Fordham University recently hosted the “Blockchain Disruptor Conference”, a conference dedicated to an entire weekend of all things blockchain and cryptocurrency related. The conference did a wonderful job at selecting speakers – all of whom are principals in their fields – who thoroughly explained the intricacies of blockchain.

The founder of Bitbuddy, an online platform providing the public with free education on blockchain and cryptocurrency, gave an extremely thorough speech on how to begin investing in the blockchain space. The founders of Bitbuddy – Maverick Kuhn, Zachary Jordan, Lucas Tesler, and Jarod Boone – met at Brown University and quickly became friends once they recognized they all had a common interest in crypto. Eventually the friends dropped out of Brown to pursue investing in blockchain full-time.

The founders of Bitbuddy make it clear they are not financial advisors, but they can shed some practical and useful light on how to get into the blockchain game. Here is the Bitbuddy team’s take on the best blockchain investment practices.

As a foundation, never invest more money than you are willing to lose, don’t invest based on emotions or social media (ex: people sharing tweets about a ‘hot’ cryptocurrency), always do your own research, and diversify to manage risk.

A couple things people should be aware of before investing in cryptocurrency is that this is a very volatile market. Prices can jump 20-30% a day, but if you are in it for the long haul then this volatility shouldn’t bother you.

Here are some key questions to ask yourself when investing:

Does the project even need a blockchain? Maverick Kuhn explained that some companies have no real need to adapt the blockchain technology. His example was the company Long Island Iced Tea. Long Island Iced Tea sold bottled iced tea, but amidst all the blockchain rage it changed its name to Long Blockchain. When Long Island Iced Tea changed its name, its shares rose six-fold or according to Bloomberg: 289 percent. Eventually, this company was delisted by Nasdaq.

According to Kuhn, once you establish if a project needs blockchain begin the fundamental and technical analysis. For the purposes of this conference, Kuhn focus on fundamental analysis, which is particularly crucial for a long-term investor.

Fundamental analysis looks at the inherent value and potential value of the project. The best way to assess the value is to look at the white papers. The white papers are the skeleton or the “pitch” of the product. Next, look at the projects team members, investors, and partners. Check out the past products they’ve done and if they are legitimate in their field. Check out if there is media and community surrounding the project. Kuhn emphasized the importance of making sure there is a community around it. To assess if there is a community, ask yourself question like: is it on twitter? Also go on GitHub and make sure there are frequent and consistent updates on the project. Kuhn states that you have to differentiate between hype vs. tech.

Hype is good for short-term growth but technology is crucial for long-term growth. Of course, research the competition and look at the stages of the product.

Once you’ve finished conducting your analysis and decided that you want to purchase this crypto, you have to get on an exchange. Exchanges like Gemini connects buyers and sellers and converts U.S issued dollars into Ethereum (ETH) or BTC (Bitcoin). According to the IRS, every single trade you make between cryptos like BTC and ETH is a taxable event, but if you send BTC to another user(friends) it is not taxed. Once you’ve converted your USD into Ethereum or BTC, you can transfer that crypto to another exchange that trades different coins.

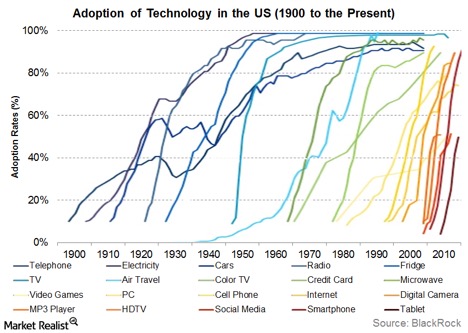

While many people are highly speculative on the nature of the cryptocurrency market, big companies like Samsung, IBM, Goldman Sachs, Mastercard, etc. are investing in the blockchain space. Keep in mind that blockchain is still believed to be in its early adopter phase. The trend lines of technological adaptation become faster overtime, as illustrated by this chart.

While there are many opinions on blockchain, it cannot be denied that this is a very exciting time in technology.