Managing personal finances has lots of moving pieces and nuanced details, and this is only amplified when accounting for the modern, cultural shift in family structures. A great solution for keeping all family members- and even friends- up to date with personal finances is Namu. This fintech app allows friends and families to manage their collective finances to reflect the change found in today’s family dynamics. Powered by a combination of AI and human expertise, Namu helps people manage real-world financial obstacles collaboratively whether its in instances such as children helping manage their elderly parents’ finances, splitting bills for your kids with your ex, or even sharing a credit card with your significant other.

AlleyWatch chatted with founder Ushir Shah to learn more about how he recognized a gap in the market for a financial planning platform that is simple, easy but sophisticated enough to cater to every family structure.

Tell us about the product or service that Namu offers.

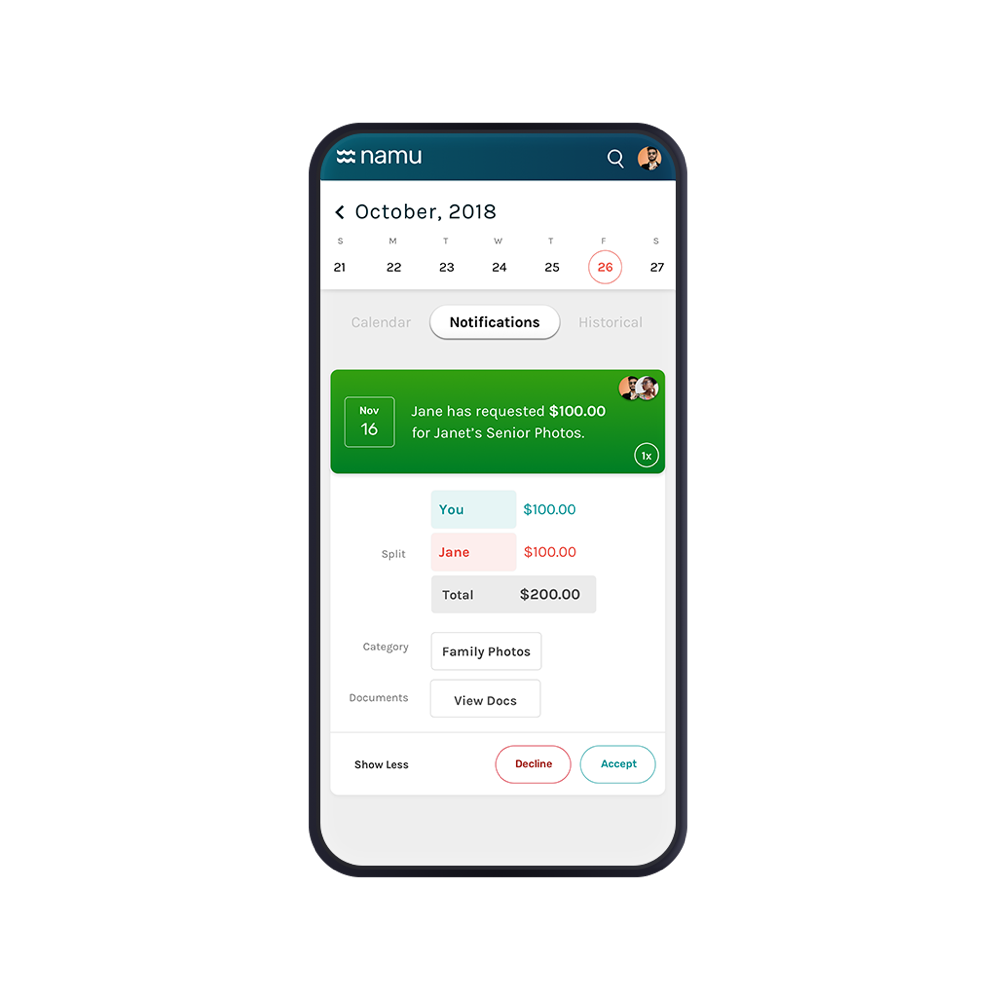

Namu is an app where friends and families can collaborate and manage their finances. We provide AI and human-powered financial management that caters to the real-world complexities of everyday life.

How is Namu different?

While many fintech apps focus on individuals, we are focused on the intersection of relationships and money – couples, parents, teens, elderly parents, etc.

Given we are handling financial data, we are prioritizing privacy and confidentiality throughout the system. Unlike most of our competitors, our business model is not reliant on harvesting and selling customers’ financial data for credit card, banking, mortgage, and other leads. We plan to follow GDPR privacy guidelines and also plan to offer premium security and encryption options to further protect our customers’ data. At Namu, our customer isn’t the product.

What market does Namu target and how big is it?

We are initially targeting the US market, and based on the above customer segments, the serviceable market is about 200M Americans. When the time is right, we plan to launch in other countries as well given the international experience my co-founder Tiffany and I have, and the broad-based utility of the app. After all, the financial interactions that we address are not unique to the U.S.

What is the business model?

Our financial management app will be offered on a tiered SaaS pricing model. The Namu checking, savings, debit, and credit card features will be free to customers and based on interchange fee sharing revenue.

What inspired the start of Namu?

Namu was born out of my own personal life. I am a divorced father of three little boys, living with my girlfriend, and monitoring my elderly parents’ finances. On any given day, I am sending money to my ex-wife for my share of the children’s expenses, sharing a credit card with my girlfriend for our joint expenses, and watching over my parents’ money to ensure they aren’t being scammed

There is little out there to help me manage this besides the traditional expensive wealth management solutions through a financial advisor, or without installing 10+ apps with different logins to remember, in addition to exporting and consolidating several different Excel files. I need to be able to track all my spending and also sort out which items need to be flagged for tax or legal purposes.

The more I started talking about my financial pain points, the more I realized that many of my family and friends (and their family and friends) were dealing with the same issues. That’s why I created Namu – to solve these issues.

Why is collaboration essential in managing finances, which has traditionally been a very private thing?

Why is collaboration essential in managing finances, which has traditionally been a very private thing?

When I was married, both of us worked full-time jobs while raising our three boys. I took on the majority of the household finances, but without better financial tools available, we were not able to independently maintain and review our financial data. My workaround was to email her reports, but with work and home commitments, she would rarely have the time look at these reports before the information was out of date. Real-time collaboration would have been immensely helpful.

My parents are healthy and pay their own bills, but I need a way to monitor their transactions on a read-only basis to ensure something isn’t going wrong, and to be familiar when the eventual time comes where they can’t do it themselves and I will need to take it over. This gives me many years of read-only familiarity versus being thrown into it when something bad happens. Giving my parents a way to easily share their data with me and my sister securely provides us all with peace of mind.

In these and other cases, financial collaboration systems allow for increasing transparency and trust, the ability to plan, and the ability to use the data as the driver of discussions, therefore hopefully reducing conflicts.

What are the milestones that you plan to achieve within six months?

We are focused on three things for the coming months: 1) continue our marketing efforts in order to grow our waitlist and increase awareness; 2) continue building our MVP which is set to launch in April 2019 to start testing with our target users; and 3) work on raising our seed round.

What is the one piece of startup advice that you never got?

I would say it’s the importance of trust and respect with your founding team. When I started Namu, I knew I wanted my first key hires to be those that I both trusted implicitly and respected professionally, so we could move quickly to establish a high performing team, and a culture that embeds the values of diversity of thought and social inclusion. I was fortunate to have both my business school partner and good friend Tiffany, and my good friend Karen, who I’ve known for 18 years from our first startup, join Namu and believe strongly in our mission.

If you could be put in touch with anyone in the New York community who would it be and why?

Though meeting fintech seed VC’s would be ideal, outside of that, I would love to meet Lin-Manuel Miranda. I am a huge revolutionary war fan and in awe of what the Founding Fathers have built.

Why did you launch in New York?

Though I live in Manhattan now, I was born and raised in Queens and have seen NYC transform over the past few decades into something quite special. I’ve also worked in wealth management for the past 15 years in NYC, much of that working for the Rockefeller family office company. Seeing how much they’ve done to improve NYC has inspired me to launch here and do what I can to give back. I’ve traveled the world yet coming home to NYC still feels special.

What’s your favorite restaurant in the city?

I love cheese so it used to be Artisanal, a French cheese fondue place, but sadly they closed the restaurant. I’m on the lookout for something new.