The pet health insurance sector is valued at $1.42B; approximately 2.43 million pets were insured in North America and this number is growing. Pawlicy Advisor allows pet owners to make sense of the pet insurance marketplace based on specific criteria such as breed-specific conditions. The varying factors are converted into data points that generate a “confidence score” so pet parents can compare and contrast their insurance options; with transparency and efficiency. Pet Pawlicy’s search engine can provide results within five minutes.

AlleyWatch spoke with Cofounder and CEO Woody Mawhinney to learn about the inspiration behind Pawlicy Advisors, the state of the pet insurance market, and the company’s future plans fresh off of a $1M Seed round closed earlier this year.

Tell us about the product or service that Pawlicy Advisor offers.

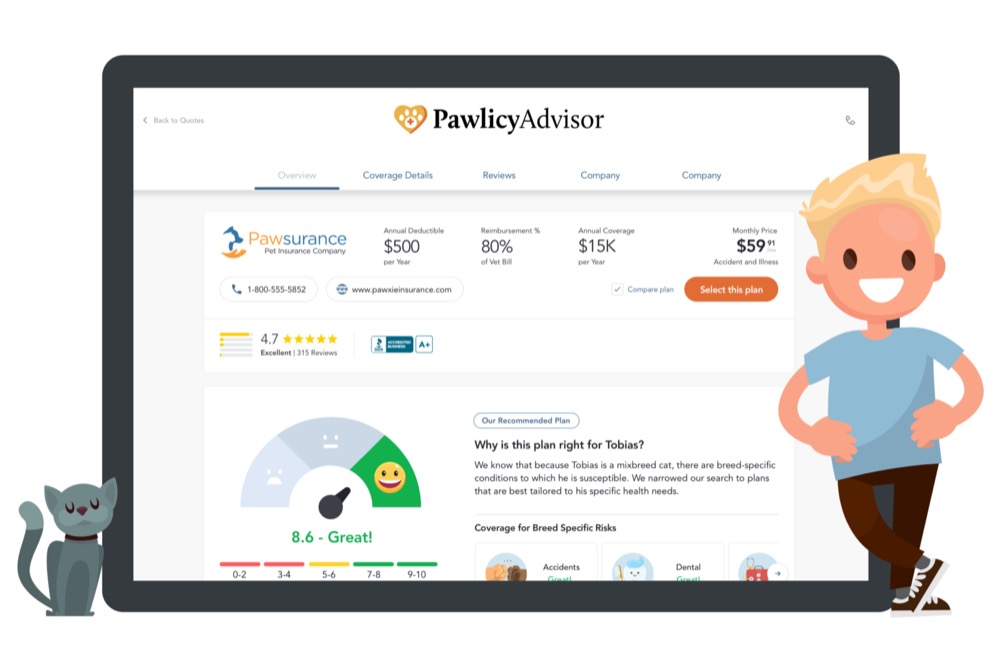

Pawlicy Advisor is the leading independent marketplace for finding the best insurance coverage for your pet at the lowest rate. Pet parents answer a few simple questions and get real-time price quotes from top pet insurance companies. We offer easy-to-use filtering tools and an objective analysis that helps people make an informed decision about their pet insurance purchase.

To help educate consumers about what pet insurance is and why it’s important, we’ve aligned ourselves as a free platform for thousands of veterinarians across the country. We’re on a mission to make it easy and affordable to do the right thing for pets.

What inspired the start of Pawlicy Advisor?

In 2015, my Shar-Pei puppy, named Wrigley, came down with a genetic disease that required expensive medication to stabilize. As an animal lover and self-described “dog dad,” I was relieved that the insurance covered Wrigley’s monthly prescription costs.

While speaking with other pet owners in my community about this experience, I discovered how lucky I was to have chosen insurance that covered Wrigley’s uncommon condition. Other pet owners shared stories about inadequate and overpriced coverage, and the difficulties they faced evaluating options. Those stories stuck with me through business school, where I spoke with hundreds of more pet owners and veterinarians around the country about how the pet insurance experience could be improved. In April of 2018, I decided to launch Pawlicy Advisor.

Around the same time, Travis (my cofounder) bought pet insurance after adopting his first pet, Ginny. Frustrated with the buying experience and wishing for a more transparent process, he reached out to me after reading about the business idea. Three months, countless coffee chats, and a nine-hour hike later, Travis joined as CTO to help pet owners everywhere find the right insurance at the right price.

How is Pawlicy Advisor different?

Unlike other insurance comparison websites, Pawlicy Advisor analyzes the projected lifetime costs of policy options and the breed-specific conditions to which pets are susceptible. These data points are turned into a “confidence score” that helps pet parents compare and contrast their insurance options.

When people choose to purchase through Pawlicy Advisor, they also get access to our intelligent alerts where we detect opportunities to use their purchased insurance policies.

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today

What market does Pawlicy Advisor target and how big is it?

Pet insurance is currently a $1.42 B market in the US. It is one of the fastest-growing lines of voluntary insurance, doubling in market size every three years. We’re now seeing industry leaders enter the market and veterinary professionals talk to clients about pet insurance for the first time, significantly boosting product awareness and distribution. Pawlicy Advisor is helping to further accelerate this growth by providing transparency to a product that, historically, has been confusing for consumers to evaluate.

When we think long-term about the company, we’re excited to become the trusted brand for pet owners evaluating products related to their pet’s health or happiness.

There is a reason our company isn’t called “Pet Insurance Advisor”.

What is the business model?

Because we’re a licensed insurance agency nationally, we get paid a commission by the insurer when consumers buy through us. But, unlike most insurance brokers, we’re standardizing the amount we get paid. When we recommend a plan to pet parents, it’s because we actually think it’s a better deal, not because we get paid more. This business model allows us to be completely free for consumers to use!

How has your business changed since going through ERA?

Pawlicy Advisor was initially focused on marketing directly to consumers. D2C acquisition is still an important part of our long-term strategy but the company is spending most of its outreach efforts on veterinarians.

Veterinarians want consumers to have pet insurance because it improves patient retention and increases the chance that pet owners will be able to accept medical treatment when accidents and illnesses occur. Vets are also seen as the primary authority on pet health and are frequently asked about pet insurance. Despite this position of authority, veterinarians tell us they don’t want to recommend one specific insurance brand and generally suggest that pet parents research their options to find the right plan for their specific pet.

Veterinarians love Pawlicy Advisor because we’ve built an objective educational platform to which they can send their patients. We help simplify the conversation and improve the chance pet parents end up getting insurance for their pets.

What are the milestones that you plan to achieve within six months?

Our product has been making waves in the veterinary community and veterinarians are excited about what we’re building. We hope to be the trusted pet insurance marketplace by the majority of veterinarians in the US within the next 12 months.

Our product has been making waves in the veterinary community and veterinarians are excited about what we’re building. We hope to be the trusted pet insurance marketplace by the majority of veterinarians in the US within the next 12 months.

What is the one piece of startup advice that you never got?

Conventional wisdom for D2C brands is to test low-hanging digital acquisition first. This is true, but it’s equally important to focus on finding strategic acquisition channels as early as possible. These will be much more defensible long term and help keep your burn low while you focus on proving out product-market fit.

If you could be put in touch with anyone in the New York community who would it be and why?

We’re talking with large veterinary care groups who are eager to roll out our product across their veterinary practices and would love any additional introductions in the space.

Why did you launch in New York?

We love New York’s vibrant tech community and look forward to growing a massive business here.

What’s your favorite restaurant in the city?

Dirt Candy! It’s the best vegan spot around.

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today