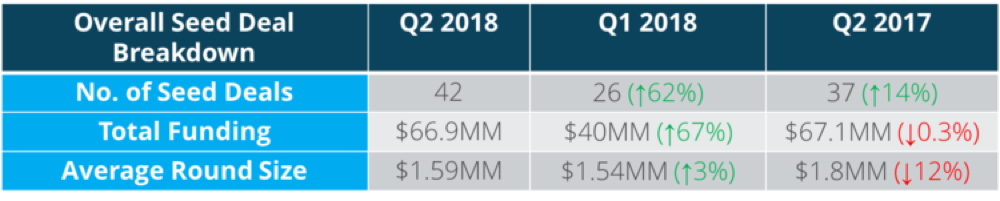

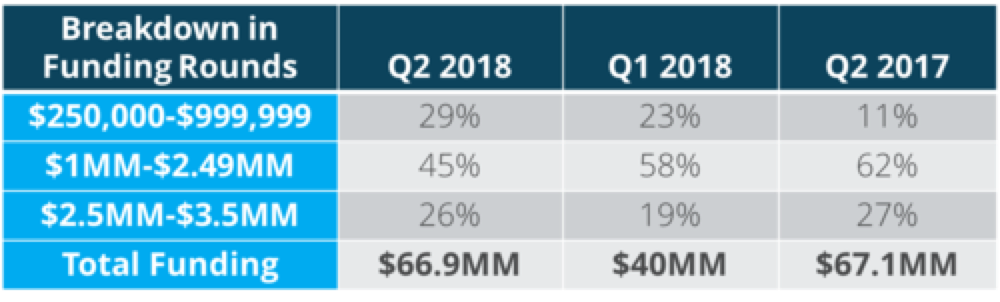

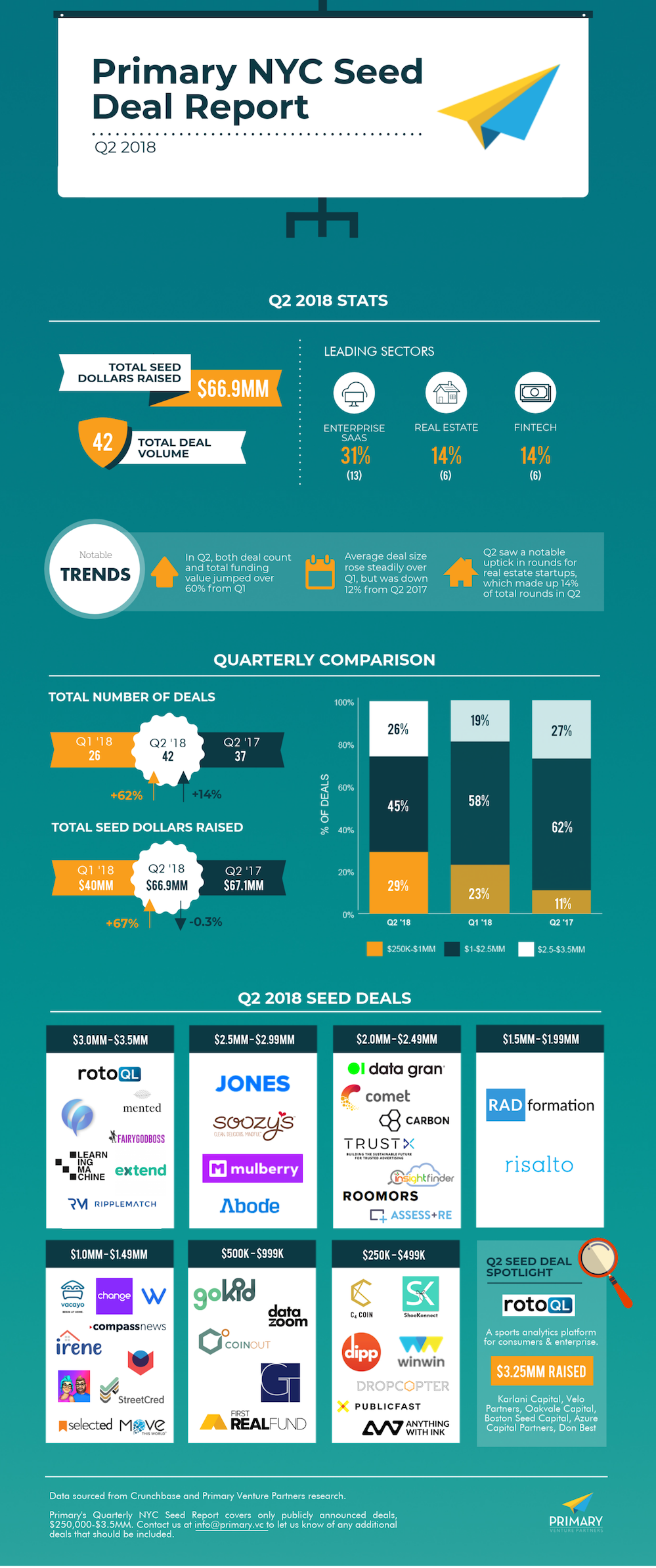

Things are finally starting to heat up around here! After a lackluster start to 2018, New York City saw 42 seed rounds in Q2 – up 62% from Q1. Total funding rolled in at $66.9 million, up 67% over Q1. Compared to Q2 2017, we’re now up 14% in deals, and right on par with dollars raised. This is the most deals we’ve seen in NYC since Q4 2016, which posted 45 rounds and $65.9 million in total funding.

Our sense of the biggest factor driving this increase in both dollars and deals is the massive infusion of dollars in the venture ecosystem these days – at nearly every level of funding. “Mega” continues to be the word of the hour as a sharp increase in later-stage mega-deals – driven by the ever-growing ranks of mega-funds – is radically changing the growth investing landscape. While this dynamic has been steadily driving up prices and competition in the later rounds, it’s also causing a material trickle-down effect, as more and more capital gets pushed down the food chain into earlier rounds. Additionally, we are seeing the reemergence of large, multi-stage funds in the seed market – a market they all but deserted just a few years ago. These large funds are writing bigger checks than the traditional seed players, and altering the playing field in meaningful ways. Simply put, more available capital in the ecosystem equals more deals.

The majority of the largest financings raised over the last 12 months fall outside of our own geography, though it’s worth noting that two of the five largest deals of 2017 were NYC born and bred: WeWork (which raised over $4 billion from SoftBank in August 2017) and Compass (which raised $450 million in December 2017, also from SoftBank). In fact, more and more mega-rounds have been happening in our midst; in Q2, nine companies raised rounds greater than $100 million (Dataminr, Zola, and Fundation, among them), compared to seven mega-deals in Q1 and six in Q2 2017. As strictly early-stage investors, we are eager to see how this trend evolves over the next few quarters.

Industries to Watch

Privacy as top priority

As cyber fraud and identity theft remain very real and growing concerns, new platforms continue to emerge at the application layer that promise to empower safe online transactions and to secure individuals’ online presence. Q2 saw a number of innovative solutions emerge that aim to protect end users in the areas of digital records (Learning Machine), payments (GATE, Extend) and new cryptocurrencies like Carbon.

Revitalization of real estate

After three quarters of fairly stagnant activity on the real estate front, Q2 saw an outcropping of new rounds for real estate upstarts. These ranged from new platforms powering smarter and faster investments in commercial real estate (ASSESS+RE, First RealFund), while others take different approaches to driving efficiencies in the rental process (Abode, Roomors, Vacayo).

Big data demands synthesis

As startups continue to rely on big data as the backbone of their platform, there is an increasing need for platforms that can synthesize data from multiple sources and provide actionable insights. Q2 saw new rounds for horizontal applications like Narrator, which leverages companies’ existing data to deliver critical insights, and GTop Group, a predictive threat detection platform that digests data across video and open-source platforms, as well as highly targeted vertical platforms like Datazoom (specifically for video distributors) and Datagran (for digital marketers).

Share and share alike

We continue to see new entrants into the sharing economy for local consumer products and services. New rounds in Q2 went to startups in mobility/children’s carpooling (GoKid), co-living (Roomors) and extended-stay housing (Vacayo). We have seen this model deployed across many categories over the last few years, and it remains to be seen how effectively these platforms can be in terms of offering consumers better experiences, selection, and savings.

High-tech help for specialists

Taking its queue from virtually every other major industry that’s already adopted efficiency-boosting software, a flurry of workflow management platforms raised rounds in Q2 that aim to help MDs manage their workflow. Radformation, for instance, automates workflow for radiologists, while Risalto, helps patients find the best musculoskeletal care.

Next-generation consumer utilities

Despite being highly regulated, we continue to see categories where new entrants build modern consumer experiences across UI, technology and service. Last quarter these included telecom and mobile services (Wing Tel) and personal banking (Change Labs). While consumers will certainly benefit from these solutions, it is still unclear how defensible the businesses are at scale, given their dependence on third parties for key infrastructure.