As of the writing of this post, Bitcoin is the top performing “asset class” of 2019 YTD, up 89% YTD. Bitcoin is up 22% in just the past week. And everyone wants to know why.

The Markets Swing Between Bubbles And Crashes

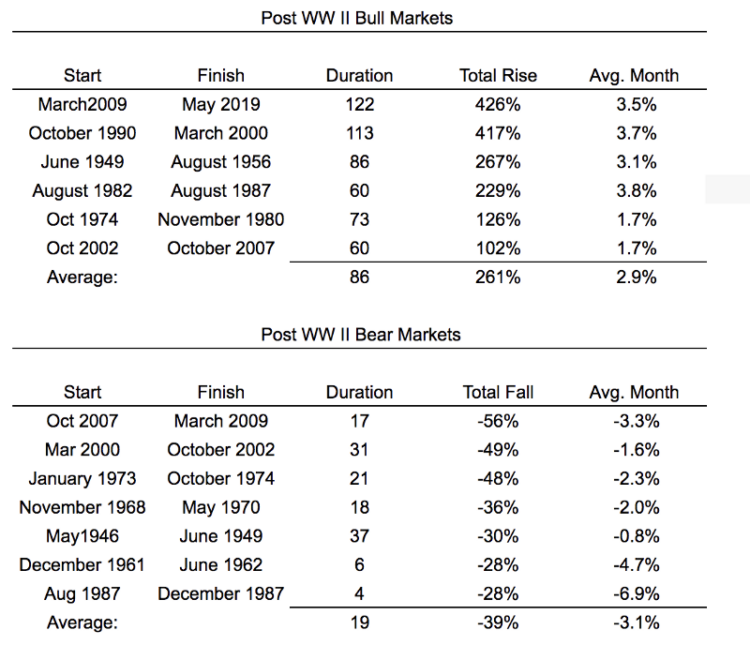

I have a word I use to describe the tendency of markets to become bubbles, crash, and become bubbles again. I call that “capitalism”. Since the end of World War II, we’ve had six bull markets and seven bear markets:

Bubbles and crashes are the rules, not the exceptions.

The Trigger For Major Market Moves, Or For The Beginning Or End Of A Bull or Bear Market, Is Often Unclear

The biggest single-day drop in the history of stocks was October 19, 1987. A day known as “Black Monday”, when the S&P fell over 20%, ushering the shortest bear market in history (just four months). While there has been lots of research regarding the cause of the plunge, the jury is still out. The Brady Commission, which was appointed to investigate the causes of the crash, concluded that plunge was caused by the derivatives market. Other studies cited reasons ranging from computer trading to a lack of liquidity, to increasingly attractive yields on bonds. Two economists from the SEC concluded that the anti-takeover legislation triggered the crash. Others blamed the announcement of a large U.S. trade deficit on October 14, which led the Treasury Secretary to suggest the need for a fall in the dollar, causing foreigners to pull out of dollar-denominated assets.

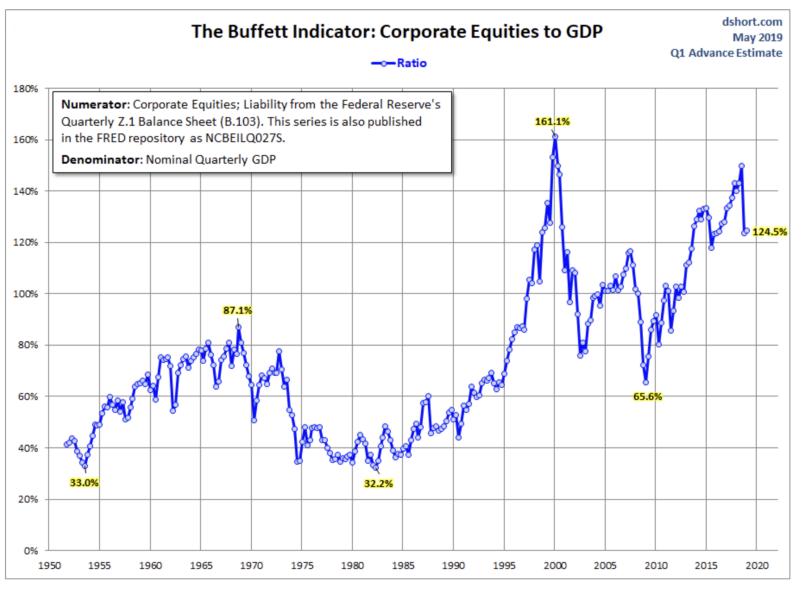

But while the “trigger” for a change in direction is often not known, all the dates above, both at the start, and the finish, of both bear markets, and bull markets, all generally share one trait, valuation was out of whack with historical norms. My favorite market valuation barometer takes the percentage of total market cap (TMC) relative to the US GNP. It’s commonly referred to as the “Buffet Indicator”, as he thinks that it’s “probably the best single measure of where valuations stand at any given moment.”

You can clearly see the overvaluation in 2000, and undervaluation in 2009, compared to relevant historic norms, that were evident when those markets changed direction.

No One Really Knows The Trigger For Bitcoin’s Current Surge

Lots of people are saying that the technicals were foreshadowing a bullish move. Now, I’m not a chartist, but I get the value of charts. It just seems that if it was as easy as looking at a chart, everyone would be driving Lambos.

Other reasons for Bitcoin’s pop range from the announcement earlier this week by Fidelity enabling institutional shareholders to buy bitcoin, to mining halving in May 2020 now just a year away, to news of the Facebook coin.

Maybe the two bitcoin commercials that began running this week had an impact. The first was Grayscale’s:

What We Do Know Is That ALL Assets Are A Confidence Game

On July 28th, 2018, Facebook lost more than $100 billion, the single biggest loss in the history of the U.S. stock market because they reported bad earnings, and people lost confidence in the company.

One of my most read Medium posts, “The Crypto Bubble Isn’t A Bubble, It’s A …….”, written less than two months before the top of the crypto market in 2017, was simply three graphs. The second showed the price activity of Amazon between 5/97and 9/01, a period that included 70X up (5/97–11/99) and 95% down (11/99–9/01)

Amazon was still growing nicely during its plunge, but the market lost confidence in everything internet related. That’s a very violent movement up, and down. But if you look at it in the context of time, it wasn’t a bubble, it was simply a blip:

Bezos didn’t concern himself with the share price, he simply continued to build Amazon. And it paid off for investors, big time.

Similar To Amazon Continuing To Build In 2000–2001, Bitcoin Continued To Build, And Sentiment (i.e. Confidence) Came Around

The truth is that there is not one event that caused the recent surge.

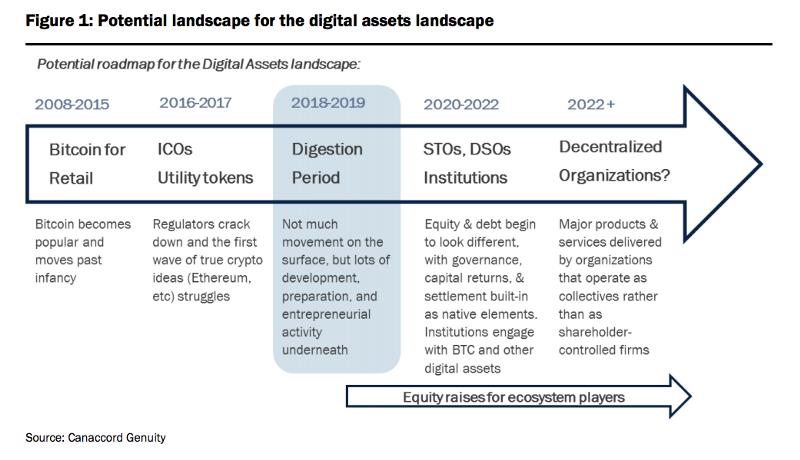

The truth is that the amount of activity and progress in crypto is staggering. While crypto is far from mainstream, we’re laying the pipes, the infrastructure, necessary to go mainstream. We’re solving the scaling problems. We’re addressing governance and token economics. The smartest people in the world are leaving Goldman Sachs and McKinsey and coming to crypto. And while none of this progress is the trigger that made bitcoin spiral upwards, in combination, they have all played a role in changing the sentiment around crypto. Michael Graham, the leading Wall Street Analyst covering crypto at Canaccord, refers to this process as the “Digestion Period”.

While large price moves like we’ve witnessed this week, are often followed by cooling off periods, what’s clear is that crypto winter is over, even if the reason why isn’t clear.

Interestingly, if you had started investing in Bitcoin at the top of the market, and invested every week since, you’d be ahead. And in 20 years, it will be seen as just another blip on the road to becoming the dominant global store of value.

Why Uber Flopped

IPO investors in Uber had the largest aggregate first-day loss in the history of IPOs, losing $655 million on paper. That’s almost 3X the previous largest first-day loss of $233 million logged by Genuity in 2000. Obviously, Uber investors had less confidence than Uber than Uber’s bankers thought they would. How could such a large disparity exist when the deal was handled by many of the best bankers on the planet?

It flopped because the whole IPO system is a black box. The transparency is limited as the investors try and game the system, without even knowing what the rules are. So the bankers have to guesstimate how much gaming is going on, and it turns out, sometimes they can guesstimate wrong.

As security tokens become a reality, transparency will grow dramatically. Companies can go to 24/7 real-time reporting about their business. And black box financial products like IPOs will feel increasingly antiquated. And the world will be a better place.