Equipped with sophisticated back-ends, larger conglomerates are often outcompeting small freight brokers, but Axle Payments wants to change this by empowering over 10,000 freight brokers currently operating in the US with sophisticated back-end solution. Axle Payments has automated the back office to handle collections, carrier payments, and integration with accounting while freeing up to 90% of the invoice within one day of verification through its factoring program.

AlleyWatch sat down with CEO Bharath Krishnamoorthy to learn more about the business, its future plans, and most recent funding round.

Who were your investors and how much did you raise?

Axle received $1.4M in pre-seed funding from Trucks Venture Capital, Plug and Play Ventures, 37 Angels, Fontinalis Partners, and Techstars.

Tell us about the product or service that Axle Payments offers.

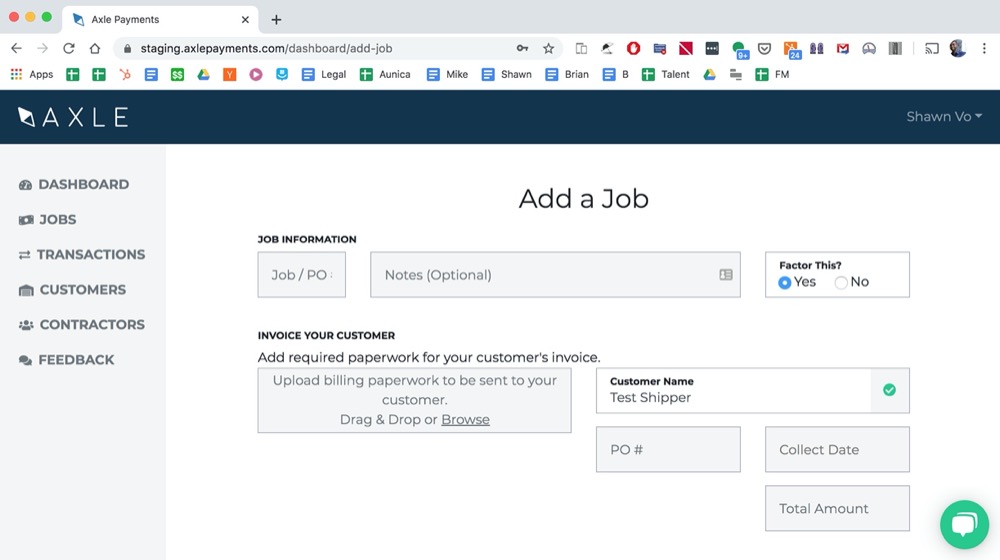

We’re building a carrier payments platform for freight brokers. We help them compete with larger players by automating their back-office work and providing them the working capital they need to pay their carriers on time.

What inspired the start of Axle Payments?

What inspired the start of Axle Payments?

Shawn Vo and I had both been working in the transportation technology space and identified freight finance as an area that was ripe for disruption. Shawn has a background in financial technology, and I previously worked as a corporate lawyer, with clients ranging from large banks to private equity funds. To round out their founding team, we partnered with Michael Sturm and Brian Perkins, who together have over 20 years of experience in the freight finance space.

How is Axle Payments different?

When SMBs in the freight and logistics space need working capital, they typically sell their outstanding invoices to a freight factoring company. The factoring company will pay the SMB upfront (minus a small fee), then collect the full amount from the SMB’s customer whenever the invoice becomes due.

Unfortunately, most freight factoring companies only focus on servicing carriers, not freight brokers. Freight brokers have a different business model, and very different needs. Axle Payments has built a unique solution, geared specifically towards freight brokers, that leverages our proprietary technology to deliver them the best quality service at highly competitive rates.

Nominations are now open for AlleyWatch’s 2020 NYC Tech Influencers feature. Know someone amazing who belongs on this list? Nominate them today here. Nominations open until 2/14. Looking to drive targeted response from the NYC Tech community at scale, learn more about partnering with AlleyWatch on this initiative here.

What market does Axle Payments target and how big is it?

We focus on the freight brokers responsible for moving the goods we rely on every day. As long as their broker’s license is valid, and no other creditors have liens against their assets, we can help them out – even if they have poor credit or none at all. There are over 10,000 freight brokers in the US, and more than 20% of the freight in the country moves through these businesses.

Who do you consider to be your primary competitors?

Factoring is a longstanding, essential part of small businesses’ financing. In 2018, private lenders purchased over $3T in invoices across a wide range of sectors. But while everything in business has changed, factoring has not: it’s always been done without the efficiencies of modern technology, and the current process simply can’t scale to fit the needs and pace of today’s businesses.

What’s your business model?

We charge our clients a financing fee whenever they take an advance on an invoice.

What was the funding process like?

It’s kind of like getting stuck in a time loop because you’re having (almost) the same conversation over and over, just with different people. The upside is you improve very quickly because you’re getting a ton of practice in a short amount of time.

What are the biggest challenges that you faced while raising capital?

It was hard to get buy-in because we had just recently pivoted and had no traction for the new business model.

What factors about your business led your investors to write the check?

Given how early we were, I think most (all?) of our investors were largely taking a bet on Shawn and I as founders.

What are the milestones you plan to achieve in the next six months?

So far, we’ve been growing very quickly — we’ve already purchased over $1 million in invoices. To maintain our growth rate over the next 6 months, we’ll need to make some additional hires.

We’re looking for senior software engineers who have experience with functional programming languages and salespeople who have experience doing inside sales in the freight transportation space. We’re a remote team, so anyone who is interested, regardless of location, should reach out!

So far, we’ve been growing very quickly — we’ve already purchased over $1 million in invoices. To maintain our growth rate over the next 6 months, we’ll need to make some additional hires.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Don’t give up! These things often take longer than you’d expect, but if you keep at it, you’ll get there eventually.

Where do you see the company going now over the near term?

Our hope is to grow the Axle team of transportation and finance experts, so we can help more freight brokers manage their cash flow and scale their businesses.

What’s your favorite restaurant in the city?

Awash, in the East Village.

Nominations are now open for AlleyWatch’s 2020 NYC Tech Influencers feature. Know someone amazing who belongs on this list? Nominate them today here. Nominations open until 2/14. Looking to drive targeted response from the NYC Tech community at scale, learn more about partnering with AlleyWatch on this initiative here.