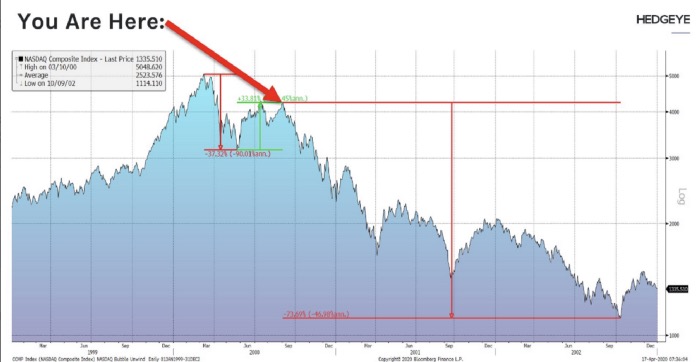

This will be the iconic image of this moment in time, capturing the juxtaposition of the rocking stock market and the coming recession/depression:

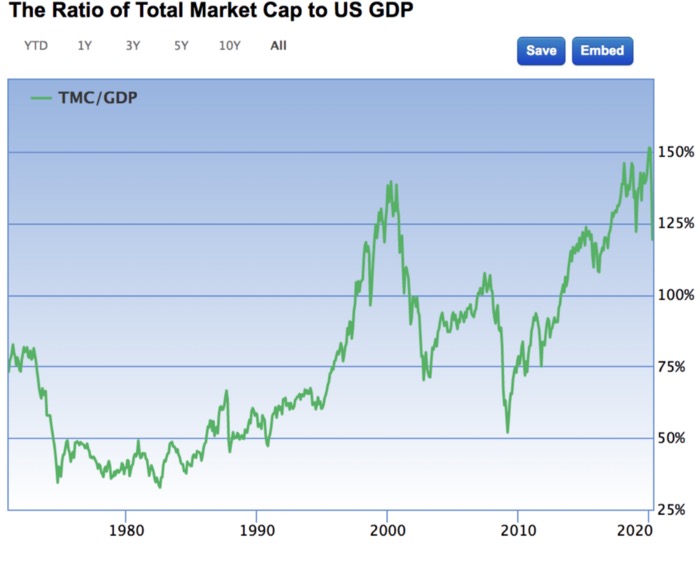

Even with the significant market drop, we are still at historically high valuations per The Buffet Index, Warren Buffet’s favorite macro view of market valuation. The Buffet Index is simply total market cap/GDP:

It’s 130% today, very near all-time highs prior to 2020.

So what’s surprising most people, is that we’re paying more in terms of multiples (130% is near record) for less, in terms of growth (all GDP growth expectations are coming down, most are coming down dramatically).

So why is the market doing this? Here are my top 6 reasons:

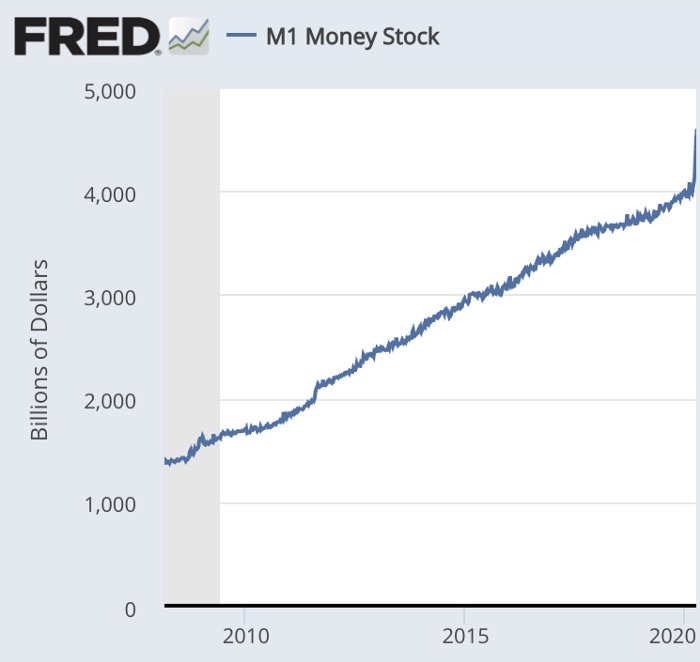

1. The Fed Is Printing money at historic levels… and it’s just beginning

This is the reason most cited for the market going up, and it’s a good one. That money has to go somewhere.

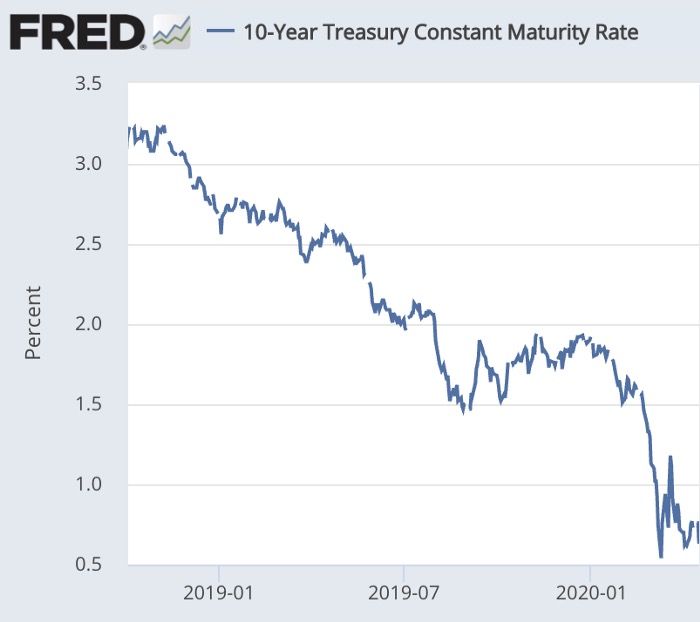

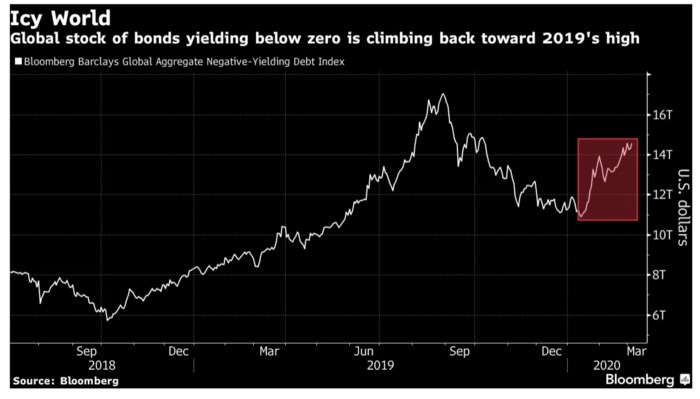

2. Interest rates are at historic lows and primed to go lower

In fact, they’re negative in a lot of places in the world.

The lower interest rates go, and the lower they’re projected to go, all else being equal, the higher the stock market goes.

3. Buy On The Dip Has Been The Right Thing To Do For 11 Years

The market last bottomed in 2009. Buying on the dip has been the right strategy for 11 years. Everyone who sold, for the last 11 years, looked like an idiot. They’ve learned, that it doesn’t matter how bad it looks, buying is the right thing to do. It turns out, we see the world not as it is, but as we are.

4. When The World Is Ending… Buy!!

Legendary market strategist Art Cashin tells a great story from his early days in the ’60s as a trader on the NYSE. One day, a rumor swept through the pit that there were missiles in the air from Cuba. So he sold everything.

When his boss saw what he had done he screamed at him “You BUY on inbound missile rumors! If it turns out to be true, you’re dead anyway.”

5. The Professionals Are Saying To Buy

“The combination of unprecedented policy support and a flattening viral curve has dramatically reduced downside risk for the U.S. economy and financial markets and lifted the S&P 500 out of bear market territory. If the U.S. does not experience a second surge in infections after the economy reopens, the ‘do whatever it takes’ stance of policymakers means the equity market is unlikely to make new lows.”

6. Bear Markets Always Have Major (Dead Cat) Bounces Along The Way

Two of the three biggest daily percentage increases in stock market history we’re dead cat bounces on the way on the way down to rock bottom (reached on July 8th, 1932) during the depression. The 5th and 6th largest daily percentage increases we’re dead cat bounces during the mortgage meltdown (which bottomed on March 6th, 2009)

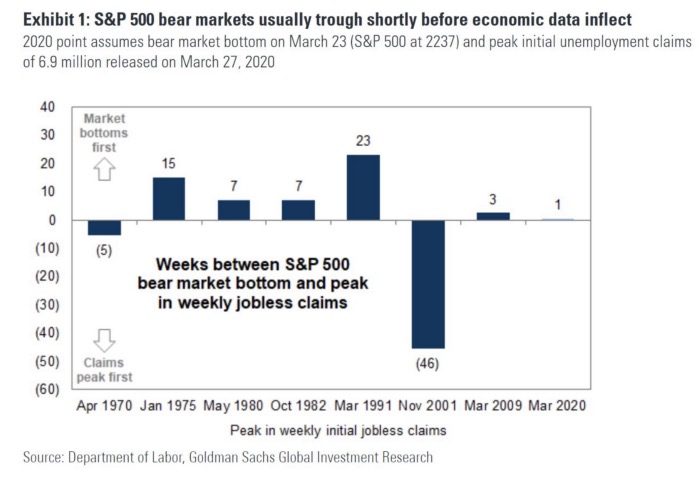

7. Bear Markets Generally Bottom Before Jobless Claims Peak

In five of the six last bear markets, the market bottomed, on average, eight months before the jobless claims did:

The bottom line is, the stock market has richly rewarded those who didn’t panic for the last 90 years, since it bottomed in 1932, compounding at a 7.5% rate. If you were great at market timing, you had many opportunities to buy and get back in. But it turns out no one is good at market timing. That’s why passive investing is a thing.

The flip side is, it took the DOW 25 years to regain its pre-depression high.

So the bottom line is, things work until they don’t. And the market has worked really well for 90 years. It’s hard for most people to bet against that.

That said, I’m long Bitcoin.