What is Bitcoin? For most, Bitcoin remains an enigma. I think part of the difficulty in understanding Bitcoin is that it’s not just one thing. Bitcoin can be many things, depending on how you look at it. Depending on the prism you look at the world through.

As my own thinking about Bitcoin evolves, I now see three Bitcoins.

Bitcoin #1 — A Peer-to-Peer Electronic Cash System (aka A Medium of Exchange, Currency, or Money)

Per Satoshi and his white paper, the original intention of Bitcoin was to be a currency. For multiple reasons, today, Bitcoin is not very functional as currency. While there is a laundry list of merchants who accept Bitcoin, it is still a minuscule percentage of total merchants. There are many companies that are building on top of Bitcoin, and working to enhance Bitcoin, so it can evolve to be a functional global currency. While it’s unclear if their efforts will be successful, what is clear, is that Bitcoin is not a functional currency today.

Bitcoin #2 — A Store of Value

This is the Bitcoin that got me excited. I believe that Bitcoin is the world’s best store of value. Gold has had a great 3,500+ year run as a store of value. Maybe the greatest run ever. But nothing lasts forever.

It’s a great time to be a store of value. As Ray Dalio pointed out in a recent post he dubbed ”Paradigm Shifts” — “Central banks have been lowering interest rates and doing quantitative easing (i.e., printing money and buying financial assets) in ways that are unsustainable…..producing more negative real and nominal returns that will lead investors to increasingly prefer alternative forms of money (e.g., gold) or other stores of wealth. ”

Most interestingly for Bitcoin, Dalio writes that while most people believe that equity and equity-like investments are the best investments, he believes that they “…. are unlikely to be good real returning investments and that those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold”. While Dalio doesn’t say it if you believe that Bitcoin is a good store of value, then following Dalio would lead you to invest in Bitcoin as a store of value.

Bitcoin #3- Bitcoin As A Speculation Platform

At the peak of the crypto bubble in January 2018, I wrote a piece describing crypto as “.. the world’s first global casino”. I mean, Ripple was trading at a $342 billion value, fully diluted.

I now have a more nuanced view.

Speculation is defined as “a financial transaction that has a substantial risk of losing value but also holds the expectation of a significant gain.” It’s on the spectrum between gambling and investing.

Earlier this week, Tony Sheng wrote a great piece “Speculation as the killer app” in crypto. I agree, and think that speculation is the killer app of Bitcoin today. That was the major lesson I took away from my recent 10 day trip to Crypto Asia.

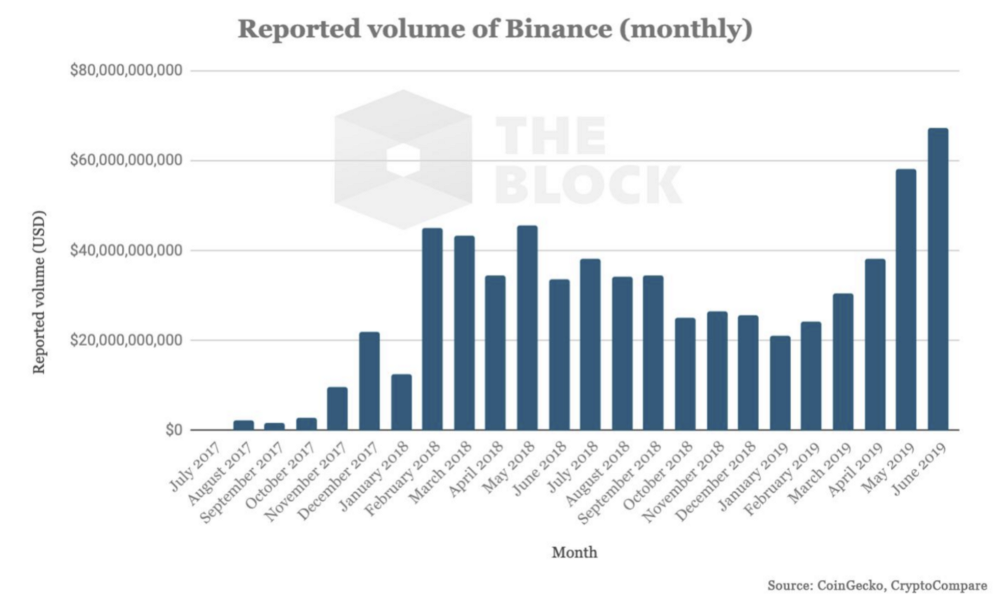

Speculation is why the biggest winners in crypto, to date, are the exchanges (Binance, BitMEX, …). They’re the house. It doesn’t matter if Bitcoin goes up or down, the companies enabling speculation, are minting money.

The new features being deployed by exchanges, like exchange tokens, 100X margin trading, coin listings, and trader signals, all provide greater opportunity for speculation.

So far, DeFi is primarily about enabling more speculation via more markets, more assets, more risk, and more liquidity.

When the internet took off, the first killer app was email. It wasn’t a new thing. It was just making an existing thing better. The first killer app of Bitcoin/crypto is speculation. Speculation has been around forever. Bitcoin/crypto is making it better. And it’s just started, so buckle your seat belts. You haven’t seen anything yet.