Welcome back to Inside the Mind of an NYC VC, a highly acclaimed series at AlleyWatch in which we speak with leading New York City-based Venture Capitalists. In the hot seat this time is Heather Hartnett, CEO and Founding Partner at Human Ventures, NYC’s premiere venture studio that operates its own $50M early-stage fund that debuted earlier this year. Launched in 2015, Human Ventures works with founders in all aspects of company building from the earliest stages of ideation, to assembling the team, scaling operations, and raising subsequent funding. With Hartnett at the helm, Human has invested in and co-built more than twenty companies that include Reserve (acquired), Clark (acquired), Current, Tiny Organics, Token, Paloma, and Girlboss.

Hartnett was kind enough to join us in our offices in Soho to provide some insight into her path to the venture, how studios like Human are filling a massive hole in the entrepreneurial ecosystem, Human’s criterion for investment, actionable advice for founders, and much, much more…

Reza Chowdhury, AlleyWatch: Please tell us a little bit about your background and how/why you started in venture.

Heather Hartnett, Human Ventures: I had always been curious about technology and how companies were built, having grown up in a family of entrepreneurs where that was very much part of our vocabulary. So when I graduated from college in 2005 I moved out to the Bay Area and was exposed to a whole new side of the company building business: investing. What I saw then — and continue to see now — is that investing is an innovative way to make an impact and give resources to people who have the desire to create true value in the world.

Tell us more about Human Ventures. How do you define the concept of a “venture studio”?

The lifeblood of the venture industry is founders. I started conceptualizing Human Ventures during interviews with founders whom I respected. I would ask them what they needed to found a company with Human instead of just launching themselves, and then I began compiling a list.

Experienced entrepreneurs were looking for a few key things across the board — the ability to tap shared business design services, hire faster, build-test-learn faster, and more. There was no single place in NYC specifically for founders to build together. We built a team at Human with the expertise to support founders with these needs, and a community around us to give founders a better shot at success.

What we saw was that the infrastructure needed to truly build from scratch was becoming more sophisticated. So we created a studio akin to a movie studio where we had all of the producers and types of talent in house, to be able to help a founder from day one.

Today, we are a destination for high growth founders who are building big businesses that will define our future.

You also have a separate fund that closed earlier this year. Tell us about that.

It’s well-known that early-stage funds have to have a differentiated approach to sourcing companies. With the studio and the ecosystem that we’ve built in NYC, we have unbelievable access to founders — some before they even start building their next company. Having a dedicated fund was the logical next step for us after building out our platform.

The fund primarily invests in the companies that we co-build with founders from inception. We’ll also make external investments in our main focus areas of media, health and wellness, and how you earn, spend, and manage money. However, regardless of the category, it’s always about the founder first.

How many deals will Human Ventures invest in a year?

We aim to co-build around 6-10 companies a year internally and will invest in about the same number externally per year. Check size ranges from $250K – $1M.

What have you learned since Human Ventures’ launch in 2015?

With the proliferation of tech, you can start a company from anywhere and anyplace, but it’s harder than ever to break through the noise and win. Human connections and relationships are and have been for hundreds of years the only way you can get an edge in building businesses. Our thesis, which is betting on founders first, has proven out over the last four years. Business isn’t done with other businesses, it’s done with other humans.

Is there a specific investment thesis that Human Ventures deploys? Where is the firm’s sweet spot?

Is there a specific investment thesis that Human Ventures deploys? Where is the firm’s sweet spot?

We focus on founders and big opportunity spaces since we often start working with founders before there is even an idea for a company. In addition to the companies we build, we invest in Seed and Series A companies with a focus on the future of new media, health and wellness. The Human lens that we have across all of our companies is around observing life stages. From adolescence to old age, every generation looks at these stages in life through a different lens. As the generations shift into new life stages, we see big market opportunities unlock.

What does your role entail? Do you spend more of your time sourcing new deals, analyzing investment opportunities, supporting portfolio companies, or communicating with LPs? Take us through a “typical” day if there is such a thing!

There’s definitely no such thing as a “typical” day, but that’s what I love about my job. I have the unique opportunity to plug into different facets of the business throughout the day, whether that’s a meeting with a potential founder or LPs (our investors), or working with our internal build team to enhance the offerings of our studio. There’s never a quiet day here. My partner, Michael Letta, is also a general partner and COO of the studio. We have very complementary skills. He runs the studio and is an operational guru, and I am out building the ecosystem helping our founders connect with investors and customers.

What resources does Human Ventures bring to the table for the companies that you work with?

Human Ventures builds the machine where entrepreneurs can thrive. We partner with the best founders, connecting them with ideas and placing them in an unparalleled ecosystem of company builders and resources for growth. We have a 15,000 square foot studio space in Manhattan and in-house teams that can support a founder at any stage of their business. This includes teams focused on business design, finance and legal, product and engineering, people operations, design, fundraising support, communications, and more.

Human Ventures builds the machine where entrepreneurs can thrive. We partner with the best founders, connecting them with ideas and placing them in an unparalleled ecosystem of company builders and resources for growth. We have a 15,000 square foot studio space in Manhattan and in-house teams that can support a founder at any stage of their business. This includes teams focused on business design, finance and legal, product and engineering, people operations, design, fundraising support, communications, and more.

What differentiates Human Ventures versus other “venture studios”? Why can “company-builders-as-a-service” scale effectively?

We are obsessed with personality traits and skills that go beyond the resume. In the next 10 years, you’re going to see the intangible skills that we take for granted, or that we don’t have the best vocabulary around, become even more critical to team building and how we work with others.

Very early on at Human Ventures we created Our Guide To Being Human that lists our values. It’s a group of six things that represent what we stand for — being focused on growth, having guts, being resilient, open-minded, collaborative, and grateful. You don’t have to look a certain way to be part of Human Ventures. What connects everyone associated with us is our underlying values. Those values aren’t just posted on the wall — they permeate everything we do.

From a young age, my parents told me, “You can’t stop the waves, but you can learn to surf.” It instilled in me an understanding and acceptance that we can’t control everything that comes at us, but we can control our reaction to it. This advice comes to mind any time I feel the inevitable turbulence of the world of startups. I remind myself how important it is to be centered in myself, my values, and my beliefs, and I encourage every entrepreneur I meet — including all of the founders building at Human Ventures — to tap into that same part of their core.

What do you need to see from teams, both qualitatively and quantitatively, in order to invest?

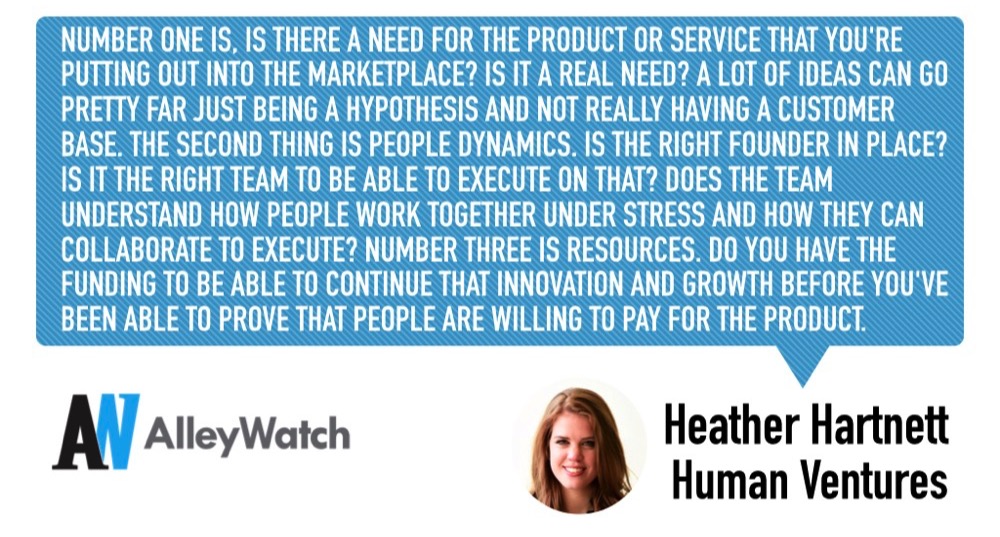

Number one is, is there a need for the product or service that you’re putting out into the marketplace? Is it a real need? A lot of ideas can go pretty far just being a hypothesis and not really having a customer base. The second thing is people dynamics. Is the right founder in place? Is it the right team to be able to execute on that? Does the team understand how people work together under stress and how they can collaborate to execute? Number three is resources. Do you have the funding to be able to continue that innovation and growth before you’ve been able to prove that people are willing to pay for the product? Those are the three most important factors that will make or break the success of a founder in the early days. Then the largest overarching indicator is timing. That’s something that nobody has the ability to predict. But I think if you have the first three honed, and you’re listening to your intuition and you’re listening to those indicators, then you fall into timing. So timing can also be construed as luck.

What is one thing every founder should ask themselves before walking into a meeting with a potential investor?

We have a term called founder market fit. What that means to me is, why that founder and why now? I think this is something that’s really important for leaders everywhere but especially for founders who are walking into meetings with potential investors. As a founder, you should ask yourself that question. Why me and why now? Being authentic resonates with people on a deep level.

Turning the tables, what makes a good investor?

A good investor is someone who’s willing to dive in with a founder and be there for them in the good and the bad. Can you be a true partner to a founder?

When you put on your headphones and need to get head down in something, what are you listening to?

Podcasts and audiobooks. Podcasts include The Daily, Axios Pro Rata, Reply All, The Moth.

What’s the last book you read?

Super Pumped by Mike Isaacs. (I listened to it!)

What’s your favorite fall destination in and around NYC?

Washington Square Park. I live right near there and I love watching the leaves change color.