On May 15th, 2020 Facebook announced the acquisition of Giphy for $400 million. That sounds like a BIG win for the Giphy investors. Even if it wasn’t a unicorn home run, it most definitely must be considered at least a triple?

Let’s take a look at the numbers:

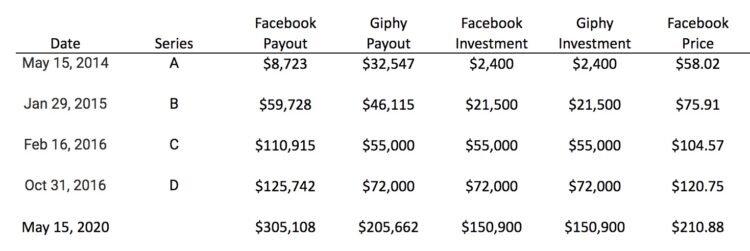

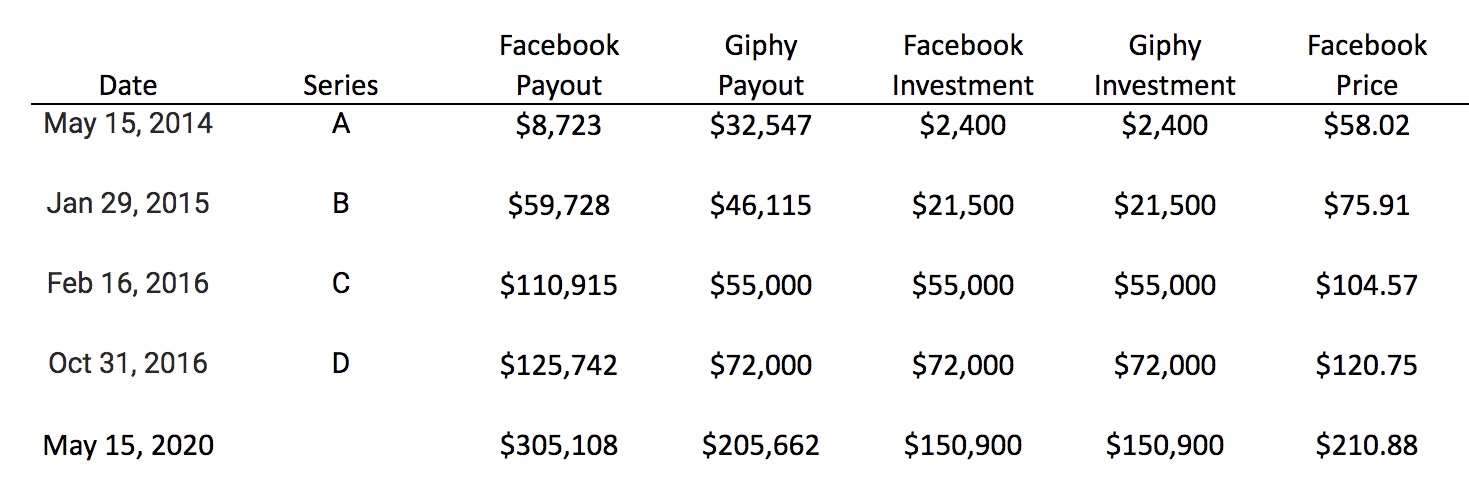

According to Crunchbase, GIPHY raised $151 million over four rounds, and per my math, they returned $206 million to investors.

The final $400 million price tag was less than the Series C round and Series D round, so, I assume those investors just got their money back. They may have had a “preferred return” of 6% or something like that, but I assumed that Giphy was a pretty hot company when those investors came in, so Giphy probably was able to avoid guaranteeing preferred returns. In any case, that would not have changed this calculus much.

The Series B investors more than doubled their money, and the Series A investors (assuming they paid a $10 million pre) got a nice 13X+ on investment.

Now, I assume, Giphy investors we’re betting that social media was going to continue to grow. Most would have bet that Facebook would continue to lead that growth. So, given that assertion, the simplest investment would have been Facebook. Giphy was a derivative of the investment thesis that social media was going to continue to grow. What would have happened if they had just invested in Facebook?

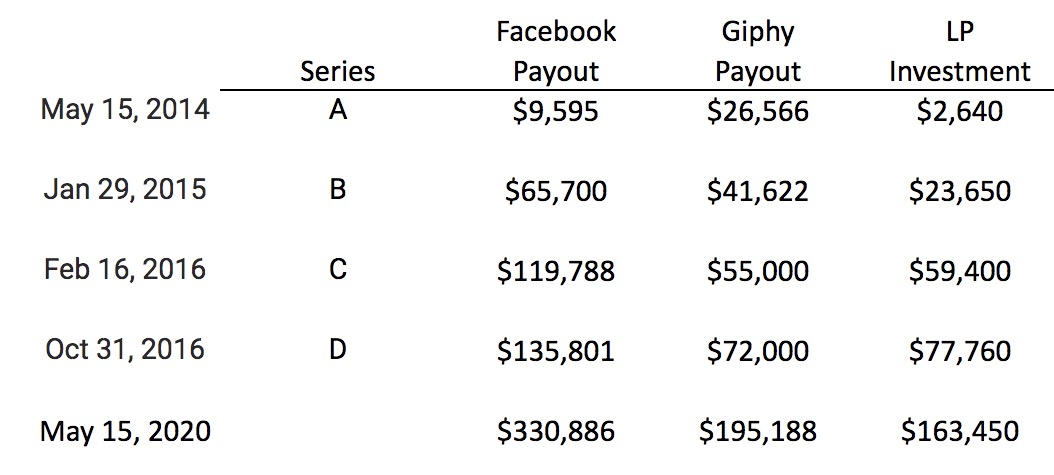

In total, the Giphy investors would have gotten 48% more money back ($305 million vs. $206 million) if they had just invested in Facebook instead of Giphy. Only the Series A investors did better investing in Giphy. Those are the returns to the investors. What about the LPs who generally pay a 2% annual fee, plus 20% of the carry.

In total, LPs would have been almost 70% better off investing directly in Facebook rather than investing in the VCs who invested in Giphy.

I’m not implying that VCs or LPs are dumb. Rather, I’m saying that venture is a hard business. I’m saying that, sometimes, investing directly in a thesis is better than investing in a derivative of a thesis. I’m saying that valuation matters.

I’m saying that investing in winners, isn’t always a winning investment strategy.