The warranty industry is to be worth an estimated $44B and it has been left largely untouched by the recent surge in technological innovation, that is until Clyde came around. Clyde offers a premiere and superior warranty program for retailers and business, many of which were overlooked by the traditional warranty structures. Clyde’s platform is easy to use and implement. In less than three minutes, businesses have access to an entire marketplace of insurers for warranty programs they can offer to their customers. Completely free to install, Clyde takes a commission when businesses sell a warranty contract.

AlleyWatch caught up with Brandon Gell to discuss the impressive growth of Clyde and creating a company that empowers retailers.

Who were your investors and how much did you raise?

We raised a $3M seed round, led by Red Sea Ventures. RRE, Expa, Starting Line, Rainfall, Knightsgate, Revel, Correlation, Summit Action Fund, and Satori Ventures were also involved. We built a great syndicate consisting of firms large and small with diverse skillsets and backgrounds

Tell us about the product or service that Clyde offers.

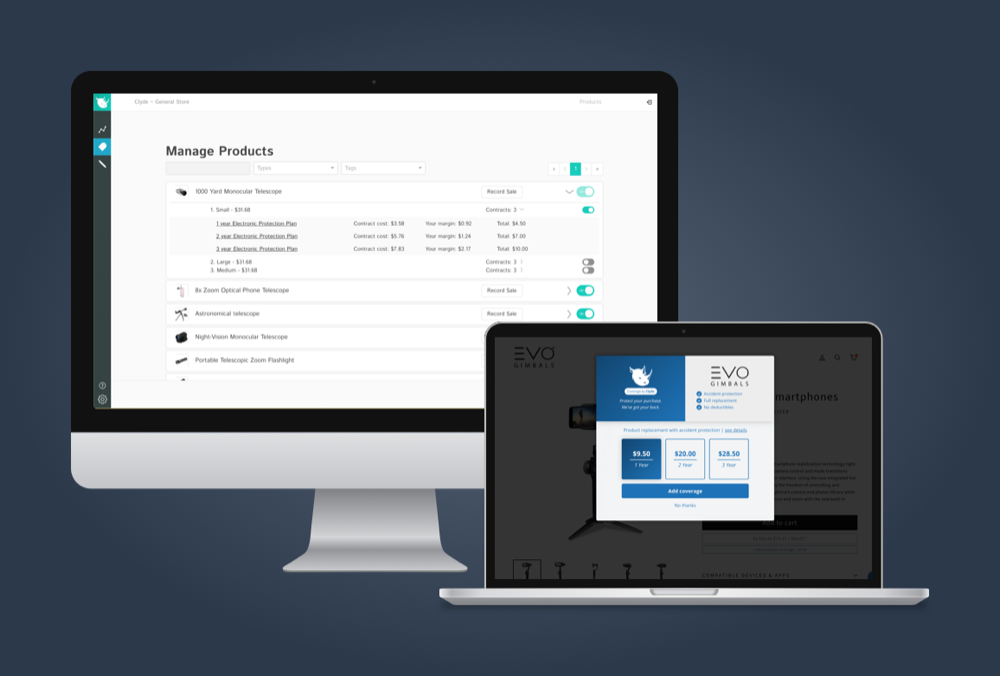

Clyde builds tools and partnerships that enable businesses to launch, maintain, and support a warranty program, online and in-store. Our suite of tools and dashboard give businesses unparalleled control and vision into their program, which is why Clyde sees ~15% attachment rate, 3x higher than the online industry average.

It literally takes 3-minutes to install Clyde and we connect your store with insurers that typically only work with the Amazon’s of the world. We work with everyone from electronic OEM’s and D2C companies, to furniture designers, to box retailers.

It literally takes 3-minutes to install Clyde and we connect your store with insurers that typically only work with the Amazon’s of the world. We work with everyone from electronic OEM’s and D2C companies, to furniture designers, to box retailers.

What inspired you to start Clyde?

A little over a year ago I was working for a small hardware company that was trying to get a warranty program started. We couldn’t find a single reputable insurer that was willing to even have a phone call with us, and every other option required losing control of our customers and such an intense integration that we’d have to hire an employee just to run the program. I knew there could be a better Stripe or Affirm like solution. So that’s what we built.

How is Clyde different?

First and foremost, we’re a tech company. Whenever you build a product that is designed to be democratized, you end up building a better product then what the head of the market is using. Clyde builds non-exclusive relationships with insurers that ensures that we always have a business’ end-customers at the forefront of our decision making. By combining superior technology with a marketplace of insurers, we ensure that we’re always delivering the best price/ value to end customers and returns for our partners.

What market does Clyde target and how big is it?

We’ve addressed the retail market, focusing initially on businesses that don’t currently offer warranties and businesses that have programs but are looking for a better, 21st-century solution. The extended warranty market, as it stands, is a $44B market that addresses 1% of retailers. Clyde expands this market by an additional $20B-$30B by giving access to any and all retailers.

What’s your business model?

Clyde only makes money when our business partners succeed. It’s 100% free to integrate and we don’t charge any sort of implementation fee. In fact, we’ll even work with you to get out of any exclusive arrangements you have with your existing provider. When you sell a contract, Clyde makes a service fee based on the size of the premium. Businesses who use Clyde also make a risk-free margin on the sale of every contract.

How has the business changed since we last spoke in the summer?

We’ve grown. A lot. Businesses of all sizes, from Fortune 500 retailers to individuals running Shopify sites, have approached us with all sorts of interesting ideas and we’re working on incorporating them all into our suite of tools. To put it in a few words, we’ve committed to being the most creative, simple, and comprehensive tool on the market.

What was the funding process like?

The process was incredibly fast for us. In July, we joined Techstars Chicago with the goal of being the first company in our cohort to raise a significant round and I’m happy to report that we did exactly that. In order to do so, we needed to deliver.

We worked closely with Scott Birnbaum and Paul Strachman of Red Sea Ventures to put together a killer syndicate and ended up significantly oversubscribed, so much so that we turned down an additional $4M of funding. Red Sea Ventures was extremely tactical and has become far more than investors – they’re friends and business partners.

What are the biggest challenges that you faced while raising capital?

Fundraising is a full-time job, and when you’re running a business it’s hard to understand where it’s more important to put in the hours. Thankfully, my team was incredibly supportive and understanding – they ran and grew the biz while I focused on setting us up for the future. One of the biggest challenges I personally faced was learning to say no to meetings or requests for information.

What factors about your business led your investors to write the check?

They spoke to our customers and business leaders in the warranty space. Once you understand just how poor of an experience the status quo is for businesses, and you then follow up by speaking to our customers, you quickly understand the problem Clyde is solving and how good of a job we’ve done so far.

They spoke to our customers and business leaders in the warranty space. Once you understand just how poor of an experience the status quo is for businesses, and you then follow up by speaking to our customers, you quickly understand the problem Clyde is solving and how good of a job we’ve done so far.

What are the milestones you plan to achieve in the next six months?

We have major goals ahead of us in terms of growth of sales and growth of the product. The next six months has us increasing the number of partners as well as the size of our relationships and types of businesses we work with. Additionally, we’ll be expanding the team from 4 to 15 – something I’m personally passionate about and excited for.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Send out a monthly update to everyone you meet and be relentless about the timing of it. Include the high highs and the low lows – include everything from product announcements to sales goals to personal problems. Fundraising is equally qualitative and quantitative – no one will invest in you if they don’t like, trust, and believe in you.

Where do you see the company going now over the near term?

In the near term, we’re focusing on growing our suite of tools, our partnerships with retailers, and our marketplace of insurers. One thing that differentiates Clyde from almost every other company in this space is our access to data. We use this data to inform businesses about their programs, how they can improve, and ultimately, how they can better their products through claims info. In the near term, we’re combining all of these aspects to work with bigger clients and seamlessly support the smaller ones.

Where is your favorite fall destination in the city?

That’s got to be Brooklyn Kava. Great location to sit down with friends to get work done on a Sunday, followed up by a game of Settlers of Catan.