In a recent survey of those with trading accounts, E-Trade discovered that 40% of millennials that were surveyed traded options at least once a month, making them 60% more likely to trade options than their Generation X counterparts. However, there’s still untapped market potential to attract more activity to the options market as presently option activity among the bulk of retail investors is still not widespread. Gatsby has answered the call and puts options into the spotlight.

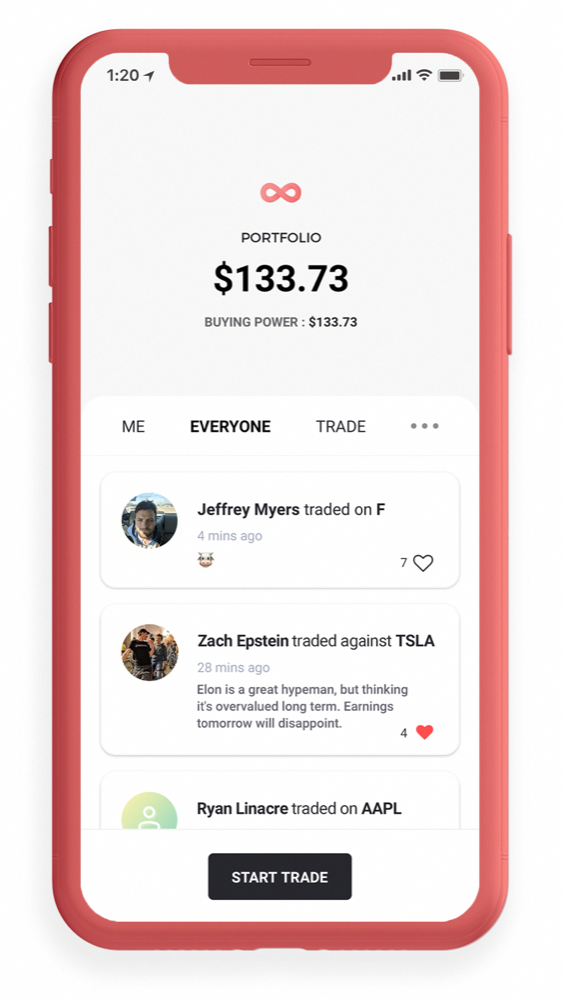

The company, founded in 2018, offers a social, commission-free options trading platform that has taken into account the previous barriers to entry – including complex language, confusing interface, and difficulty understanding financial concept – replacing the experience with a simple interface that shows investors how to make options trades for or against stocks and ETFs. Users can register for Gatsby within seconds and begin trading with as little as ten dollars. Gatsby’s platform is currently invite-only, opening up to the public later this year.

AlleyWatch spoke with founder Jeff Myers about creating a fintech platform that takes a simple approach to option investing, the company’s future plans, and recent round of funding, which brings total funding to $2M across two rounds.

Who were your investors and how much did you raise?

Gatsby raised $1.5M in seed funding from SWS Venture Capital, Plug and Play Ventures and Irish Angels, among others. To date, Gatsby has raised $2M in funding.

Tell us about the product or service that Gatsby offers.

Tell us about the product or service that Gatsby offers.

Gatsby is a social, commission-free options trading platform where investors can make trades for or against stocks and ETFs.

What inspired you to start Gatsby?

Options are powerful and are the perfect instrument to express trade ideas with more leverage. There’s also something really fun about being able to take a position for OR AGAINST a company. My first position was a put on United Airlines after a viral video surfaced of a passenger getting violently dragged off of an overbooked flight.

How is Gatsby different?

Gatsby strips away all the jargon and lets you share ideas or find inspiration for trades from your friends. On any other platform, even platforms with a retail focus, the interfaces are often confusing and some concepts are hard to understand.

Gatsby focuses on long options, so you can’t get in over your head and it’s easy to get approved for. Signing up for any other options trading platform often takes four to five days, but with Gatsby, you can get approved immediately.

Given the risk associated with options trading, do you think the bulk of retail investors should have options as a part of their portfolio?

Certainly, not everyone should be trading options, but we think the ratio of equity traders to options traders is artificially low. Many traders want leverage and are turning to things like crypto or sports betting to get it when options are a great tool.

That said, we use interface and technology to make sure our users are trading intelligently. We initially only offer long options for example, which means a trader’s risk is capped at the price of the contract.

What market does Gatsby target and how big is it?

2018 saw over $1.5T of options volume, a record-setting year for the options industry.

What’s your business model?

We sell our order flow to the exchanges and market makers where they need liquidity, as most brokerages do.

What was the funding process like?

It’s always somewhat distracting from building product and community, but we’re fortunate to have some great backers and advisors to help guide us and our journey.

What are the biggest challenges that you faced while raising capital?

When traveling a lot for pitches and investor meetings it’s tricky to dedicate time to other things. I’m glad our team is diverse and super talented so we were able to keep moving at full speed.

What factors about your business led your investors to write the check?

User interface and innovation brokerage tech. It’s a complicated process to make a not-complicated brokerage platform.

What are the milestones you plan to achieve in the next six months?

We plan to use this funding to improve our technology and the application, and also help to grow the team in the areas of compliance and technology.

Due to high demand, we’ve kept our waitlist for now and are gradually letting more and more users onto the platform each week. We plan to open up the platform to the public later this year.

Due to high demand, we’ve kept our waitlist for now and are gradually letting more and more users onto the platform each week. We plan to open up the platform to the public later this year.

We’ve already been able to bring on some amazing talent like Alex Wohl, former MD at Goldman Sachs as our chief strategy officer and Jeffrey Kleiss, formerly at Apex Clearing Corporation and Amazon as the VP of engineering, and we hope to continue to make impactful hires.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Stay lean. Focus on building a great product or service.

Where do you see the company going now over the near term?

We want to build the best, easiest-to-use trading platform out there.

Where is your favorite bar in the city for an after-work drink?

Jeremy’s Alehouse downtown. You step through time walking into that bar.