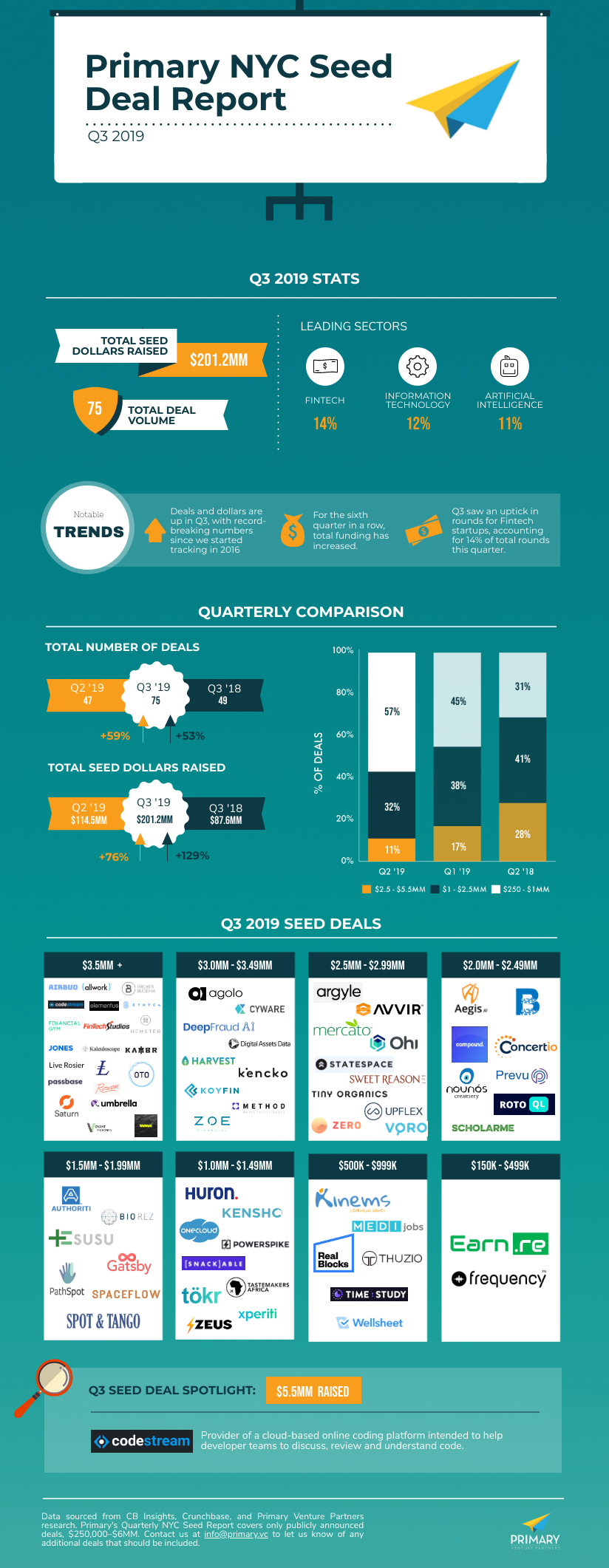

Deals and dollars are on the rise. Last quarter we touted a new all-time NYC seed activity high, and we’re already back at it again. In Q3, total funding reached a whopping $201.2MM, up an impressive 76% from Q2’s sizeable amount. And this quarter saw 75 deals (up 59%), just breaking the previously held record of 74 deals in Q1 2016 when we first started tracking.

This is the second quarter in a row of green arrow signs. Notably, the average round size hit another new high, 2.7MM, up nearly 13% from Q2. For comparison, the last time we saw nearly this many deals, which was Q1 2016, the average check size was 1.4MM. How the times have changed.

Industries to Watch

Losing my religion

IRL and digital community startups that support people’s mental health and address the inherent desire to build community are taking off like wildfire. From Yoni Circle’s female focus to Evryman’s strong product offering for the male population, we’ve seen more than a handful of companies looking to enhance mental wellness and perhaps help fill the void left from the declining participation in religion.

Powering the on-demand workforce

As the gig economy shows no signs of slowing down, new companies continue to pop up to service them. Argyle, an API that unlocks access to workforce data, is helping power the infrastructure of this segment while Upflex’s booking platform gives companies the flexibility they need to operate from anywhere.

Doubling down on delivery

You may have thought that the loud rise of Doordash and Uber would keep new entrants from entering the delivery game, but it appears things may just be getting started. From Ohi, which handles shipping for eCommerce companies (raised $2.89MM), to Mercato’s marketplace for local grocery delivery (raised $2.73MM), we’ve seen a handful of players finding unique angles in food, product sampling (nok brands), and eComm delivery.

Insider information

Knowledge is power, and companies continue to look for new ways to outsmart the competition. People are relying more on other people to optimize job performance, whether it’s sourcing information from outside experts (Xperiti) or better leveraging their own internal resources (CodeStream).

Abiding by the law

Compliance and fraud remain top of mind for enterprises as more regulations go into effect. As a result, we’re seeing an increase in software that empowers businesses to build their own monitoring and defenses. Startups like Ethyca aim to help companies comply with privacy laws, while Deep Fraud AI and Authoriti help secure data while reducing fraud.

Looking like a snack

Venture dollars are flowing into food and beverage here in NYC. Magic Spoon brought in $5.5MM in their seed round to reinvent the children’s cereal category, while Sweet Reason (CBD infused sparkling water), Tiny Organic (personalized food for baby’s and toddlers), and Kencko Labs (reinventing how we consume fresh fruits and vegetables) also all have a little bit more capital in their bank accounts in Q3.

Primary NYC Seed Deal Report: Q3 2019