While medical bills are notoriously expensive, it’s always surprising to open up a bill to find out after the fact that your insurance did not cover your latest medical service or that you received some unexpected charges. Addressing this problem is Flume Health, the NYC startup that empowers people with its transparent, third-party platform that offers an end-to-end solution for self-insured employers to make the most of their health insurance plans. The company’s signature product, Flume Pay, allows employer plans to pay medical claims at the time of service eliminating uncertainty and reducing overall costs. Payments are typically processed in less than 72 hours, giving both the insured and employers peace of mind.

AlleyWatch sat down with CEO and cofounder Cedric Kovacs-Johnson to discuss how his family’s personal experience with the healthcare system inspired him to create the technology that’s combating one of the biggest inefficiencies in healthcare – payments.

Who were your investors and how much did you raise?

We raised seed funding of $4.05M from Primary Venture Partners, Founders Collective, Accomplice, ERA, and other angel investors.

Tell us about the product or service that Flume Health offers.

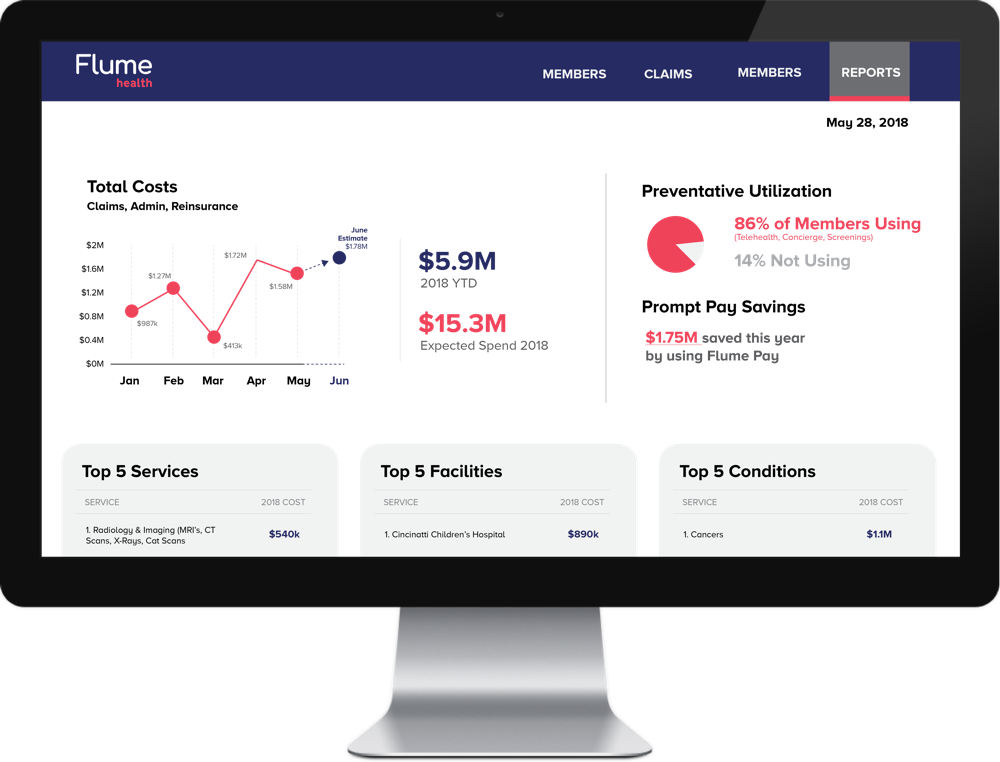

Flume Health’s mission is to bring transparency into the very opaque world of healthcare in the US. Flume Health offers an end-to-end solution that allows self-insured employers to optimize, and make the most of the health insurance benefits they offer their employees. We created Flume Pay, the first healthcare payments technology that enables employer plans to pay medical claims at the time of service – usually in less than 72 hours. By working directly with providers to get cash prices for services, patients avoid surprise bills and know what they’re paying before an appointment. It’s a small shift with big implications for the future of healthcare.

What inspired you to start Flume Health?

What inspired you to start Flume Health?

Exploration for Flume was catalyzed by my little sister’s encounter with the healthcare system. Her journey was my first time seeing how healthcare actually works (versus how it’s purported to work). We were frustrated, as a family, that her healthcare was so expensive while her health insurance and health plans were extremely hard to use.

I wanted to work in an area that I personally had strong feelings about fixing.

How is Flume Health different?

The industry is really stuck in the status quo right now. Big insurer plans put very little focus on price transparency, data access, and cost consolidation for the patient. Flume exists to meet brokers and clients where they are and guide them into the unbundled, or “self-funded”, model of health benefits.

This is backed up by really innovative tech such as Flume Pay and our lighting-fast portal for onboarding and data analysis, along with deep industry knowledge from the Flume team and advisors.

What market does Flume Health target and how big is it?

Today, over 80% of companies with 500+ employees have switched to self-insurance already, with 12,000 more joining them every year.

What’s your business model?

B2B and charge on a per-employee-per-month basis.

What are the biggest challenges the business faces presently?

Distribution. For the longest time “Third Party Administrators” were an old stodgy group of businesses with unrecognizable brands and a low bar for customer support – we need our customers to know that a better health plan experience is actually possible and it’s here today.

What was the funding process like?

We met with investors in 2018 to build relationships and set ambitious growth targets for Q1 2019. We then went heads down and proved that we could execute and that the market was demanding what we were building. After that, the funding process was fairly smooth in 2019.

What are the biggest challenges that you faced while raising capital?

Flume Health plays in a few different fields – fintech, healthtech, insuretech, SaaS- we don’t fall neatly into any investor’s portfolio from a business perspective. We’re also going into an industry with a known solution – not inventing anything brand new. So the question became: how much better do you have to be to make a difference?

For instance – Zoom just did the same thing with their successful IPO last week. Video conferencing was a concept that already existed, but they did it better than everyone else, and it paid off.

What factors about your business led your investors to write the check?

We were able to clearly show the need for our company to exist. In a very short time period, Flume attracted a great team, then won several competitive bids and are successfully managing thousands of lives. That kind of early success shows how desperate Americans are for someone to declutter the healthcare system.

What are the milestones you plan to achieve in the next six months?

We’re focused on two things for the rest of 2019:

- Building a best-in-class sales team and infrastructure with individuals who are fighting for a change and also understand how these complex relationships are structured.

- Opening up Flume Pay to new geographies and deploying support for even more appointment types that touch all of our members – giving them transparent, lower-cost healthcare.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Prove it! Prove why you matter, why people need you. Even with few resources if you’re scrappy you can get to the point where you see if you’re going in the right direction or not.

What’s your favorite restaurant in the city?

Llama Inn. I love ceviche.