Per CoinMarketCap, total crypto market capped peaked at $795.8 billion on January 7, 2018. Since that time, we’ve lost over $680 billion in market cap. We’re down over 85%. Crypto total market cap bottomed at $102 billion. So at the bottom, crypto had lost $692 billion.

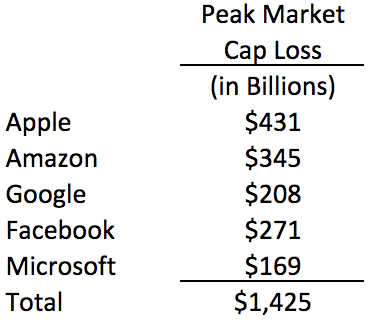

However, the total amount lost by FAMGA (my acronym for Facebook, Apple, Microsoft, Google & Amazon) during the FAMGA winter, that started after the market peaked on August 31st, bottomed at a loss of over $1.4 trillion.

That’s more than double the crypto loss at the bottom. While FAMGA has had a nice bounce off the bottom, as of today, it’s still off $893 billion from its peak. Every FAMGA company is still down more than $100 billion, with Apple leading the way with a $316 billion loss. That’s more than the $266 billion loss in Bitcoin.

What does all of this wealth destruction teach us?

1. Every Asset is A Confidence Game

On July 26th, Facebook lost more than $100 billion in a single day! It’s the largest loss of market cap by a single company in a single day in history. Every FAMGA member has lost more than $100 billion from its peak. It turns out, like Bitcoin, every asset is a confidence game, including every member of FAMGA. On July 26th last year, the market lost confidence in Facebook.

This is what I’ve been saying since my first appearance on CNBC yapping about crypto in October 2018:

2. FAMGA Still Has Massive Competitive Advantage Over Every Other Company/Project In The World

Last September I wrote “The Coming Epic Battle Between Crypto & FAMGA (aka Facebook, Apple, Microsoft, Google, & Amazon)” in which I stated my belief that FAMGA is well positioned to capture the majority of the massive global value to be generated via crypto. I turned that piece into a deck that I gave (and posted on Slideshare) for the first time on January 30th at the Japan Blockchain Conference. My belief is that the scale achieved by FAMGA in terms of data aggregation is a massive competitive advantage in any market they want to compete in.

3. Amazon Is An A Roll

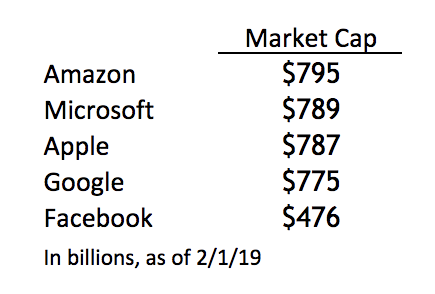

It’s quite amazing how close the top four companies are in terms of market cap:

But looking back over the last five years, it’s clear that Amazon has massively outperformed the other FAMGA members:

The reasons for Amazon’s rapid rise relative to the other FAMGA members is two-fold. First, in its core retail market, Amazon still has a small share of the overall market. While it has almost 50% share of online retail, Amazon has only has a 5% share of total U.S. retail, which is why it can continue to grow at an astronomical pace. In addition, Amazon has a major second business, AWS that is reportedly worth hundreds of billions.

4. Crypto’s Competitive Advantage Is Community

So after all the market cap carnage for both crypto and FAMGA, we believe that the major advantage that crypto has to compete is still community. While FAMGA has the massive scale to leverage, there is not a lot of community. As FAMGA continues to extract value from its user base and increasingly compete against their partners (per Chris Dixon’s epic “Why Decentralization Matters”):

Crypto can build community, give their users more value then they contribute, and make the world a better place.

5. The Word I Use To Describe The Tendency Of Markets To Become Bubble, And Crash, And Become Bubble Again

Finally, with all the market cap carnage, it’s important to have perspective. That’s why I have a word to describe the tendency of markets to swing from bubble to depression and back again. The word that I use to describe that phenomenon is “capitalism”. That’s what history has proven.

While it’s crypto winter today, crypto spring will come eventually. And we’ll be there, building the crypto community, and making the world a better place.