Per Wikipedia, a Ponzi scheme ….

is a form of fraud which lures investors and pays profits to earlier investors by using funds obtained from more recent investors

This is how the U.S. government now operates. It loses massive amounts of money every year (i.e. runs at a deficit) and finances it with new debt. When the debt comes due, they “pay profits” to those earlier investors by issuing more debt (i.e. “using funds from more recent investors”). That is the definition of a Ponzi scheme.

The U.S. government has no intention of ever paying the debt off. In fact, the U.S. government recently passed a significant tax cut that is estimated to cause an additional $1.071 trillion over 10 years ($298 million a day).

In Davos recently, famed investor Seth Klarman stated that “There is no way to know how much debt is too much, but America will inevitably reach an inflection point where a suddenly more skeptical debt market will refuse to continue to lend to us at rates we can afford.”

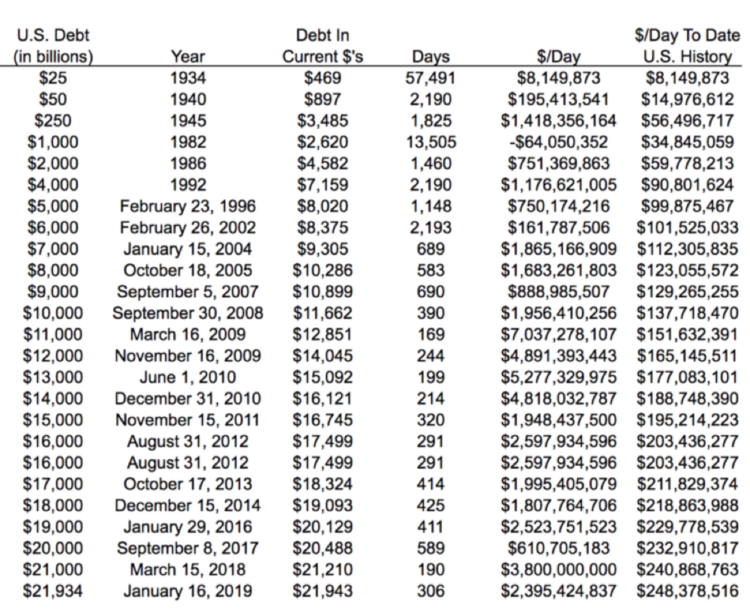

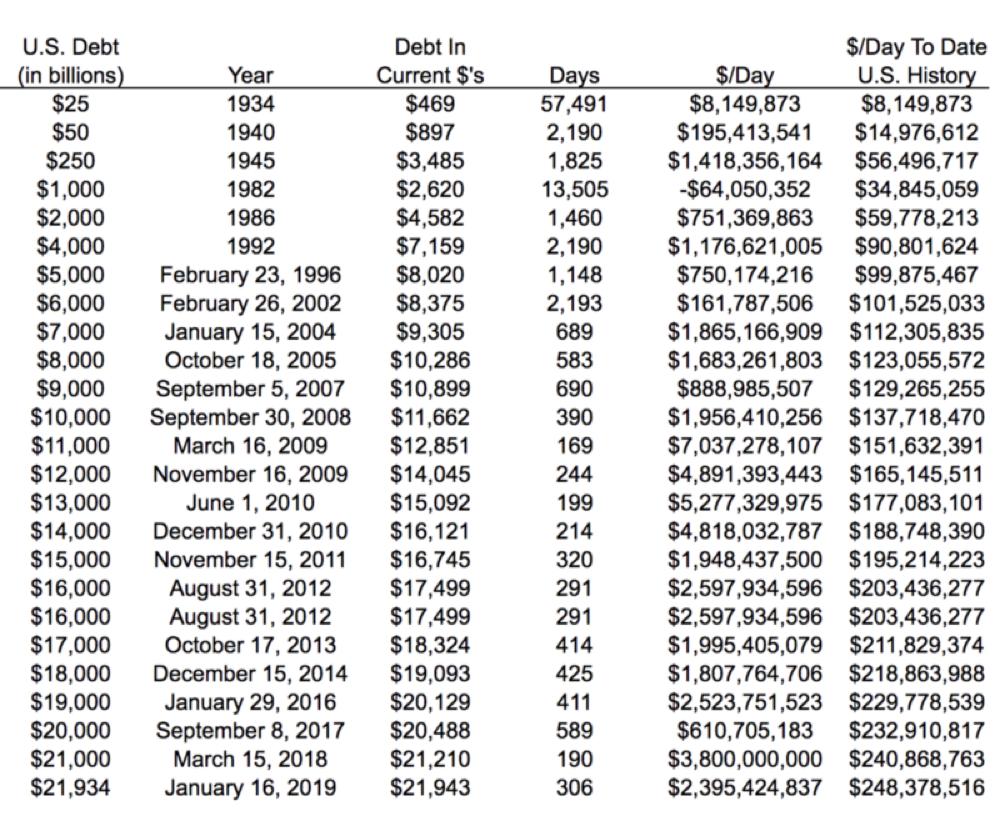

I ran some numbers below, and it turns out the U.S. has been run since our founding in 1776, at an average daily deficit of $248+ million. Every day. For 88,345 days:

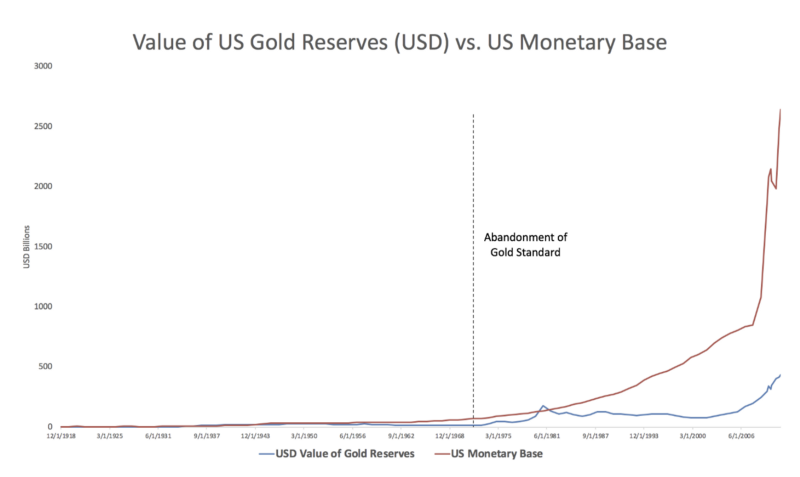

The dollar, once tied to gold, is now just a confidence game. So in addition to piling on debt that will never be repaid, the government also “prints” massive amounts of money.

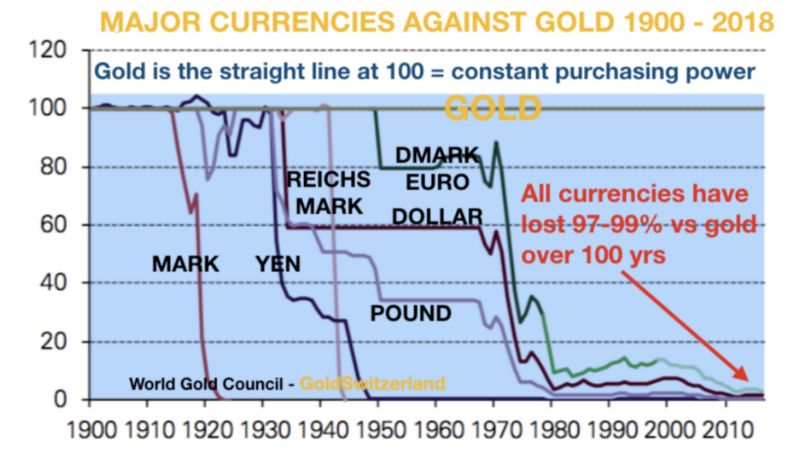

It’s Not Just The U.S. Dollar, All Currencies Are A Ponzi Scheme and lose value relative to gold, the world’s best store of value for over 2,500 years.

Bitcoin is clearly a better store of value than gold, as many have written. I even discussed that fact on BloombergTV late last year:

So I’m long Bitcoin because #The$IsAPonziScheme and #CryptoIsComing

Reprinted by permission.