The anonymity of blockchain is one of its biggest selling points but at the same time, it also causes one of the largest problems – security. In order for widespread adoption to occur, everyone needs to feel certain that their assets will be protected and the tales of losing millions of dollars worth of crypto must be a relic of the past. Fireblocks understands this pain point and has developed an enterprise-grade platform that is focused on the transfer of digital assets – safely and securely. Cofounded by a security veteran with a successful exit under his belt, Fireblocks is the platform that financial institutions are turning to manage their digital assets.

AlleyWatch sat down with cofounder and CEO Michael Shaulov to learn more about the company’s inspiration, future plans, the state of security in the digital asset world, and the company’s recent round of funding.

Who were your investors and how much did you raise?

We raised $16M Series A round from multiple investors, including: Cyberstarts, Tenaya Capital, Eight Roads, Swisscom Ventures and MState.

Tell us about the product or service that Fireblocks offers.

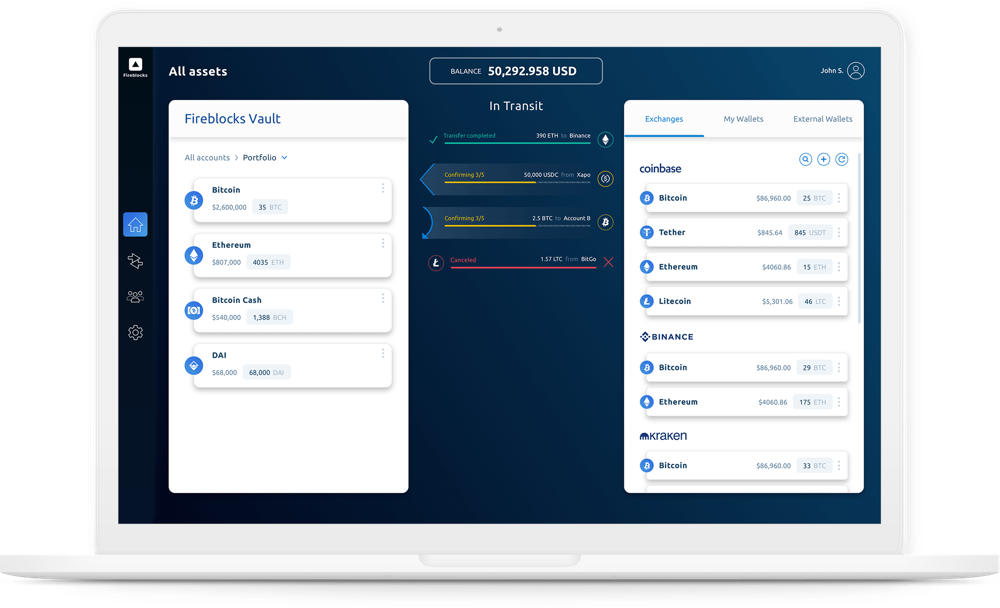

Fireblocks is an easy to use, enterprise-grade platform for financial institutions that need to streamline digital asset operations – without sacrificing security. We help financial organizations and other enterprise customers that trade and handle blockchain based assets to move them without being hacked. Our product allows them to set up a secure network of all their accounts and counterparties to transfer cryptocurrencies or other tokenized assets at a click of a button, while meeting enterprise-grade security and regulatory requirements.

What inspired you to start Fireblocks?

What inspired you to start Fireblocks?

We sold our previous company, Lacoon, to Check Point one of the global cybersecurity leaders.

In 2017, the infamous Lazarus Group (who hacked Sony and SWIFT) hacked into four South Korean exchanges and stole $200M of Bitcoin. Our team was part of the task force that investigated the massive cyber breach.

Two things became obvious during that investigation: the shift and motivation of cybercriminals from hacking traditional finance to digital assets, and the complexity and the lack of solutions for securing digital assets in an enterprise environment.

How is Fireblocks different?

Fireblocks secures the actual coin movement of digital assets themselves, instead of simply just securing the private keys.

What market does Fireblocks target and how big is it?

We go after the enterprise and institutional blockchain market. Our primary market is the financial industry where we propel the transformation of the financial infrastructure to create a transparent, efficient and fraud-free financial system.

What’s your business model?

It’s a SaaS-based business model. We have a monthly license fee, with standard, professional and enterprise tiers.

What are the biggest challenges that you faced while raising capital?

Mostly confusion about the current state of blockchain adoption and the use-cases it has across the various enterprise markets.

What factors about your business led your investors to write the check?

We are a very experienced team in the cybersecurity domain, and we are tackling a big problem with huge monetary pain. In a very short period of time, we were able to develop several technological breakthroughs and sign up some of the leading customers in the space.

What are the milestones you plan to achieve in the next six months?

First and foremost, we are planning to continue investing funds into R&D as we continue to develop the product and expand the use-cases. In addition, we will expand our go-to-market teams and client services in order to onboard and support more customers.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Be lean and focus on the pain of your strategic customers. The most important part is not the investors but to understand what your customers need and willing to pay for.

Where do you see the company going now over the near term?

Onboarding many more customers and eliminating not only the cyber risk from the equation but also the financial counterparty risk

What’s your favorite restaurant in the city?

Wherever anyone from my team would like to go since they’re all allergic to gluten.