The freelance economy is all around us and it is growing rapidly every single day. In fact, over 60 million people are expected to be their own boss by 2020. While this seems great, it does come with a downside; potential clients are unlikely to hire these workers if they don’t have business insurance. Moreover, the insurance market doesn’t supply inexpensive, short-term solutions that are flexible for freelancers. Verifly has introduced a solution by creating an app that provides inexpensive, “bite-sized” insurance policies to freelancers and small businesses in less than 30 seconds.

AlleyWatch spoke with CEO and Founder Jay Bregman, who previously founded Hailo (acquired by Daimler) on how his startup is tapping into a $100 billion market.

Tell us about the service Verifly provides.

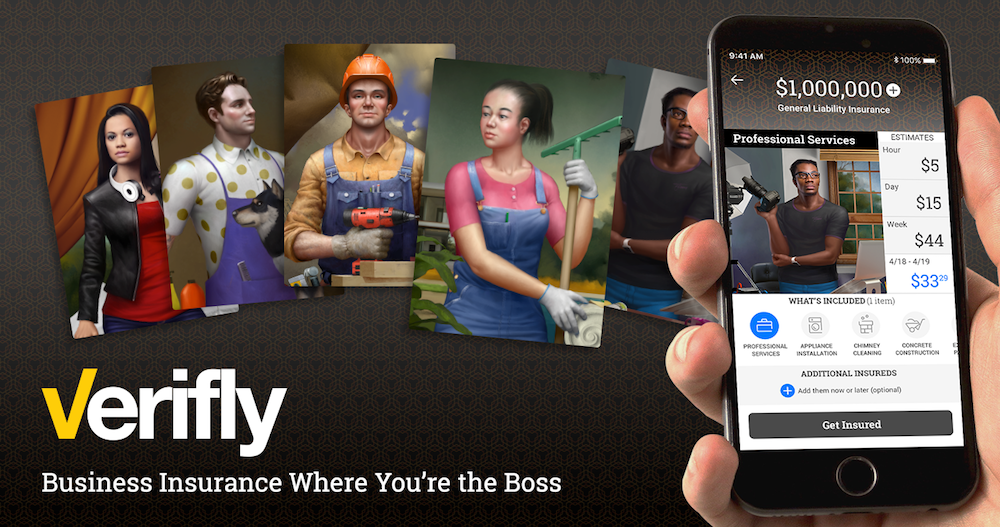

Verifly delivers on-demand insurance by the job to cover the 57 million people who work independently — such as photographers, handymen, DJs, and others — via our Verifly app. As more people freelance, many clients require them to be insured. These workers need easy, mobile access to quick, inexpensive, short-term insurance so they never lose a potential job or have to call an insurance broker. Verifly delivers this in seconds for as little as $5 for one hour and one million dollars of business insurance.

Forty percent of US workers (over 60 million people) are expected to be their own boss by 2020. In today’s litigious society, many potential clients won’t consider hiring these workers if they don’t have insurance, but employers traditionally bought business insurance. Moreover, many jobs are booked for the hour or the day, but the insurance industry still only sells policies by the year. Insurance hasn’t evolved to meet the needs of this burgeoning workforce, so these workers often miss out on lucrative opportunities. That’s where Verifly comes in: arranging insurance as short as a single job, starting at $5 for one hour. It takes less than 30 seconds on our app, and you can instantly show clients you’re insured.

What market is Verifly attacking and how big is it?

The small business insurance market is a $100 billion market.

What is the business model?

Verifly is a licensed insurance broker in all 50 states plus D.C. and we take a commission of each policy we arrange.

What inspired the business?

The gig / freelance economy is no longer stigmatized, but, rather, it has become aspirational — an attainable type of freedom and career success. Verifly helps professionalize and institutionalize the ‘future of work’ by delivering business insurance tailored to the way people work today. We are doing this because we are lifetime entrepreneurs and we want to empower independent workers with the tools they need to thrive.

How has your previous experience founding Hailo guided and impacted this venture? Building a complex two-sided marketplace with over 10 million users across ten countries prepared me a bit for the epic challenge of building an insurance policy from scratch that disrupts the fundamental business model in favor of the customer.

What are the milestones that you plan to achieve within six months?

We expect nationwide coverage and will expand the number of activities and types of insurance we arrange. Our vision is to be the insurance mission control for independent workers.

What is the one piece of startup advice that you never got?

It’s lonely on the frontier.

If you could be put in touch with anyone in the New York community who would it be and why?

Michael Bloomberg. He’s the ultimate financial services entrepreneur.

Why did you launch in New York?

For financial services there is no equal.

What’s your favorite restaurant in the city?

Minetta Tavern. It’s as classic as it gets.