Crypto is a new computing paradigm, poised to create more disruption and wealth creation in the next 20 years, than the internet has in the last 20. The question I face as a VC is who is going to capture that massive wealth creation? The wealth creation can either go largely to the five incumbents who have captured the majority of tech wealth creation over the last five years, or to the new entrants, aka the crypto natives. In this post I’m going to 1) define what I mean by crypto, 2) highlight the strengths and weaknesses of the two warring factions, and 3) state the factors that will decide the coming epic battle for capturing the future wealth generation of crypto.

Defining Crypto?

There are four emerging technologies:

- Blockchain — aka Truth

- CryptoCurrency — aka frequent flier miles

- Smart Contracts — aka as if-this-then-that statements

- Zero Knowledge Proof — aka the ability to prove things without showing anything, aka Magic

Those four technologies, in combination, are ushering in a new paradigm in computing, that enables an (almost) infinite variety of new business processes. That’s what all new computing paradigms enable. The most exciting new business process enabled is:

5. Decentralization-aka taking the man out of the middle

And the success (or failure) of these new business processes are increasingly driven by:

6. Community-aka a group of people who help a crypto project succeed incentivized by “value” they derive from that success

The Majority of Wealth Creation Accrues To FAMGA

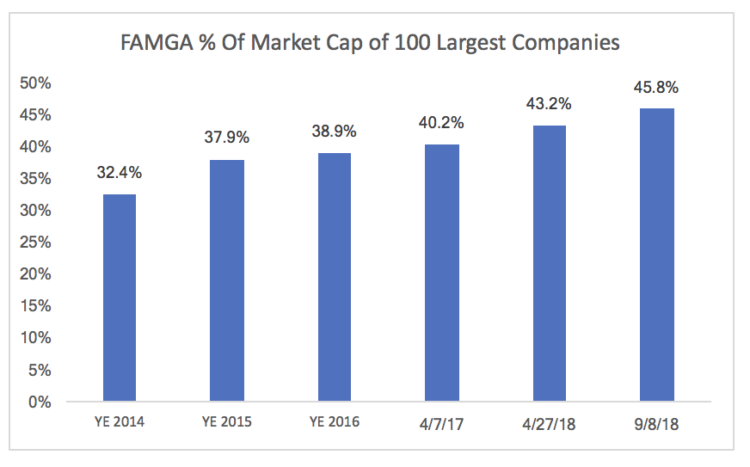

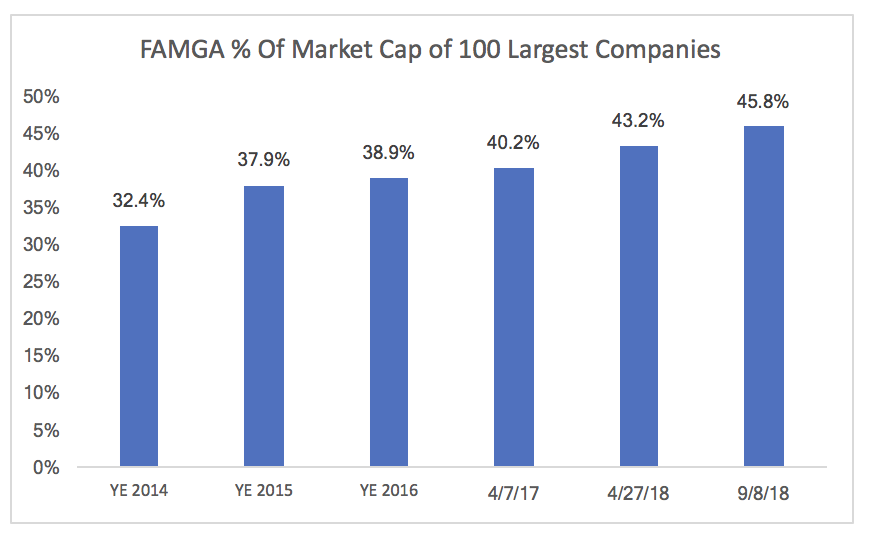

I first wrote about FAMGA and the destructive impact of the growing oligopoly in January 2017. Fewer than 200 people read the story in the first month. But I thought it was important, so I wrote another piece on FAMGA in April 2017. More than 10,000 people read the story in its first month. My biggest Medium success up till that time. My simple premise was that every business was increasingly a data business, and the more relevant data you had, the stronger a competitor you’d be. And FAMGA dominated the aggregation of data. The obvious negative implications for the world include the stifling of competition and innovation. The power of the oligopoly can best be seen by its ever-growing share of market cap of the top 100 U.S. companies by market cap:

Remarkably, since year-end 2014, FAMGA has accounted for more than 63% of all the value creation of the 100 most valuable companies. That’s remarkable power in just five hands.

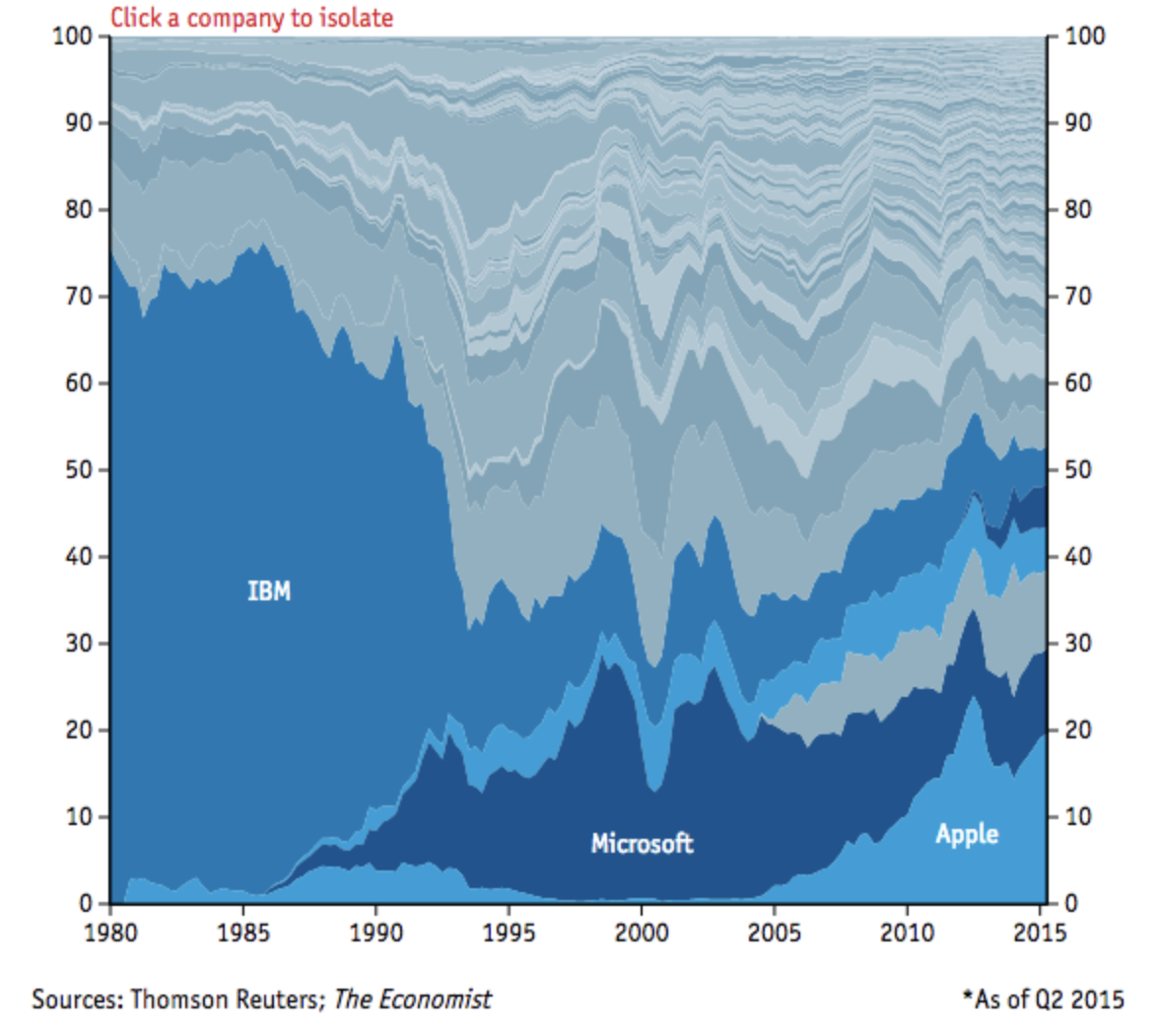

While the FAMGA trend was worrisome, the most optimistic thought I had was communicated in the graph below which shows the market cap market share of the 100 most valuable tech companies in the U.S., over time:

It turned out we had gone through a series of periods where it seemed like a dominant company or companies would reign forever. First, it was IBM, then it was Microsoft, and now it’s FAMGA. And while I didn’t see anything on the horizon to threaten FAMGA’s dominance, I was encouraged by the fact that history has taught us that nothing is constant but change. Two months later I saw the crypto light.

By the “crypto light”, I mean the belief that crypto was going to drive unprecedented disruption and wealth creation.

Why Crypto Is Poised Drive Massive Wealth Creation

Crypto is poised to drive massive wealth creation because we have a new set of tools that enable new business processes. It’s already driving massive value.

At either $68 billion (per the WSJ), or $72 billion (per CB Insights and ), Uber is widely considered the most valuable “startup” in the world. Uber was started in March 2009. At almost the same time, in January 2009, Satoshi mined the first Bitcoin. Today, Bitcoin is worth $107 billion (even after dropping more than 68% from it’s high in December). Not only has crypto proven it can drive massive value creation, but it has also proven that it can create more value then the old business processes were able to generate.

While there are many factors driving Bitcoins value, at the end of the day, it’s simply the community’s belief in Bitcoin that drives its value. At first blush, that seemed like a confidence game/Ponzi scheme to me. But then I realized that ALL assets are simply confidence games (h/t Ari Paul). Facebook is a confidence game. Recently, on July 26th, Facebook reported earnings and a weak outlook and lost $119 billion in value. That was a largest one-day loss of market cap by any company in the history of mankind. People got new information, and simply lost confidence.

The community still believes in Bitcoin. The community is still mining Bitcoin. The community is still HOLDING Bitcoin. The community is building new tools and application to enhance the value of Bitcoin, as well as thousands of other crypto projects. The crypto community is doing all tht work, because they believe they will get more “value” from Bitcoin and other projects then they are giving. Many are building new business processes that the community believes will make the world a better place.

As the tools get better, as the networks get stronger, as throughput increases, as the UI get’s easier, as the community addresses it’s biggest problems (e.g. governance, token economics, ….), the new business processes enabled by crypto will be poised to drive massive disruption and wealth creation.

But who will capture that value creation?

Occam’s Razor Says FAMGA Will Capture The Majority Of Crypto’s Value Creation

Occam’s Razor is the construct that “the simplest solution tends to be the right one”. As I look at the competing factions, the simplest solution is that things will stay the same. That FAMGA will continue to leverage its data advantage, it’s scale, and all its other advantages, to outmaneuver and outcompete the crypto community, and capture the lion’s share of crypto value creation. In some ways, it feels like Star Wars. Occam’s Razor would suggest that The Empire is so dominant, the simplest solution is that it defeats The Force.

There’s A Better Way And The Crypto Community May Be The Deciding Factor

In his seminal piece, “Why Decentralization Matters”, Chris Dixon highlighted the natural evolution of platforms, including FAMGA:

Ultimately, FAMGA is accountable to its shareholders and employees. As massive numbers of people use FAMGA, for large periods of time, the future profit growth of FAMGA is not going to come from user growth or growth in engagement. The only way FAMGA continues to grow its profit is to extract more value from its users and from others in its ecosystem.

Now I don’t believe these companies are evil. Profit growth is the mantra of capitalism, and I’m a capitalist. But I’m also human. And I believe that there are new business processes that are being built, that simply have better outcomes for humanity far beyond just the economic benefits (which can be enormous). These new processes give the community the power. The processes enable user privacy. They enable forking (which is a feature, not a bug). I could go on and on.

But the only way I see that those new processes overcome the massive competitive advantages of FAMGA and capture the lion share of crypto value creation, is if crypto can harness the true potential of community.

The Coming Epic Battle For The Future Of Crypto

We know FAMGA is gearing up for the battle. This week’s business headlines included “Facebook’s blockchain team is looking for a lead dealmaker”. Amazon stating offering BaaS (Blockchain-as-a-Service) in May, and rumors of an Amazon cryptocurrency have been circulating for almost a year, ever since they registered a slew of crypto-related domain names. While Sergey Brin admitted in July that Google “… failed to be at the bleeding edge..” of blockchain technology, it launched a blockchain solution for its cloud platform later that month. FAMGA may have been asleep at the wheel, but they’ve woken up, and the vehicle they’re driving is currently a Death Star for competitors. The Force that crypto has to use to battle the FAMGA Death Star is community:

We are at the very beginning of understanding how to provide effective incentive structures for the various community members (aka token economics). While much of the work on community has focused on tokens, I “status” in a community can also be a very powerful incentive, and it’s free to give. I also know the community is building new tools to enhance the ability of the best projects to quickly attract and engage a large community.

With trillions of dollars at stake, the battle will be epic. May The Community Be With You.