPS is weaker for smaller contracts (perhaps a proxy for client resourcing), is your product too complex for small teams? Is there an upsell service offering as a result?

As your sample size grows, you can go beyond the more straightforward data cuts and build a regression model between the “other” question scores and NPS. But even if you have a small customer base and limited dimensions for analysis, it’s never too early to measure NPS and one or two supporting CSAT questions to help you dig a level deeper. Earlier stage companies should actually be the most consumed with NPS as they iterate on the product and refine their ideal customer profile.

Operationalize an action plan

Companies can’t manage what they don’t measure, but they also shouldn’t measure what they don’t intend to manage! More important than the data cuts and insights is your commitment to operationalize a plan fueled by the newfound insights. Once you unlock your company’s “sticky drivers,” you should optimize your implementation efforts to ensure those traits. In the AlphaSense example, focusing onboarding to ensure customers are configured for the 5 most meaningful “sticky drivers” (e.g. uploading a watch list, saving searches) in the first 90 days has resulted in extremely high NPS scores. Think about how a visual similar to the LinkedIn “profile strength” score might be helpful in gauging implementation progress.

For several of our more technical portfolio products, there is a strong correlation between the number of product integrations implemented and NPS/net dollar retention; in those situations, new customer onboarding should be focused on integrations, even if it might slow time to value. Even though “lift and shift” implementations are often the quickest from a time to value perspective, they are rarely the best path for optimizing NPS or retention.

When the team at Hammerhead felt the NPS score for its Karoo cycling computer could be stronger, they conducted extensive customer research through additional surveys and telephone interviews. Reliability emerged as a theme in all of those conversations; Hammerhead’s customers are passionate about cycling and most ride every day (most often early in the morning or late in the evening), so even 95% reliability was not good enough. The Hammerhead team decided to make reliability the central focus of their software development, rather than big-ticket features or integrations; they worked to ensure consistent battery life; a sensor pairing that worked the first time, every time; no upload failures; and data readings that never fluctuated. The result? A 60-point NPS gain within one year.

Electric has operationalized a playbook for swift follow-ups, including a rubric that outlines the actions required for different scores and comment types and even internal SLAs for the timeliness expected for follow-ups.

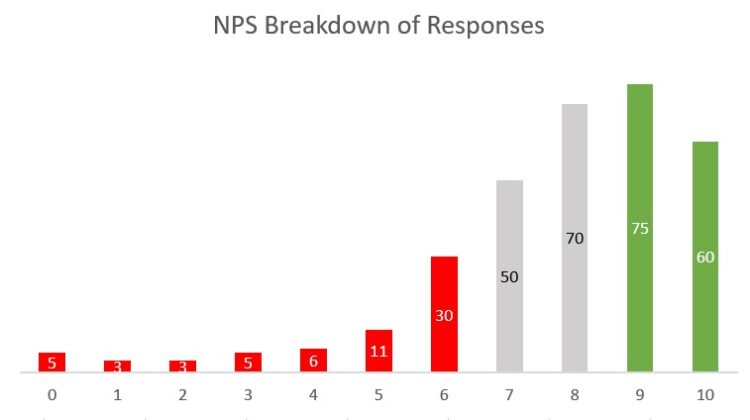

In the example below, where detractors are mostly concentrated in the 5–6 score range, perhaps you focus company efforts on your 5–6 respondents to move them into the 7–8 passive zone. You should track the composition of each detractor/passive/promoter bucket over time.

Even if very low scores are outliers, each one of them warrants executive outreach. A “0” is a terrible score; even if the customer is a poor fit or a legacy client, it was your decision to sign them or retain them, so it warrants follow-up. Your detractor set not only helps with dictating product and service roadmaps but also with refining your beachhead.

NPS: show me the money!

NPS data can be powerful for prioritizing upsell and cross-sell opportunities; a 2×2 matrix of product white space vis-a-vis NPS response can dictate a roadmap for expansion and cross-sell opportunities. Companies can also use the NPS survey itself for customer research questions and even for building upsell pipeline (e.g. “Are you interested in learning more about new product X [with description]?”)

Perhaps most importantly, ask for referrals! This is one area where the NPS response on its own actually is quite useful; promoters are indicating they would recommend your product, so this is a prime opportunity for an executive to follow up with a thank you note and an ask. Ask the customer if there are others in their networks you should engage (and for introductions to those individuals!). Ask your promoters if your sales team can connect with them on LinkedIn and ask for help with account introductions. Ask your promoters to write reviews on G2.

NPS as a rallying cry

NPS is everyone’s job, and it is the CEO’s responsibility to drive alignment around its importance. If the customer success leader is bonused on NPS, arguably the entire management team should be bonused on NPS.

NPS should ultimately be a rallying cry for businesses; raw data should be shared and celebrated, regardless of the feedback (remember: bad news is good news, good news is no news, and no news is bad news!). If you do everything in your power to help your customers unlock value in your product, it would be challenging for you not to succeed as a business!