If you looked at internet commerce ten years ago, you might well have imagined that the future belonged to the box. Specialized goods subscriptions boxes suddenly popped up everywhere, like mushrooms after a strong rain.

The idea was that consumers would be delighted to have their interest in a particular area ratified by an easy sale: Simply say yes, and surprising, delightful goods in your area of choice—in a nifty, thematic box—would land on your doorstep every month. Suddenly, we had boxes for pets, for men’s and women’s clothes, for tampons, for wine. You name it – there was a box for it.

Unilever bought shaving sub box company Dollar Shave Club for $1B. BarkBox, the sub box for doggie stuff, raised more than $80M, at somewhere around $200M in value and seemed poised to also rise into unicorn territory.

But then, the box business hit a bump. Raises and valuations suddenly flattened in 2016. For instance, beauty breakout Birchbox, which hit $485M in value in 2016, went through massive layoffs shortly afterward, and then raised a tiny inside round at barely any increase in value.

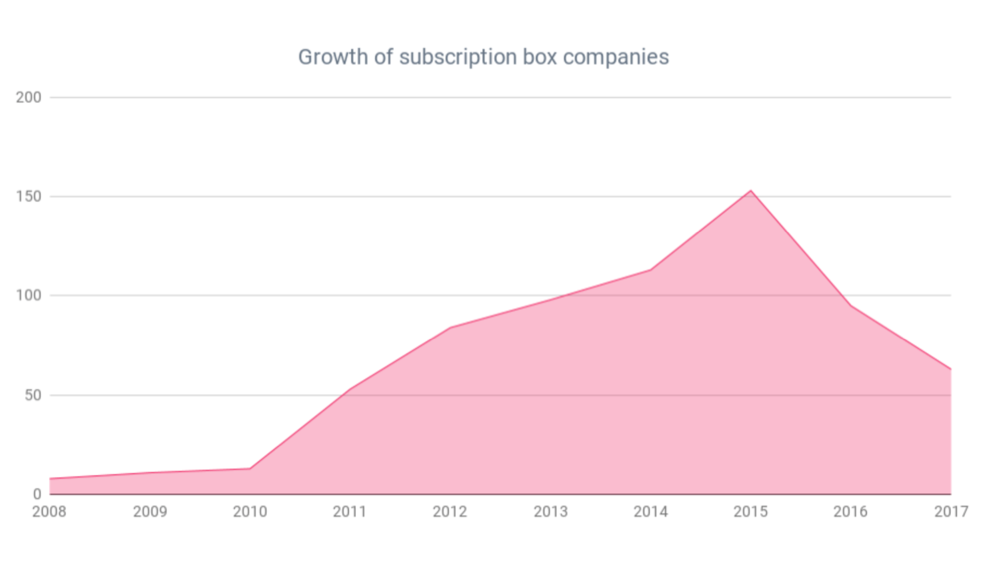

Since then, according to a report from Pipe Candy, a new commerce analytics platform, it has been all downhill for the box biz:

This drop in subscription box companies stems from one basic reason: Consumers have, quite quickly, become serious about e-commerce.

The supposed attraction of boxes is that they’re easy. One click, and you have a gift that keeps on giving to wine-mad Uncle Charlie or cosmetics princess Cousin Charlotte. You can spiff up your hubby’s wardrobe, without actually going through the painful process of shopping with him, by having the box company’s stylistas send along a stream of fashionable, well-chosen products that can even define a new style for the lug.

Another seemingly attractive attribute of boxes was that they could be branded independently from any product. Need more margin? Stick a fat margin product in the box, or reduce the frequency of the popular, but low margin component. The look and feel of the box and its components overmatched the value of what was inside, since that was always unknown beforehand.

These attributes attracted both buyer and investor interest on first blush. But the benefits of boxes miss one key point about how people actually buy things: Consumers spend the most where they care the most. And where they care the most, consumers specify the most. A non-wine person might be fine with a wine of the month box. But a wine snob would be horrified. The thoughtless dresser might get a boost from the shirts-and-socks-in-a-box, but they won’t cut it for anyone committed to actually developing and controlling their personal style.

The outbreak of commerce boxes came at a moment when consumers were still unsure about the role of online buying in many areas of goods and services. Given that timidity, boxes made a lot of sense. Quickly, however, younger consumers decided that they preferred digital buying to any other option. They’d rather buy online, or at least compare products online, than any other way. This means, of course, that specifics suddenly mattered a lot. I don’t want to just buys shoes, I want those shoes. Not just cosmetics, but those cosmetics. And not just the product alone, but also the opportunity to see it in action with those I admire or aspire toward and with the chance to check in with friends and family to get their take on what I’m considering buying. I don’t merely want to receive and own, I want to select.

The result of the increasing importance of e-commerce is today’s powerful and growing universe of information-driven, community-oriented, consumer experience obsessed digitally native brands – the antithesis of sub boxes. No mystery. No uncertainty. Rather, the deep satisfaction that comes from knowing you’re buying just the right thing for you, right now, in the right size and color at the right price.

The era of try-it-you-might like it subscription commerce boxes shows how the fates of startups can shift in an instant. For all the attention paid to clever branding, novel acquisition strategies, cool promo and the like, in the end, those aren’t the keys to commerce success.

Only the behavior of buyers matters. So, the decline of subscription commerce boxes is a natural and inevitable expression of the expanding importance of online commerce across an ever-broadening expanse of goods and services. That is why we never jumped on the box bandwagon, but have moved into digitally native brands with enthusiasm.