Software is undoubtedly making our work easier in countless ways. But the current process of how we secure software has not really taken advantage of the very benefits that software provides, instead relying on old, obsolete frameworks centered around RFPs. Tropic is the buyer enablement platform that makes buying software seamless and efficient. The platform, which just emerged out of stealth, contains a matching engine with connects buyers of software to the best vendors based on needs, comparison engine, and anonymous reviews. Tropic is engineered so that those who are making the actual business decision and are the end-users of the software being evaluated can use the platform without relying on procurement departments. Most other platforms are focused on enabling sales for the vendors and Tropic flips the model to empower buyers. Initial customers at launch include Airtime, Bleacher Report, and 50+ other brands.

AlleyWatch sat down with CEO and Cofounder David Campbell to learn more about Tropic’s launch out of stealth, future expansion plans, and recent funding.

Who were your investors and how much did you raise?

Tropic raised a $2.1M Seed round led by Founder Collective with participation from notable angels and operators that include Zach Perret and Will Hockey (founders of Plaid), Nat Turner and Zach Weinberg (founders of Flatiron Health), Scott Belsky, and Jason Finger (former CEO of Seamless)

Tell us about the product or service that Tropic offers.

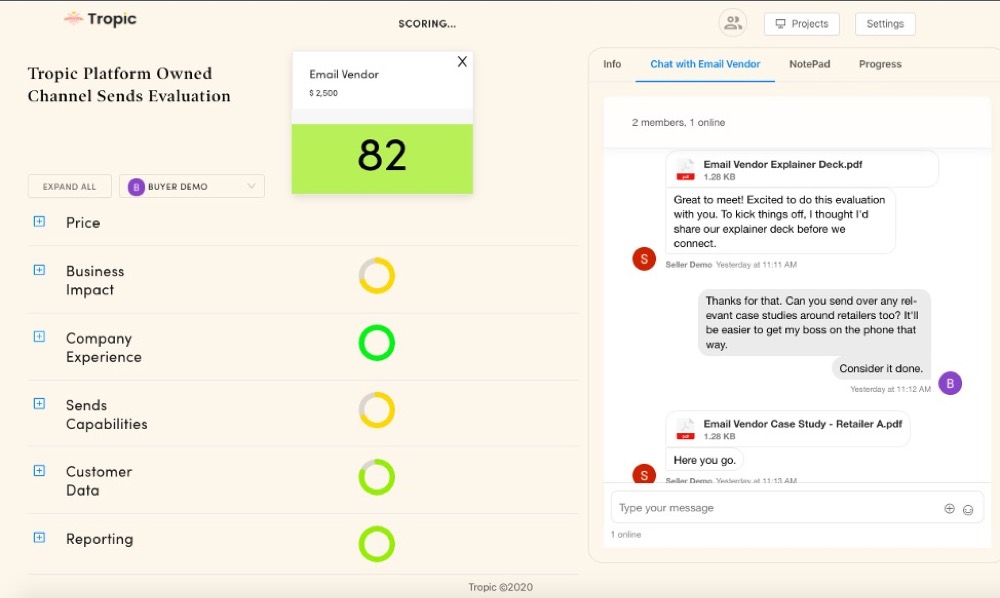

Tropic is a buyer enablement platform, making the process of buying enterprise software easy and transparent. Think of us as the equal opposite of sales enablement, which delivers data and tools to give salespeople power in the process. Our platform does this for buyers. Tropic matches businesses to the best vendors based on their unique needs. On our platform, buyers can selectively communicate with matched vendors they like, collaborate internally on the comparison, and negotiate with vendors in real-time in one place — no endless back-and-forth via email.

We also provide an anonymized view of the evaluation to the vendor, demonstrating how they’re performing relative to competitors. Vendors then calculate the best proposal for the buyer right in the platform, no calls required and no input needed from the buyer. Tropic is reversing the dynamic to empower buyers and give them back their time.

What inspired the start of Tropic?

I was working on a very large enterprise agreement with a global financial services business. The whole buying team had nearly 30 people on it, all the way up to the top. This team was using a mix of Excel, Powerpoint, OneNote, Microsoft Word, and Slack to manage the evaluation. I could see information slipping through the cracks left and right across all these files, which helped me advance my sales agenda. The team’s mandate was to create an objective comparison between my deal and a competitor’s. Both my competitor and I were making that as difficult as possible. Before the deal could close, the entire team I was dealing with was laid off, which wouldn’t have happened if they had made a decision. I witnessed firsthand the impact modern sales strategies have on the buyer. This was a team that had a full RFP process they were supposed to run in Ariba, but it just didn’t work for SaaS. I knew that I needed to drive the change that I wanted to see and undo some of the damage I’d done for years as a sales rep.

How is Tropic different?

Tropic is the first buyer enablement platform. Most solutions focus on empowering the seller. Also, we really mean “buyer” when we say buyer. Unlike RFP tools designed for procurement and finance teams, Tropic is purpose-built for the person in the business who actually needs the technology, the real buyer. You can be a marketer with zero experience evaluating software and run a successful evaluation and negotiation on Tropic.

We are focused not only on discovery, but everything that follows. Unlike reviews sites offering blanket landscape data with biased vendor information, we match vendors selectively based on specific use case requirements and budget. Our platform also handholds the user through everything that happens next. On those websites, once you click “connect to a rep” your their help ends.

Our transparency is differentiated. We’re creating secure transparency into the vendor ecosystem and also throughout the evaluation process. Never before have vendors had this level of transparency into a buyer’s specific needs — and never before have buyers had total transparency into the reality of the vendor ecosystem. This information has historically been guarded and traded closely, through manual, across inefficient phone calls, email, Slack, and other information silos. Our platform breaks these silos.

What market does Tropic target and how big is it?

Tropic is currently focused on helping startups and SMBs find the perfect marketing SaaS products for their business needs.

The TAM is the global software market, predicted to surpass $500B in 2020, of which Tropic’s opportunity is around $25B. We hedged the total global spend number to account for software that is not a fit for our current system (ERP etc.) hence 10% of $250B, or $25B

What’s your business model?

Our go-to-market is marketing technology in North America and UK, which was $65B in 2019, of which Tropic will take $6.5B.

We achieve this number collecting a consistent marketplace fee from the winning vendor in each evaluation. We do not charge the buyer anything to use us, and the platform matches cannot be influenced by vendors. We believe this platform should be democratized for buyers

Importantly, there are things we don’t do:

- We don’t share the identities of buyers on our platform with vendors

- We don’t offer sponsored posts or advertisements

- We don’t sell positive listings or reviews in our network

- We don’t enable one vendor to outbid another for entrance to our platform

Who do you consider to be your primary competitors?

Advisory Firms (Gartner, Forrester) – advisory firms facilitate discovery and workflow, but they are very expensive and not tech-first. They also are better suited to share data on enterprise providers, rather than startups and SMBs, where we excel.

Directory Review Sites (Capterra, G2, etc) – the data on these websites is biased. They sell reviews as a product and pay people to write them. Furthermore, they do not help buyers through the subsequent evaluation workflow once vendors have been researched. Buyers still have to get on the phone and negotiate with vendors.

ScoutRPF – ScoutRFP is arguably the best RFP tool on the market. It has strong comparison features, but it does not enable the buyer with competitive vendor data, and it is not used by the lines of business, but by procurement. It is not free for the buyer. We believe the legacy RFP model needs to change; it destroys value for both sides.

What was the funding process like?

It was my first time fundraising, and it took 3.5 weeks, but those weeks were grueling. We spoke to SF and NYC funds, and we had to fly back and forth a bunch in the process. We were bootstrapped then, of course, so Justin and I were sleeping in $100/night Airbnb rooms in SF on twin beds that were like five feet apart. We learned that preparation and staging are key, and we were lucky to get through it so quickly. In the end, we bought into the Founder Collective value proposition. As former founders, they understand what we’re going through and have been a huge help.

What are the biggest challenges that you faced while raising capital?

When you are focused on creating a new category, it is challenging for investors to contextualize you. Buyer Enablement hasn’t existed as a true software category until now, but we were insistent about doing things differently. It’s easy to hear an investor say “why not just build a better RFP tool” or “why not just build a specialized directory” and want to go chase their idea to get the check, but we stay disciplined around what we believed, and we’re seeing our assumptions bear out in the market.

What factors about your business led your investors to write the check?

I think it came down to me and my cofounder as people. My experience with seed investments is they’re investing in you. Are these the right people, and is this the right problem, and will they listen to their customers? If the answers to all three of those are yes, I think that’s what investors are looking for. I have lots of experience selling software, and my cofounder Justin was a VP of Ops with a lot of experience buying software, so it made sense. We worked together. We already learned how to disagree. We are probably just the right amount of crazy.

What are the milestones you plan to achieve in the next six months?

Our six-month focus will be on product and market expansion. For the product, we will be focused on creating smarter ways to leverage the network effect of buyers on our platform to reduce time spent with salespeople. For the market, we are currently focused on buyers who need sales and marketing software. In the next six months, we will have finalized a playbook that we can use to expand into our next two markets, which are likely to be HR and Cybersecurity. We are also on track to surpass 150 buying companies on our platform in that timeframe.

Our six-month focus will be on product and market expansion. For the product, we will be focused on creating smarter ways to leverage the network effect of buyers on our platform to reduce time spent with salespeople. For the market, we are currently focused on buyers who need sales and marketing software. In the next six months, we will have finalized a playbook that we can use to expand into our next two markets, which are likely to be HR and Cybersecurity. We are also on track to surpass 150 buying companies on our platform in that timeframe.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Keep your burn at zero, and find your lane. Either you have something that is going to make people’s lives better right now or you have something that is going to make people’s lives better after COVID-19 recedes. If it’s the latter, go heads down and focus on building. Spend no money. If it’s the former, remember that investors have to put capital to work. It’s their job. So I say get out there and raise! Some of our investors had more than one at-bat with investors before landing the deal, so there’s no reason not to try if you have an angle that makes sense right now.

Where do you see the company going now over the near term?

More automation, more simplicity. Every time a decision is made on our platform, we are enriching our data asset on vendors and why buyers make the decision they make. We are laser-focused on tapping into that data to create a more intuitive, more automated product. The future is a world where the modern sales role evolves into a more on-demand, SME type of role, and most decisions are made autonomously by self-guiding buyers on tools like ours. In this world, buyers win because they can execute complex decisions in a fraction of the time and access learnings from others. Sellers win because they can execute many more deals with the same resources they have now.

What’s your favorite restaurant in the city?

John’s Pizza. No frills, perfectly executed pizza, and you have to sit down, which I value. Plus, the way they singe the crust in the oven is perfect.

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today