With a three-year growth rate of 990%, Reonomy is disrupting the CRE industry by providing the most extensive database of property-centric intelligence available for CRE teams and individual investors. Through its proprietary ML and AI technology, Reonomy connects and centralizes disparate property information into its platform that features over 50M properties and 68M property sales. Reonomy is used by some of the biggest names in CRE and has exclusive data partnerships with data providers such as Black Knight and CoreLogic.

AlleyWatch interviewed Rich Sarkis to learn more about Reonomy’s success and growth (total funding amount of $128.4M across four rounds).

Who were your investors and how much did you raise?

Series D funding led by Georgian Partners, with participation from Wells Fargo Strategic Capital, Citi Ventures, and Untitled Investments.

Existing investors, including Sapphire Ventures, and also continued their participation in this round.

Tell us about the product or service that Reonomy offers.

Tell us about the product or service that Reonomy offers.

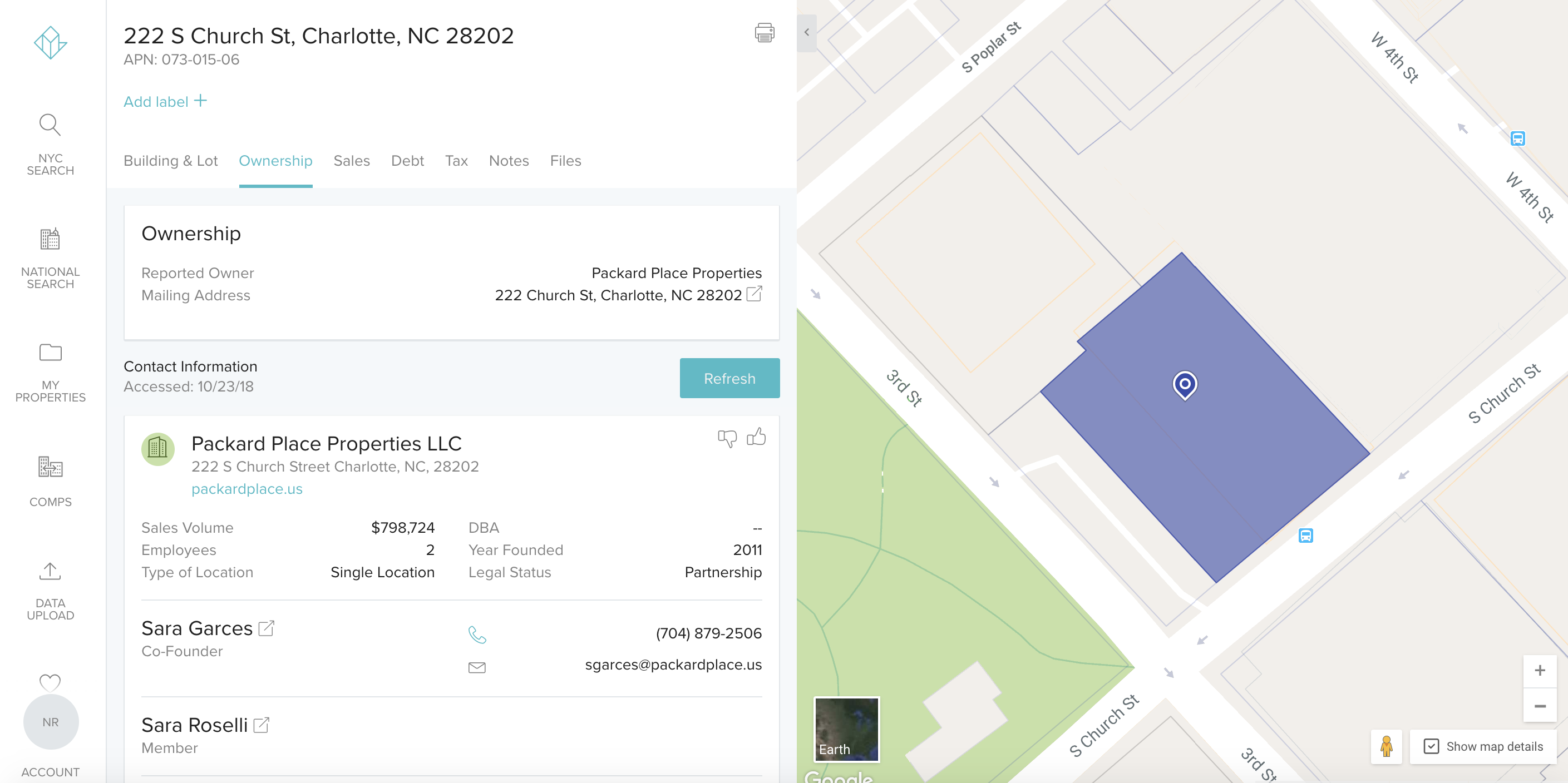

Reonomy is a platform that connects disparate property information, enabling applications that empower users to reach better property-centric decisions. The platform leverages machine learning and the Reonomy ID—a unique identifier for every commercial asset that connects data on properties, companies, and people.

Reonomy’s solutions include a portfolio of SaaS applications for Individuals or Teams, along with a platform upon which Reonomy’s leading ecosystem of partners build their own custom applications.

What inspired the start of Reonomy?

Despite being one of America’s largest industries, individuals that work on any asset outside the single-family home have been deprived of insights and opportunities due to the fragmented, disparate nature of real estate information.

Most data is recorded in a variety of ways, without a property identifier to make information shareable. Our team set out to fix this and have since built the largest platform of property intelligence available to the market.

How is Reonomy different?

Commercial real estate data has been siloed, disparate, and devoid of a common language to standardize information collection and sharing.

Our unparalleled AI Technology, paired with machine learning and exclusive data partnerships resolve data from any source and restructure it into our own universal language: the Reonomy ID.

What market does Reonomy target and how big is it?

We are committed to making property intelligence accessible for everyone, from the individual investor, to the world’s largest enterprises. This means making it easier to discover new deals and make property-centric decisions.

Our clients represent the biggest names in CRE, including Newmark Knight Frank, Cushman & Wakefield, Tishman Speyer, and CBRE.

Why do your clients choose your platform over competitors?

Our competitive advantage is in our unparalleled machine learning algorithms, trained on the largest CRE dataset, along with exclusive data partnerships with Black Knight, CoreLogic, and Dun & Bradstreet. Our proprietary machine learning algorithms standardize and resolve data from historically disparate sources and have allowed us to scale to the most extensive database of property-centric intelligence available.

The platform consists of more than 50M properties, 80M companies, 300M people, 38M mortgages, and 68M property sales.

In addition to the depth and breadth of our data, we offer a suite of products tailored to the diverse range of clients we serve. Individual, hobbyist investors up to the largest enterprises are able to leverage our platform through a variety of access points. Our platform provides a level of visibility into real estate assets that was previously unattainable

What’s your business model?

We offer a broad suite of solutions, catering to the individual to the world’s largest enterprises. Our core product is a SaaS offering, structured per/user per/month. Our large enterprise offerings are based on the volume of intelligence consumed.

What was the funding process like?

Our series D funding came at a time when we weren’t necessarily out raising money. In June of 2018, we partnered with Sapphire Ventures on our Series C. Since that time, we have seen tremendous growth and traction with our clients adopting our solutions.

Georgian Partners, who led our Series D funding, invests in high-growth enterprise software companies in the US and Canada, which made this partnership a natural fit.

Our series D funding came at a time when we weren’t necessarily out raising money. In June of 2018, we partnered with Sapphire Ventures on our Series C. Since that time, we have seen tremendous growth and traction with our clients adopting our solutions.

What are the milestones you plan to achieve in the next six months?

- Expanded machine learning capabilities and platform-driven applications in an effort to continue developing the most robust and comprehensive CRE data solutions available.

- Continue building best-in-class solutions for banks and financial institutions

- Enhance proprietary applications with a focus on predictive analytics, portfolio analysis, and market insights

- Improve our employee experience with a new office space and continued investment in learning and development for our team.

- High velocity of recruiting, particularly for data analysts and data engineers.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Hire according to your values.

What’s your favorite restaurant in the city?

Bohemian.