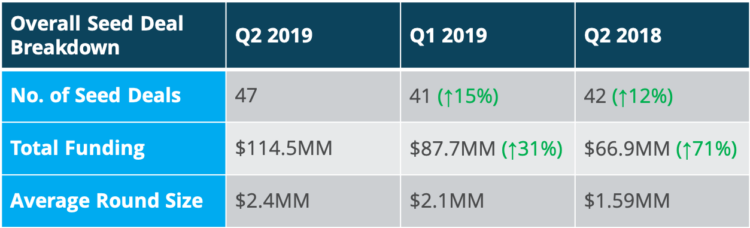

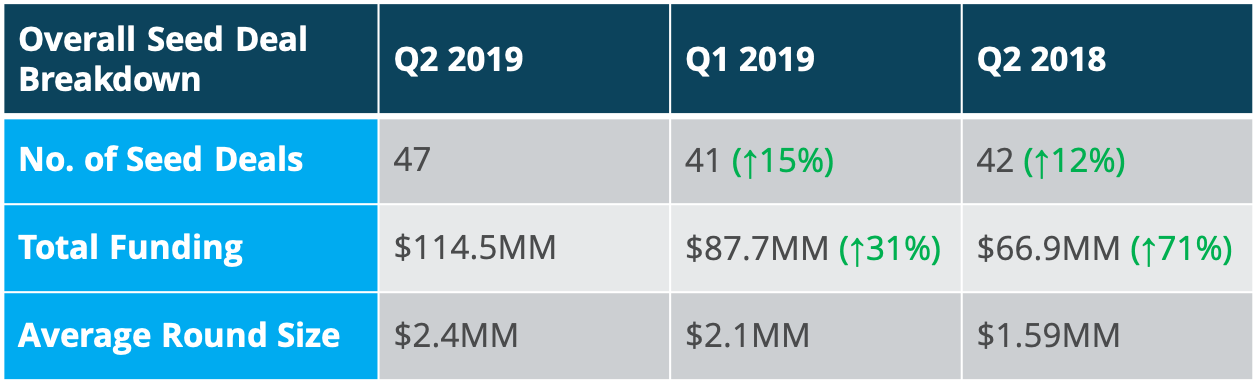

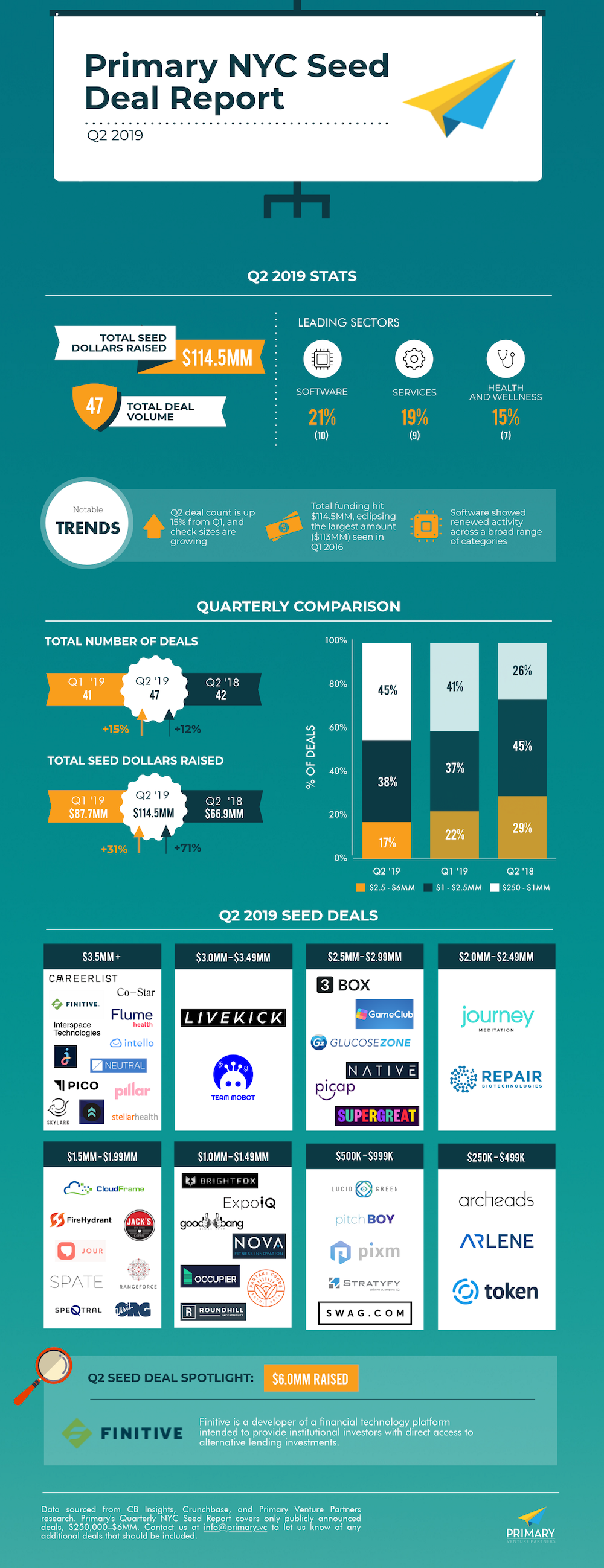

It continues to be an exciting, active time when it comes to investing in New York. While we saw a dip in deals last quarter, we’re back up (47 deals, up 15%), and total funding hit $114.5MM, an impressive 31% leap from Q1. Since starting the quarterly Seed Report, the largest sum we’ve recorded was in Q1 2016, when NYC seed activity reached $113MM from 74 rounds. Looks like we’ve got a new record on our hands!

Nothing but green, upward arrow signs this quarter. The average round size was $2.4MM, up 14% from last quarter, and the highest average we’ve seen since we started tracking over three years ago.

Industries to Watch

Reinventing your medicine cabinet

From an all-natural Advil replacement to companies looking to replace your herbalist, we’re seeing a rise of consumer players who are looking to disrupt traditional pharma in one way or another.

National appeal, local execution

Managed service marketplaces are popping up left and right. They’re acquiring customers to buy products or services, but the execution is handled by a local expert in pest control, tires, dental and beyond. These players are helping small business owners perform the tasks that they’re good at while offloading all the customer acquisition, customer service, and more.

Baby boomer businesses are booming

73.4MM Baby Boomers in the U.S. represent $2.6 trillion of spending power and startups are taking notice. Social clubs, DTC eCommerce, and housing marketplaces are just a few of the categories that we’ve seen being tackled by a dozen-plus companies in New York that we discovered this quarter.

Fintech

As we continue to live in a market flush with capital, investors are looking for fresh ways to earn returns. It’s no surprise then that the two largest seed deals in NYC for Q2 were marketplaces related to lending. Finitive, a marketplace that connects originators and institutional investors for alternative lending, raised $6M, while Pillar, a student loan management platform, raised $5.5M.

Voice Applications

Voice continues to gain momentum in the enterprise as a number of AI-enabled assistants look to augment business users’ workflows by listening to and transcribing conversations. Sales enablement continues to have the most traction to date, though newcomer PitchBoy takes it a step further by using VR to create a fully immersive sales training experience.

Healthcare

Though the U.S. spends about twice on healthcare when compared to other industrialized nations, patient satisfaction remains low. Unsurprisingly, Q2 saw an abundance of startups looking to improve the quality of care delivered. Stellar Health’s* point-of-care solution incentivizes health providers to deliver higher-quality care through meaningful rewards, while GlucoseZone enables self-care solutions for diabetes prevention and management through its digital programming. Flume Health* takes a different approach by helping the self-insured employer deliver best-in-class insurance plans to their employees at more affordable prices.

*Denotes a Primary portfolio company.