.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.tyle=”text-align: center;”>

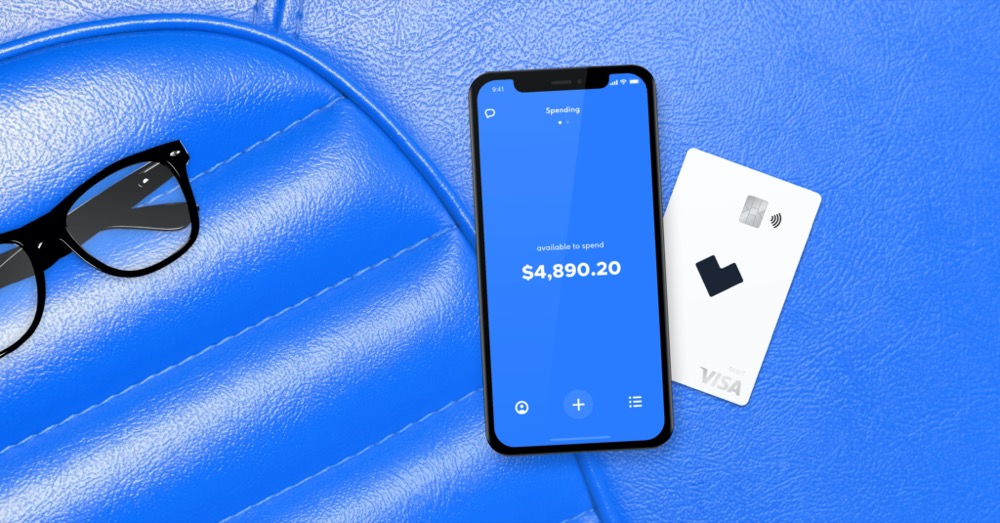

Managing a HSA (health savings account) can be confusing because requirements are adjusted each year to account for inflation. In 2020, if you have a HSA account and self-only coverage, you can contribute up to $3,550 with pre-tax dollars. Starship is the first robo-advisor to help manage HSA accounts and earn a return on these funds. Through its mobile app, users can chat with Starship to figure out where to spend and invest your HSA, and Starship charges a nominal .5% fee for handling the investment portion. Additionally, the app serves as an educational tool, spreading klnowledge of the many items that are HSA eligible and not thought to be like acupuncture, condoms, dental care, psychiatric care, and therapy.

AlleyWatch interviewed Sean Engelking about the inspiration behind Starship, how the HSA market is often misunderstood, and the company’s recent fundraise.

Who were your investors and how much did you raise?

We raised $7M for our Series A from Valar Ventures. Broadhaven – our Series Seed lead – Clocktower, Third Prime, and 500 Startups also participated.

Tell us about the product or service that Starship offers.

Most Americans are eligible for a health savings account (HSA) but often don’t have one. Those that do have one often don’t know how to use them. To solve this problem, we built an HSA that automates the complexities as much as possible and does it all from a beautiful app. Our product helps manage investments and provides the ability to organize anything from receipts to a fully managed investment experience. We even help them figure out where to use their HSA, all by chatting with us in the app.

What inspired the start of Starship?

Our healthcare system is completely broken. I learned this when my dad lost his leg in 2015. To say nothing of the toll it took on the family, the bills just kept rolling in, which ultimately drove him into bankruptcy. Tragically, he’s not alone. Of those that file for bankruptcy, most are for medical bills, and for $1,000 or less.

Having used an HSA myself, I started thinking about ways that this tool could be reimagined to offer Americans a better way to pay and plan for healthcare costs. This spurred the decision to found Starship in 2017 with my two cofounders. Our mission was to make it as easy as possible to solve for present and future needs.

How is Starship different?

We offer the highest savings rate in the country

We’re the first robo-advisor built for health savings accounts

Our people are technology and health insurance experts. We can help you figure out where to spend your HSAs, all by chatting with us in the app.

Who do you consider to be your primary competitors?

Traditional and new HSA platforms built primarily around money movement rather than the consumer experience.

What market does Starship target and how big is it?

HSA adoption in the US is blowing up. Total deposits in HSAs is projected (by Devenir) to exceed $100B by the end of next year. This significant growth illustrates the reality that more and more Americans are being asked to devote a larger share of their income towards healthcare; before insurance kicks in. Our platform addresses this by focusing on what matters most to each person: whether immediate cost savings, mid-range “emergency fund” building, or long-term planning for medical costs in retirement.

What’s your business model?

While we don’t charge anything for the HSA, we do make money when you:

- Hold your money with us

- Swipe your card

- Invest your money with us (where we charge a nominal fee)

What was the funding process like?

We were extremely selective with our early investors and prioritized those that believe in our mission. Valar, who was also an investor in our series seed, was so excited about our growth and mission that they decided to lead our Series A. Every single one of our Seed investors also participated in the Series A.

What are the biggest challenges that you faced while raising capital?

Let’s just say we got better about explaining how HSAs work to folks who have never had one.

What factors about your business led your investors to write the check?

Our differentiators, unit economics and our passion. Investors were intrigued by our low-cost HSA offerings, solid team, structural changes in the health industry driving adoption, and also that we really care. It’s a classic disruption story—an old process that nobody likes that nobody cared to fix.

What are the milestones you plan to achieve in the next six months?

We have a ton of great plans in the works, including:

- Lots (and lots) of customer growth

- Exciting partner announcements

- New features for our users

- Great content to help anyone navigate and understand HSAs

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

I really believe that hard work eventually pays off.

I really believe that hard work eventually pays off.

Where do you see the company going now over the near term?

We’re focused on scaling. We’re really passionate about giving Americans the tools they need to grow their money so healthcare costs don’t become such a burden.

What’s your favorite restaurant in the city?

Any place that’s quiet – the real unicorns in New York.