Target Price = $50,000 (assumes $1 Trillion valuation and 20,000,000 BTC, fully diluted)

I’ve been around the block. In the 90s I was an equity analyst following media companies at Goldman Sachs. I loved it. But the internet came calling, and I jumped in. After my 2nd company, I became an angel investor and then a VC.

I did some crypto investing in 2013/14 and saw the crypto light on June 29, 2017 when Bitcoin was $2,500. I stopped everything I was doing, and I’ve been crypto 24/7 since. I published my first thought piece on October 8, 2017, and I’ve been one of the most influential bitcoin bloggers on Medium ever since. Yet I’ve refrained from putting out a price target on Bitcoin.

The last time I put out a price target on in a blog post was 2010 when I put a $100B 5 year target on Facebook when it was actively trading at $16B. A projected 6X return. My 2014 revenue estimate was off by just 1%, and Facebook was worth more than $200B YE 2015. I was a bull for 8 years and finally went negative after they reported Q4 ’17 earnings.

Accurately Predicting The Future Values of Assets is Not A Thing

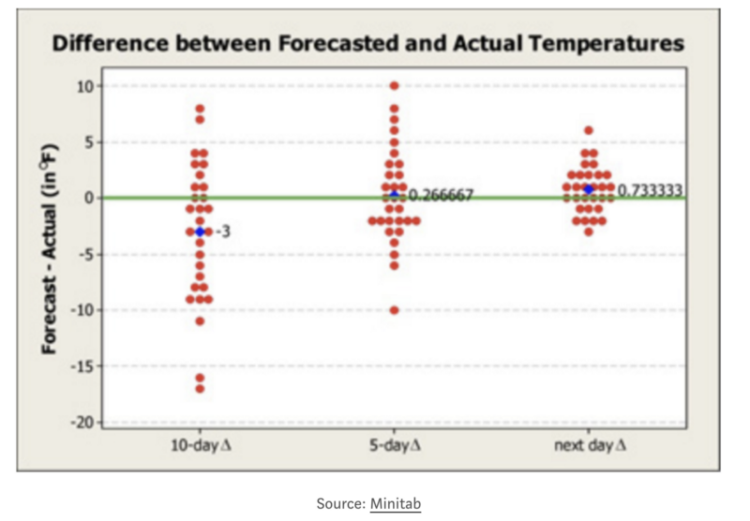

Humorously, I don’t think predicting the price of Bitcoin is a thing. In December I wrote “The Two Reasons Why The Forecasts For Bitcoin YE 2018 Were So Horribly Wrong” because like predicting the weather (see below), there are just too many variables to accurately predict out very far.

I just penned a piece ”The Reason That Bitcoin Popped And Uber Flopped”, which further expands on this thought

Why Put Out A Price Target Now

First, I’m approaching the 2nd anniversary of seeing the crypto light, I’ve now been through a boom and bust cycle that afflicts all assets. While each cycle is different, I feel I now have the context I needed to put out a price target.

So, the target will hopefully help the next 100,000,000 buy and hold.

I’m Bullish On Bitcoin

My Twitter profile starts “Believe that Crypto is the biggest thing to happen in the history of mankind.” There’s some hyperbole there, but you get the point. There are four main reasons I’m so bullish:

- Bitcoin is simply a better store of value than gold. And gold is a $7.5 trillion thing. This is the foundational concept.

- Bitcoin is an asymmetric bet — While the downside is limited to 100%, the upside is vast/unlimited. Asymmetric bets don’t come around often (see Facebook). So take advantage of it when you see one.

- Bitcoin is an uncorrelated asset — investing in uncorrelated assets improves the overall portfolio risk-adjusted returns of any portfolio. As institutional investors become comfortable with the safety of bitcoin, this feature will be a major driver of investor interest.

- Bitcoin is getting “brighter” every single day —- I looked at bitcoin for a year in 2013/14, and I didn’t get it. I had to look harder to finally see the light in 2017. But the light was also easier to see in 2017 then 2013/14, and it is getting easier to see every day as more progress is made.

There are LOTS of other reasons, but let’s get to the price target.

My Market Cap Target Is $1 Trillion Or $50,000 For BTC

I’m not the first person to call bitcoin $1 trillion. Chris Burniske recently stated his belief that bitcoin will hit $1 trillion in 2021.

Uber crypto bull, Tim Draper, has set a $250,000 ($5 trillion+) price target for Bitcoin in 2022 and thinks it will eventually hit $10 trillion.

My trillion dollar target is predicated on bitcoin growing its market share of a store of value from less than 2% today to 12% by 2024 (assuming gold holds it’s current market cap of $7.5 trillion). Could bitcoin surpass gold in share? Sure! But 12% appears, to me, to be a reasonable forecast for market share of the #2 player. I recognize that every industry has different dynamics that drive different market shares for the #2 player. While perennial #2 in soft drinks, Pepsi, has a 25% market share, Bing, #2 in search, has just 2.6% share. Safari’s the #2 browser with 15% share. Time will tell if 12% was too high, or too low, but it feels reasonable to conservative to me today.

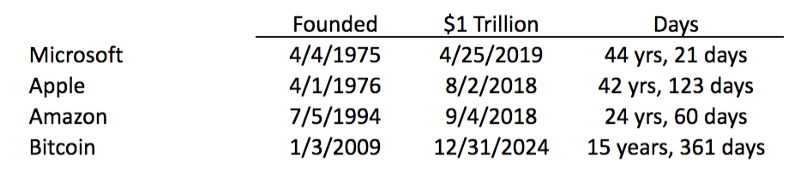

While $1 trillion is a hard number to comprehend, I get comfort by the fact that the three largest companies in the U.S. biggest companies (Apple, Microsoft, Amazon) all recently reached $1 trillion market cap. So we know that things can grow to that level in value. If Bitcoin achieves $1 trillion market cap in 2024, it will crush all current records in terms of years to $1T

A trillion is a 7X from where Bitcoin is trading at today. So the asymmetric bet with bitcoin is you could lose 100%, but you could be up 700% if I’m right.

There is obviously significant upside from this target if bitcoin is able to evolve into money, but to date, progress has been slow, and governance issues make it difficult for bitcoin to evolve effectively. And bitcoin doesn’t need to evolve to be a great store of value.

There is no magic to the 2024 date/5 years out. Others see it getting there faster. I’m taking longer because of my belief in Amara’s Law, which states that the impact of all great technology is overestimated in the short run and underestimated in the long run. Which is just a fancy way of say shit takes time.

There is also no magic to the 20M bitcoins used to get a price target. There has been 17.7 million bitcoin mined to date. It’s estimated that 3–4 million of those are lost. And we have another 2.3 million to be mined. So 20 million is simply a round number that most will find conservative.

There Are Significant Risks

All asymmetric bets have significant risks. The risks to bitcoin have been well documented, from 51% attacks to government crackdowns. I believe the two most significant risks are:

- Bitcoin does not grow its share of store value. — The fact is, better doesn’t always win. But I believe that the positive social impact of bitcoin will prove to be a powerful force that, combined with all the other advantages bitcoin holds over gold, will continue to propel bitcoin’s market share forward.

- A FAR better store of value will emerge. While bitcoin has a large first-mover advantage (it controls close to 60% of the total crypto market cap today) we’re in a period of tremendous fintech innovation that could lead to a new store of value that is FAR superior to bitcoin, as bitcoin is far superior to gold.

I think I appreciate the risks. But even if bitcoin goes to zero, I’ll be comfortable with my projection because I believe it gives context to the kind of asymmetric bet that investors rarely see. And the only reason not to take advantage is that you haven’t seen the crypto light.

My final prediction …. when Bitcoin hit’s $1 trillion in 2024, that’s when Buffett will start buying it.