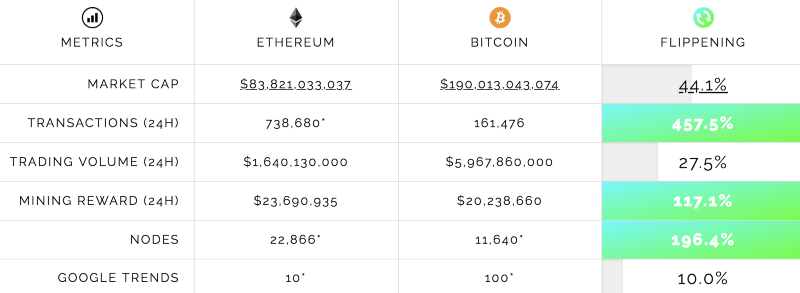

In Cryptoland, “The Flippening” refers to a point in time at which Ethereum overtakes Bitcoin in terms of market capitalization. There are websites dedicated to the “Flippening Watch”:

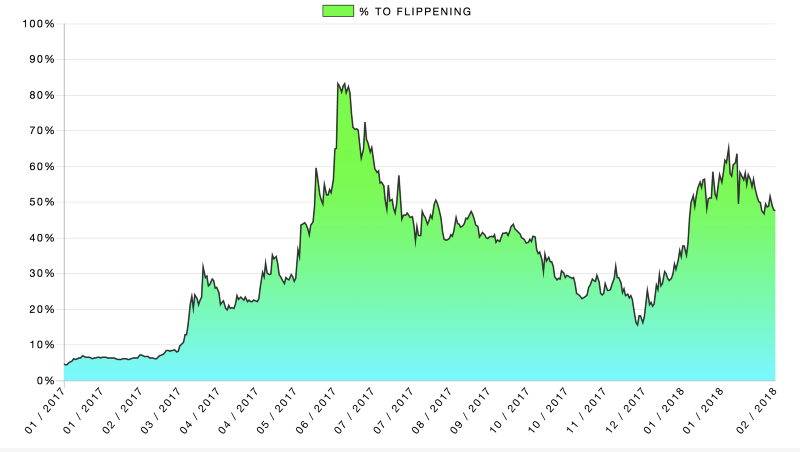

As of the publication of this post, Ethereum was 44% of the way to “The Flippening” (ie. it’s market cap was 44% that of Bitcoin). That’s down from a peak of more than 80% in June 0f 2017 when “The Flippening” felt imminent:

In my view, this “Flippening” isn’t really all that relevant, as Bitcoin and Ethereum are largely solving for two different things, so one being worth more than the other doesn’t mean that one is winning and the other is losing.

A New Meaning For The Flippening

The Flippening I’m referring to, is when the value of security tokens issued overtakes the value of utility tokens issued, and I view the likelhood of that Flippening as being fairly high.

My view that this Flippening is likely isn’t predicated on a collapse of the utility token market. Utility tokens are definitely a thing. To date, almost all ICOs have been for utility tokens. We are in the early days of what utility tokens can be as smart contracts evolve and new technologies emerge. Great work is being done by Chris Burniske and others on valuing utility tokens. As it’s the early days of a this new asset, it’s not surprising that regulators are struggling to appreciate utility tokens:

“I believe every ICO I’ve seen is a security. … ICOs that are securities offerings, we should regulate them like we regulate securities offerings. End of story.”

— Jay Clayton, Chairman, U.S. Securities and Exchange Commission, testimonybefore the United States Senate, February 6, 2018

While the statement above can chill utility token activity in the United States, the rest of the world doesn’t really seem to care (e.g. see Telegram’s token sale). And the U.S. regulators will figure it out at some point.

Rather than any negative statement on utility tokens, my view regarding the likelihood of the Flippening is based on a number of factors, most notably, the massive pool of assets that are prime candidates for tokenization via a security token. But first let’s define what a security token is.

Defining A Security Token

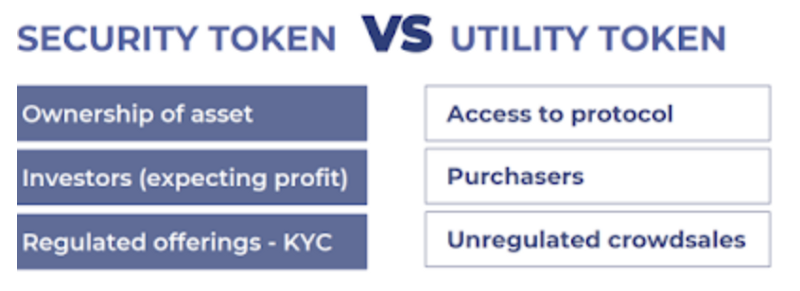

In this great recent piece on security tokens by Anthony Pompliano, Pomp starts by giving a definition: “Security Tokens are digital assets subject to federal security regulations. In layman terms, they are the intersection of digital assets (tokens) with traditional financial products — a new technology improving old things.”

Below is a great graphic from Polymath highlighting the major differences between security tokens and utility tokens:

There’s A Massive Pool of Privately Held Assets Waiting To be Tokenized

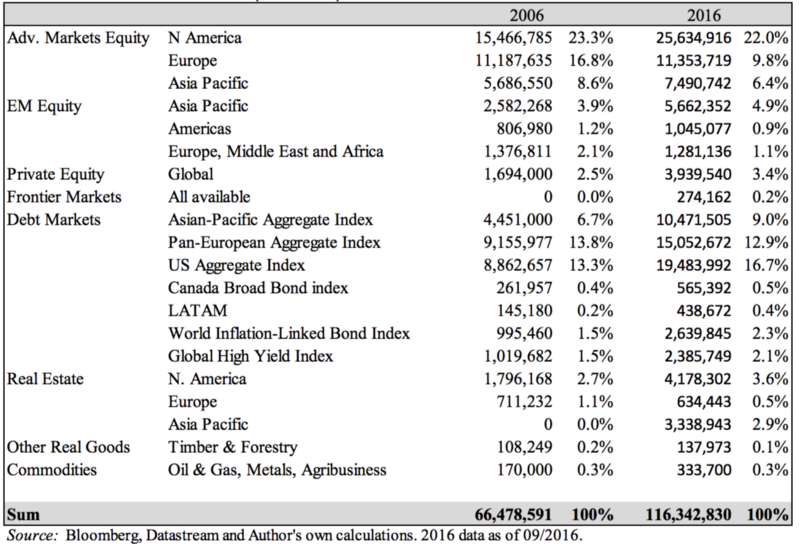

The size of globally publicly traded assets was estimated at $116 trillion in 2016 by SAALT:

Privately held assets dwarf that number. If we just look at real estate, Savills estimates the total value of “non-investible” real estate assets at $136 trillion. That’s 17X the amount of publicly traded real estate assets per Savills. And, by definition, when that privately held realestate starts getting tokenized, it will rise in value as investors pay for liquidity.

There’s A Laundry List of Assets Being Tokenized Via Security Tokens, And Its Growing By The Day

There are numerous real estate tokenizations in process, including Evareium, TokenLend, Slice, and PropertyCoin. In fact, here’s a list that includes over 80 ICOs tagged as “Real Estate” related.

Venezuela is tokenizing oil . Given U.S. Geological Survey estimate of 2.3 trillion of global oil reserves, oil alone could be a $135 trillion token market.

Carats is tokenizing diamonds in partnership with the Israel Diamond Exchange.

The 22X Fund Is tokenizing a venture capital portfolio comprised of 10% of the equity from 30 different companies from the 22nd batch at 500 Startups.

The list of real world assets being tokenized goes on and on.

There’s A Growing List of Exchanges & Protocols Focused on Security Tokens

These exchanges and protocols include The Open Finance Network, tZERO, Polymath, and Harbor, to name just a few.

The Tokenized Future Will Be Different From What Anyone Thinks

One of the most thoughtful writers on traditional asset tokenization is Stephen McKeon, who noted that “As the world’s assets become increasingly liquid, the concept of ownership will evolve in ways we cannot yet imagine.” According to the Bank for International Settlements, at the end of 2017, there was more than $500 trillion of notional value in OTC derivatives (largely in interest rate contracts). That is a market that is ripe for disruption by tokenization that leverages smart contracts.

When Will The Flippening Happen?

I’m a believer in Amara’s Law, which states that “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run”. So while I’m confident that security tokens are going to be a BIG thing, I’m also cognizant that everything takes longer than people think. As an example, people are always shocked when they learn that only 9% of U.S. retail sales happened online last quarter.

Even with Amara’s Law in mind, that, I’m still going to guess that the Flippening is a 2019 event. Let me know your guesses below.