The largest U.S. companies by market cap are all tech. That wasn’t always the case:

In April last year, I published “The Profound Implications of Five Increasingly Dominant Tech Companies”, which outlined the increasing share of market cap that FAMGA was accounting for of the 100 largest NASDAQ companies by market cap. That trend not only continued over the last year, it accelerated:

FAMGA accounts for remarkable $3.5 trillion of the $8.2 trillion total market cap of the top 100 NASDAQ companies. The average FAMGA stoick is valued at over $700 billion! The smallest FAMGA stock by market cap, Facebook, at $503 billion, is still more than double the $246 billion market cap of Intel, the 6th largest NASDAQ stock by market cap. FAMGA is so dominant, it’ market cap is greater then the next 44 largest market cap tech companies combined.

The point of my post last year, was that FAMGA’s increasing domination has profound implications, including the stifling of innovation that results from the MAJORITY of value creation going to just five companies.

A year ago I didn’t see any emerging technology that could impede the FAMGA’s increasing dominance. But I did state that “History has taught us that nothing is constant but change”, as noted by the great graph below showing the market cap market share of the top 100 tech companies over time:

Per the graphic above, IBM’s market cap dominance eventually waned, as did Microsoft’s. Less than three months after I wrote the FAMGA post, on June 29th, 2017, I saw the Crypto light. By Crypto, I’m referring to four technologies, that are complemented by Community, that together, enable Decentralization.

Below are a few thoughts on why FAMGA’s domination is threatened by Crypto:

Crypto Enables Identity and Associated Data To Be Decentralized and Controlled By The User

This is happening without Crypto, most notably in Europe, with the recent introduction of the GDPR (General Data Protection Regulation) in the EU. The GDPR is about about giving people control over their data and ensuring companies comply with “Right to be Forgotten ”and “Data Portability” requests. With the onslaught of data breaches, people are becoming increasingly aware that if you’re not paying for it…:

The impact of initiatives like the GDPR, and a shifting cultural ethos, particularly among millennials, will be greatly enhanced by Crypto.

From Civic, to Sovrin, to HyperLedger’s Indy project and uPort, there are numerous Crypto projects solving for identity.

There are also numerous projects like Datawallet, Wibson, solving for general user data, and projects like Mint Health (solving for healthcare data), Loomia(solving for data from wearable tech), and streamr (solving for tokenizing real time data) are providing more niche solutions.

These blockchain-based platforms all aim to lesson the dominance FAMGA has over the means to make money from user data. To date, users have focused more on the risks (e.g. data breaches, fake news) of not controlling their data. As the impact of growing risk awareness is complimented by the ability to earn money and be rewarded by for controlling one’s data, users are likely to become more pro-active in how they manage and share their data. The more restrictive users become with regard to their personal and behavioral information, the less fuel for FAMGA to grow their market cap market share.

While the impact of these projects will likely be limited in the near term, the ultimate success of these projects will usher in a data revolution.

Crypto Projects Are Already Emerging That Directly Compete With Each FAMGA Member

As Chris Dixon recently pointed out, The natural tendency of centralized platforms is to increasingly extract value from users and compete with their early collaborators:

Cryptonetworks attempt to fix these problems by building a community (developers, maintainers, and other network participants), and providing economic incentives to the community members in the form of tokens.

Their are Crypto projects competing against each FAMGA members:

In addition to the Bitcoin blockchain, Ethereum, Stellar, EOS, NEO, NEM and Hashgraph are currently the best known contenders to be the leading “operating system” (or Microsoft) of Crypto.

Brave and Bitclave are browsers competing head on with Google.

Shping is competing with Amazon by tokenizing shopping.

DTube is disrupting video viewing otherwise going on via YouTube (aka Google) and Facebook.

Minds, SuchApp, YOYOW are all competing directly, or at the edges, with Facebook’s social network (which is struggling in any case).

Following it’s $150 million ICO in December, Sirin Labs appears to be leading the charge to develop a blockchain-enabled mobile phone to compete with Apple. Sirin Labs recently announced a partnership with Foxconn to manufacture the phone. Huawei, the second largest smartphone manufacturer in the world (after Samsung) is reportedly in talks to license Sirin Labs’ technology.

There are dozens of others relevant projects I could have mentioned, and many more will be built as the functionality of Crypto continues to improve.

The Impact of Crypto Is Going To Be Bigger That Anyone Thinks

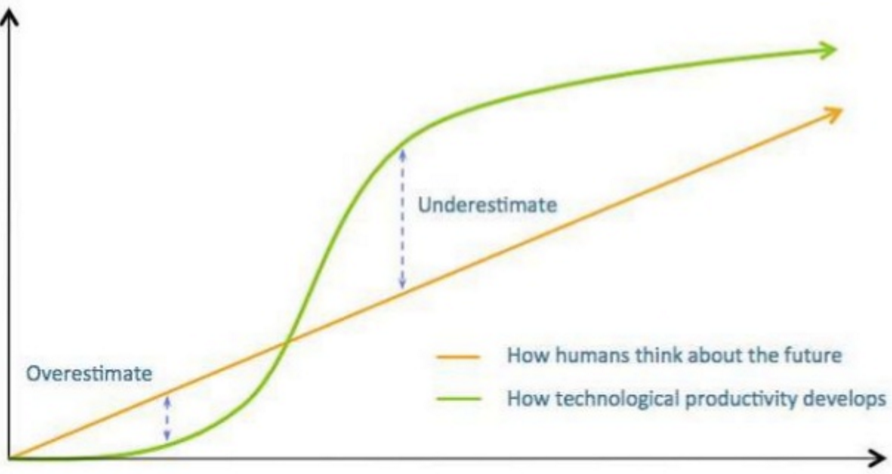

As humans, we think in a liner fashion, but technology adoption follows an S curve, leading to this situation:

The graphic above was codified by Roy Amara, President of Palo Alto think tank Institute For The Future, when he coined Amara’s Law in the early 70s:

“We tend to overestimate the effect of a new technology in the short run and underestimate the effect in the long run”

This will be true of Crypto as well. So FAMGAs increasing grip on market cap marketshare may not be at risk in the near term, but Crypto is the biggest technological threat to FAMGA that I see on the horizon.

I recently went to dinner with a good friend who happens to be a very senior Google exec. When I asked if he viewed Crypto as a threat, he couldn’t contain his laughter. So I guess Crypto’s in the second stage of the path to winning.